Brought to you by Senior Research Analyst Wayne Shum

State of the nation: an overview of the New Zealand property market for the three months ending April 2025

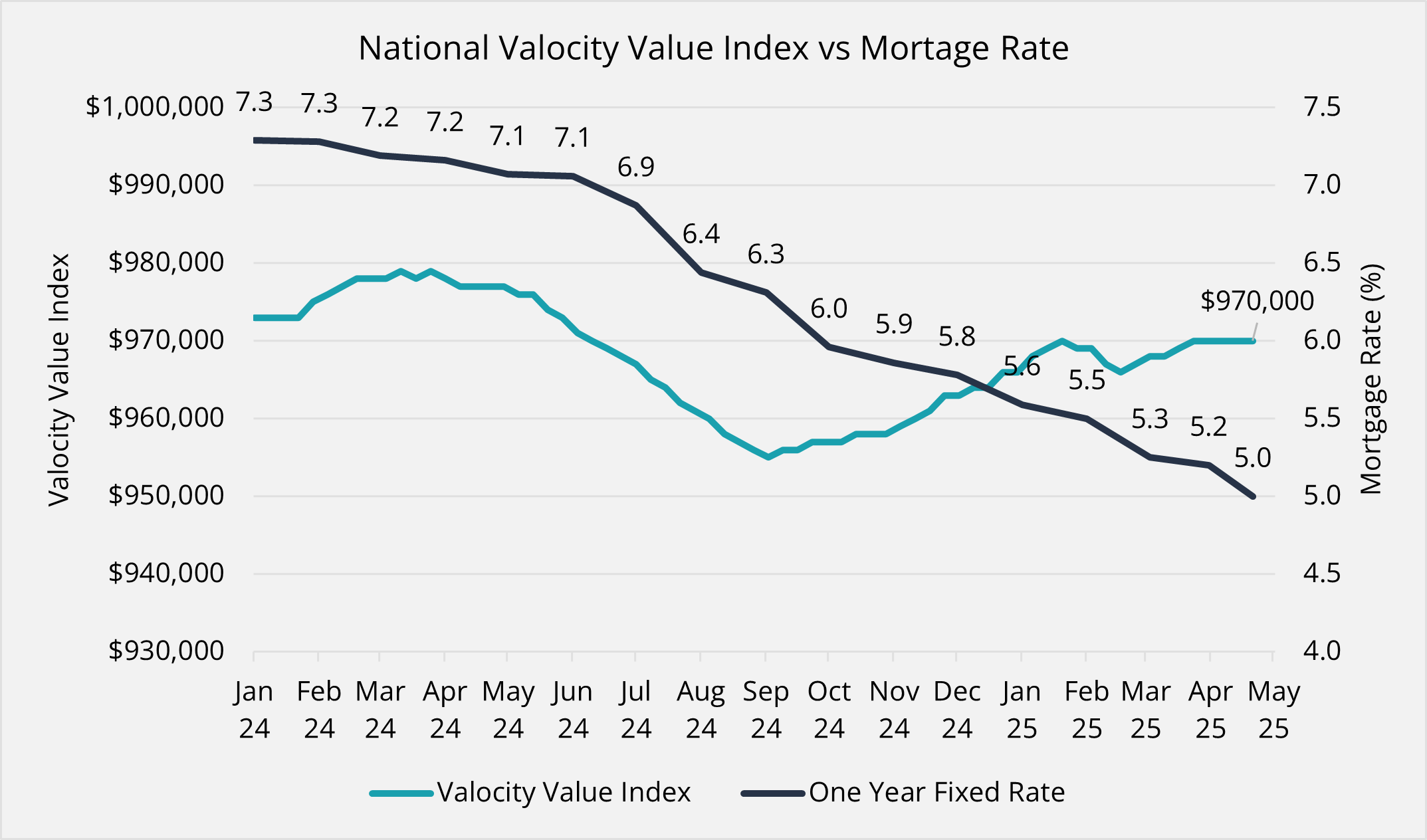

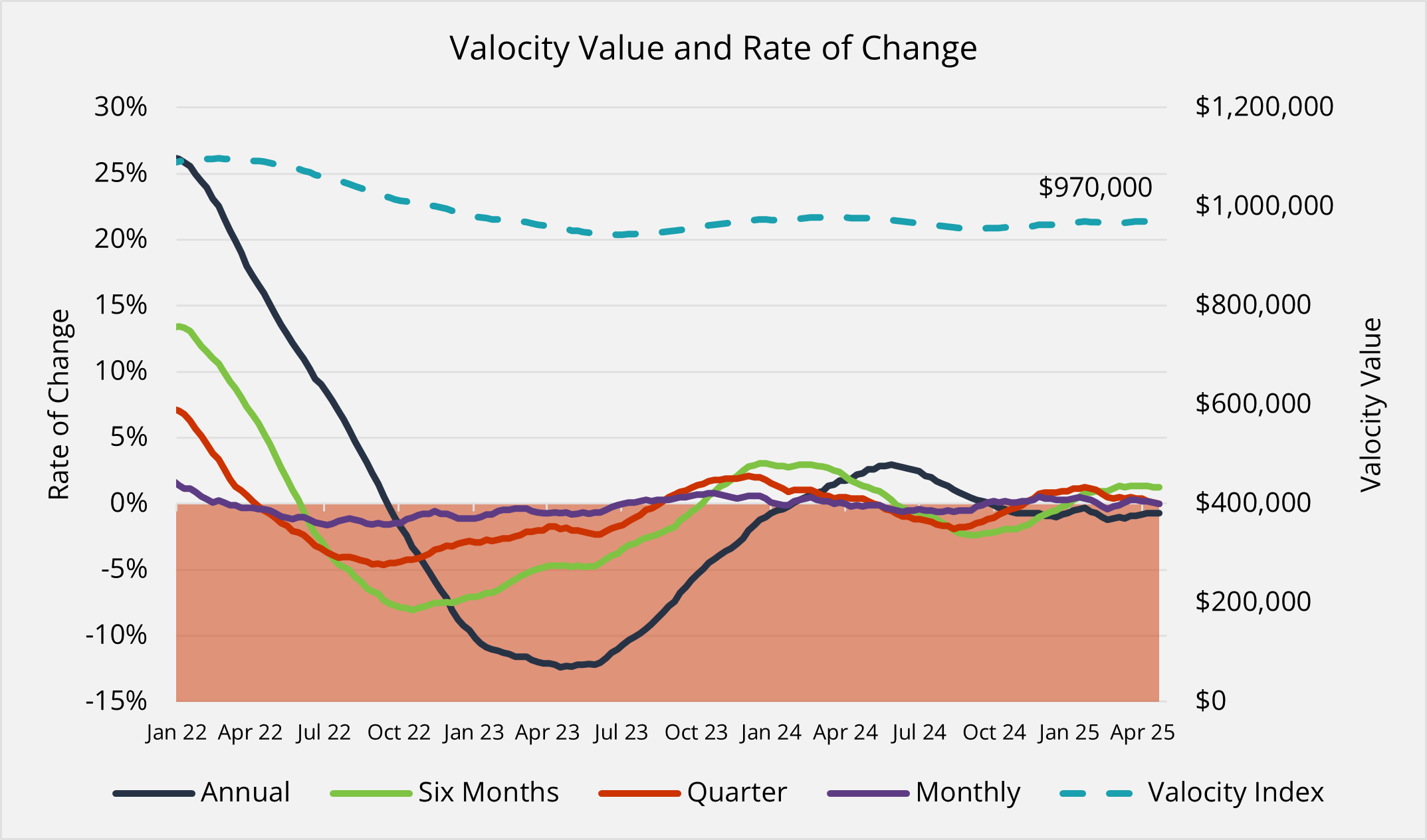

Over the past quarter, the national Valocity Value Index remained stable at around $970,000, showing minimal movement despite declining mortgage rates. The index remains unchanged from the previous quarter and has increased by $12,000 over the past six months.

Despite a decline in mortgage rates, listing volumes have stayed elevated heading into winter. Concerns around employment and global trade uncertainty have continued to suppress market activity. The unemployment rate may not yet have reached its peak, and the ongoing impact of tariffs on key trading partners remains unclear.

The broader economy continues to feel the strain from public and private sector cutbacks and reduced net migration. In April, the Reserve Bank of New Zealand lowered the Official Cash Rate by 0.25%, a move that was widely anticipated by markets. This prompted a decline in short–term mortgage rates, while longer–term rates remained largely stable. Inflation rose to 2.5% in April but stayed within the RBNZ’s target range. However, ongoing global trade uncertainty may continue to impact future economic performance both locally and internationally.

Within the mortgage market, there has been a slight shift in activity away from first–home buyers towards other buyer groups.

Looking ahead, the outlook for the property market remains cautiously optimistic. As we progress through the traditionally quieter winter period, a modest recovery is expected in the second half of 2025, underpinned by lower mortgage rates.

Frequently asked questions

To read our CommBank specific FAQs, please expand the section below.

Q: How do I know what report type or valuation basis to use for my Valocity order?

A: The report type and valuation basis are not predefined fields or requirements set by Valocity; they are designed to meet Commonwealth Bank lending criteria.

If you’re uncertain about which report type or valuation basis is best for your upcoming order, please reach out to your Property Advisory Services (PAS) team member or email BBValocity@cba.com.au for guidance.

Q: What is a portfolio order within the Valocity Platform?

A: The portfolio option within the Valocity platform is designed for Commonwealth Bank customers who hold a portfolio of properties and require multiple or all properties to be assessed simultaneously.

If there are three or fewer properties to be assessed, please order them separately using the standard commercial ordering procedure. If you’re unsure whether the portfolio option is appropriate for your needs, please contact BBValocity@cba.com.au or your Property Advisory Services (PAS) team member for confirmation.

Q: What is a client instructed report type?

A: If you have received a report which was instructed by the customer/client/broker/another OFI, you will need to process this as a client instructed report in accordance with the SOP. This report type will allow the consultant to readdress the already completed report to Commonwealth Bank. If you’re unsure whether the client instructed option is appropriate for your needs, please contact BBValocity@cba.com.au or your Property Advisory Services (PAS) team member for confirmation.

Q: The firm I want to assign this order to is not in the eligible firms list, what do I do?

A: If you attempt to assign a firm during the standard Valocity ordering process and the firm is active but not listed as eligible for allocation, please contact your Property Advisory Services (PAS) team member for assistance with the assignment.

For the same scenario above, but with a client-instructed report type, please assign the order directly to the ‘PAS Team’ from the eligible firm list.

Q: How do I initiate an upfront quote request or send additional quote requests?

A: When entering information on an ordering page, the system will automatically determine if a quote is needed based on the report type, property type, and estimated property value. For commercial or rural valuations, you can also obtain a quote by selecting the appropriate quoting risk flag on the ordering page.

On the summary page of a quoting order, you have two options to proceed:

- Proceed with Quote: Clicking this button will automatically request a quote from a predetermined panel of valuers, QS firms, or property consultants.

- Select a Specific Firm: To request a quote from a specific firm, click the ‘Select Firm’ button. Choose the firm(s) from the dropdown list, add them to your request, and click ‘Update.’ Once you have returned to the summary page, select ‘Proceed with Quote’ to activate the notifications.

Please note that valuers, QS firms, and property consultants have 2 business days to submit a quote before it expires. To reopen the quoting window, resend the notification to the firm by selecting ‘Reassign Firm’ and following the steps outlined above.

Q: What are the Valocity Platform payment options?

A: The Valocity Platform offers two standard payment options for bankers, ‘client to pay’ and ‘bank to pay’.

- Bank to pay: Selecting ‘Bank to Pay’ enables you to absorb the associated fees. These fees will be charged monthly to the requestor’s Department ID as specified in the order form. To proceed, select a reason from the drop-down list, add a comment, and check the box confirming that you have obtained the necessary approvals to charge the Bank. Once you click ‘Proceed,’ you will be directed to the order page, and your order will be assigned to a firm.

- Client to pay: Selecting ‘Client to Pay’ will generate a summary of the order details and create an email from the Valocity Platform containing all payment instructions. This payment email will be sent to the customer’s email address as entered in the client details section of the platform. The banker will also receive a copy of this email for their records.

The two options provided to the customer for direct payments are ‘PayID’ and ‘Credit Card’.

- Credit card: If the customer chooses to pay via credit card, they will be redirected to the Valocity payment gateway. From here they can follow the prompts to process the payment online. Please note a credit card surcharge will apply.

- PayID: If the customer chooses to pay via PayID, they will need to log in to their Online Banking and enter Valocity’s PayID identifier, the Valocity Reference Number, and the Order Fee. Please note that payment processing may take 24-48 hours. The order will be assigned to a firm once Valocity has verified that the payment has cleared. No processing fee is applicable. All instructions are provided in the payment email.

If your client cannot pay via the options provided above, please contact BBValocity@cba.com.au or your Property Advisory Services (PAS) team member for escalation approval.

Q: Why has my order not progressed?

A: If your order is currently pending, it indicates that payment has not yet been received. The Valocity Platform requires upfront payment before allocating the order to a firm.

If your order is still in quoting status and you haven’t received a quote, please ensure you have clicked the ‘Proceed with Quote’ button on your order summary page.

Q: What should I do if I’ve selected the incorrect quote?

A: If you’ve accidentally accepted the wrong quote, please do not progress with any payment options provided and contact Valocity Technical Support (support@valocity.com.au) immediately.

You will need to provide the relevant details in your email, including the Valocity order number, the firm you intended to select and any other pertinent information. The Valocity Support Team will review your request and take the necessary steps to rectify the situation.

Q: How can I amend a Performa Invoice or Tax Invoice for an active order?

A: Please select the type of invoice from the options below.

- Performa Invoices: If the customer has not yet paid for the Valocity order and requires an update to their contact details, you can make the necessary changes by selecting the ‘Update Client Details’ button. After completing the updates, resend the payment link (updated Performa Invoice will be attached) via the ‘Client to Pay’ page.

- Tax Invoices: Once the customer has successfully made payment and requires the Tax Invoice to be updated, please email Valocity Technical Support at support@valocity.com.au with the required changes.

Q: How do I update customer contact details on an active order?

A: To update the customer contact details on your Valocity order, navigate down the page and find the ‘Update Client Details’ button. This action will allow you to return to the client details and property access section to make any changes or amendments as necessary. The customer information and email address provided here will serve as the recipient for the payment link, invoices, and any payment confirmation receipts. Please ensure all information is accurate before saving.

Q: How do I reassign a firm on my Valocity order?

A: If a consultant has confirmed they are unable to complete the property report, you can reassign the order to a new firm. Scroll down to the ‘Reassign Firm’ button, select an eligible firm from the drop-down list, and click ‘Update.’

If the order is in a status where reassignment is no longer possible and a cancellation fee may apply, please contact BBValocity@cba.com.au or your Property Advisory Services (PAS) team member for approval.

Q: How do I add an additional or new owner to an active Valocity order?

A: If you initiated the Valocity order, you can navigate to the ‘Comments and Actions’ section and select ‘Add an Owner.’ From there, you can choose the appropriate team member from the drop-down list and update accordingly.

If you did not initiate the order, please contact your internal support team at BBValocity@cba.com.au or reach out to your Property Advisory Services (PAS) team member for assistance.

Q: What’s the status of my order?

A: To locate your order, use the search bar by entering the Valocity Order number. Alternatively, you can access your dashboard and either navigate through the status buckets or select ‘View All’ to search by order number or address.

Orders completed within the last 90 days can be found under ‘Recent Activity,’ while those older than 90 days will be listed under ‘All Activity.’

Q: How can I contact the consultant assigned to my order?

A: On the details page, scroll to the bottom to see all status changes and comments. To add a comment, type in the comment box and click ‘Comment.’ This will be visible to all users with access to the order, including the assigned consultant, who will also receive an email notification.

For urgent matters, you can find the consultant’s name and contact details about halfway down the Valocity order details page. These details are highlighted in bold for easy identification.

Q: How can I update or edit the valuation report acceptance (VAC)?

A: For any errors or incorrect information in the VAC, please contact your Property Advisory Services (PAS) team member for assistance. Valocity Technical Support does not have the ability to make changes on behalf of Commonwealth Bank.

Figure 1: Valocity value index and one-year fixed rate

Figure 2: Valocity value and rate of change – New Zealand

|

Value now – New Zealand |

Value – three months ago |

Quarterly Change |

Quarterly change – three months ago |

Value six months ago |

Value one year ago |

|

$970,000 |

$970,000 |

0.0% |

1.3% |

$958,000 |

$977,000 |

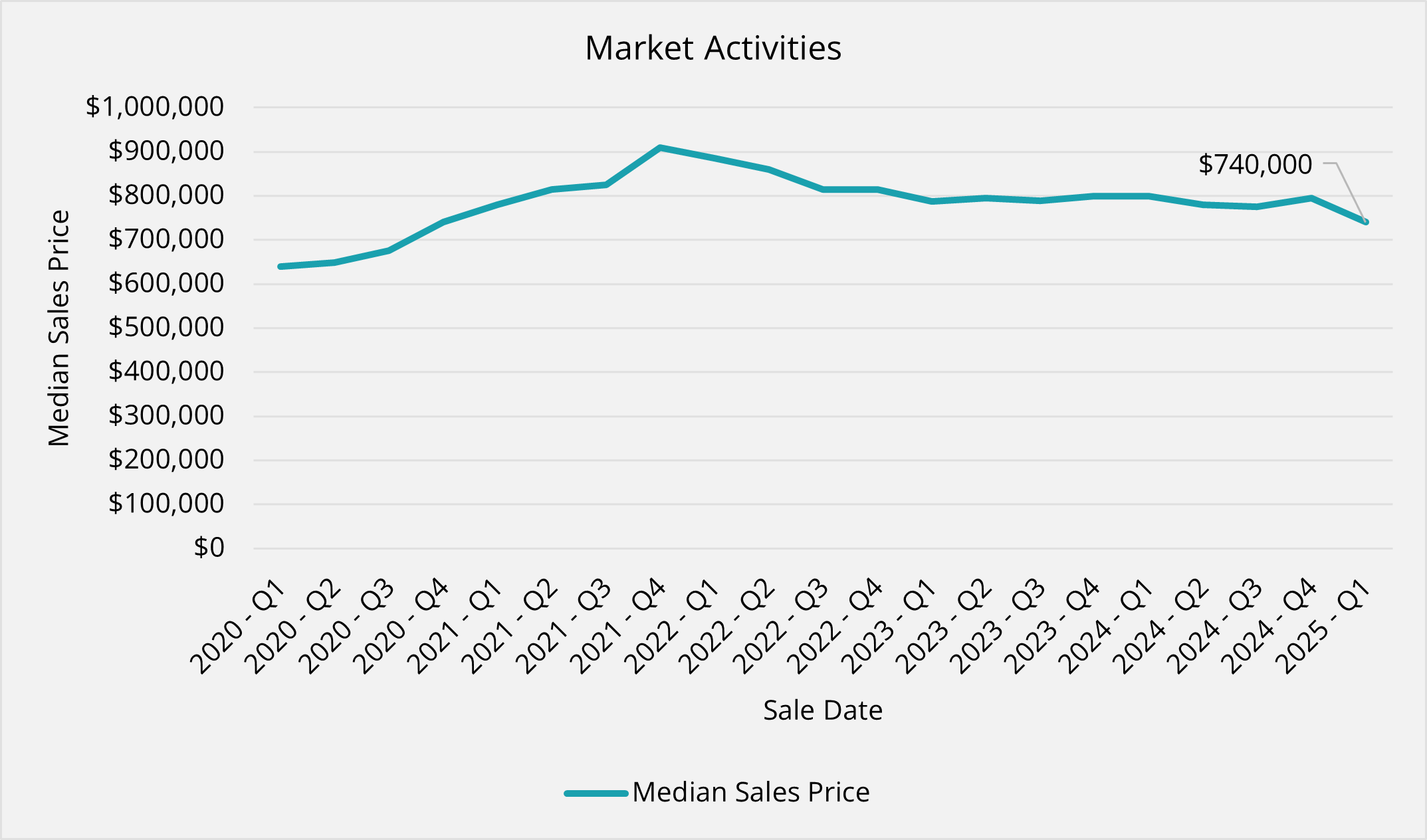

The national median sales price decreased to $730,000 in the first quarter of 2025. However, not all sales have been settled. Despite lower mortgage rates, listing volume is high, given potential buyers’ options and, therefore, no urgency to act.

Figure 3: Median sales price and quarterly volume (settled sales only)

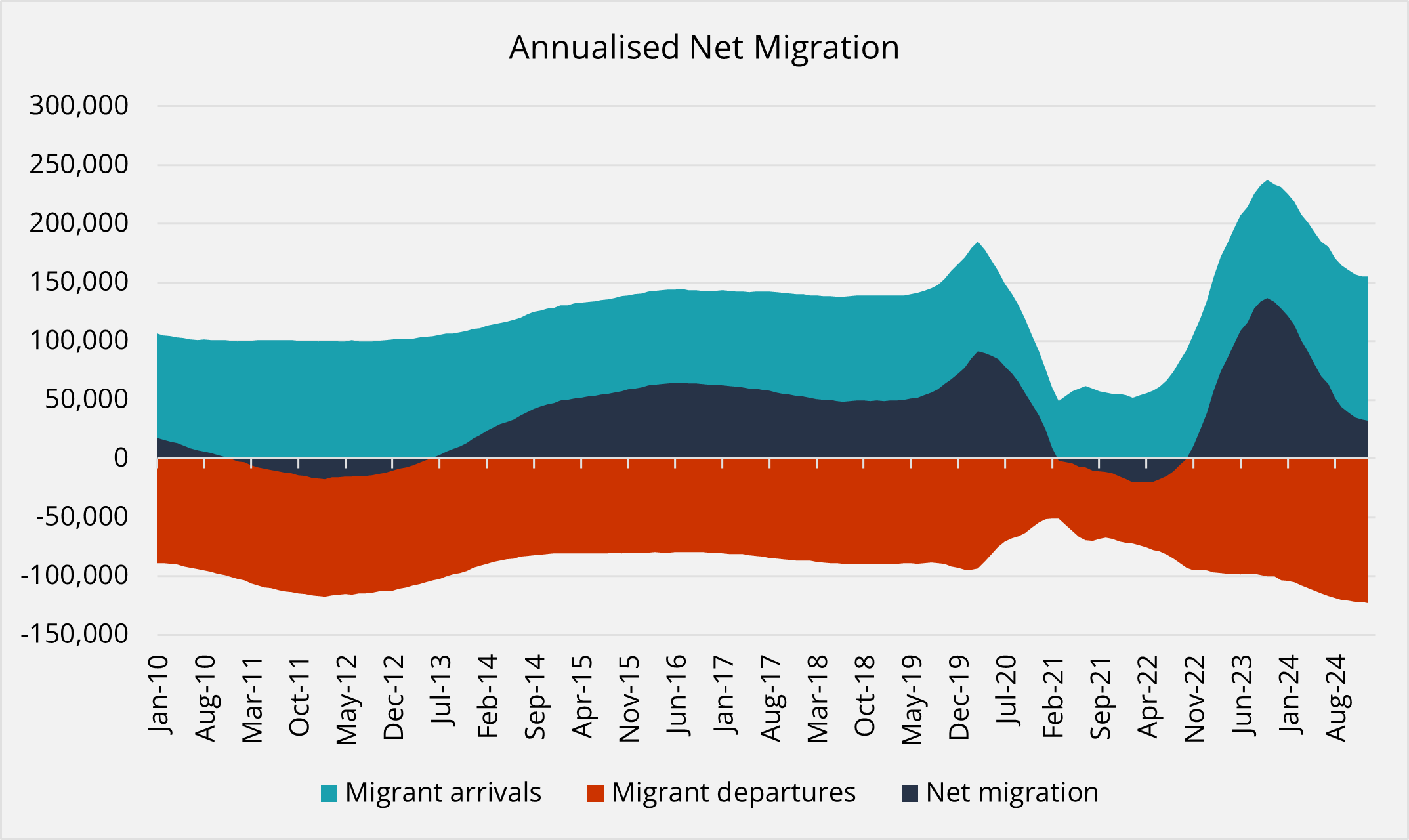

Annualised net migration may have reached a low point, increasing from 30,932 in the 12 months to January to 32,922 in the year to February. However, there was a net loss of 44,100 New Zealand citizens with the departure of 69,100 over the past 12 months.

Lower net migration and the rise in the departure of New Zealand citizens reduced rental and purchasing demand, acting as a release valve for the weaker employment market.

Figure 4: Net migration – Stats NZ

Construction

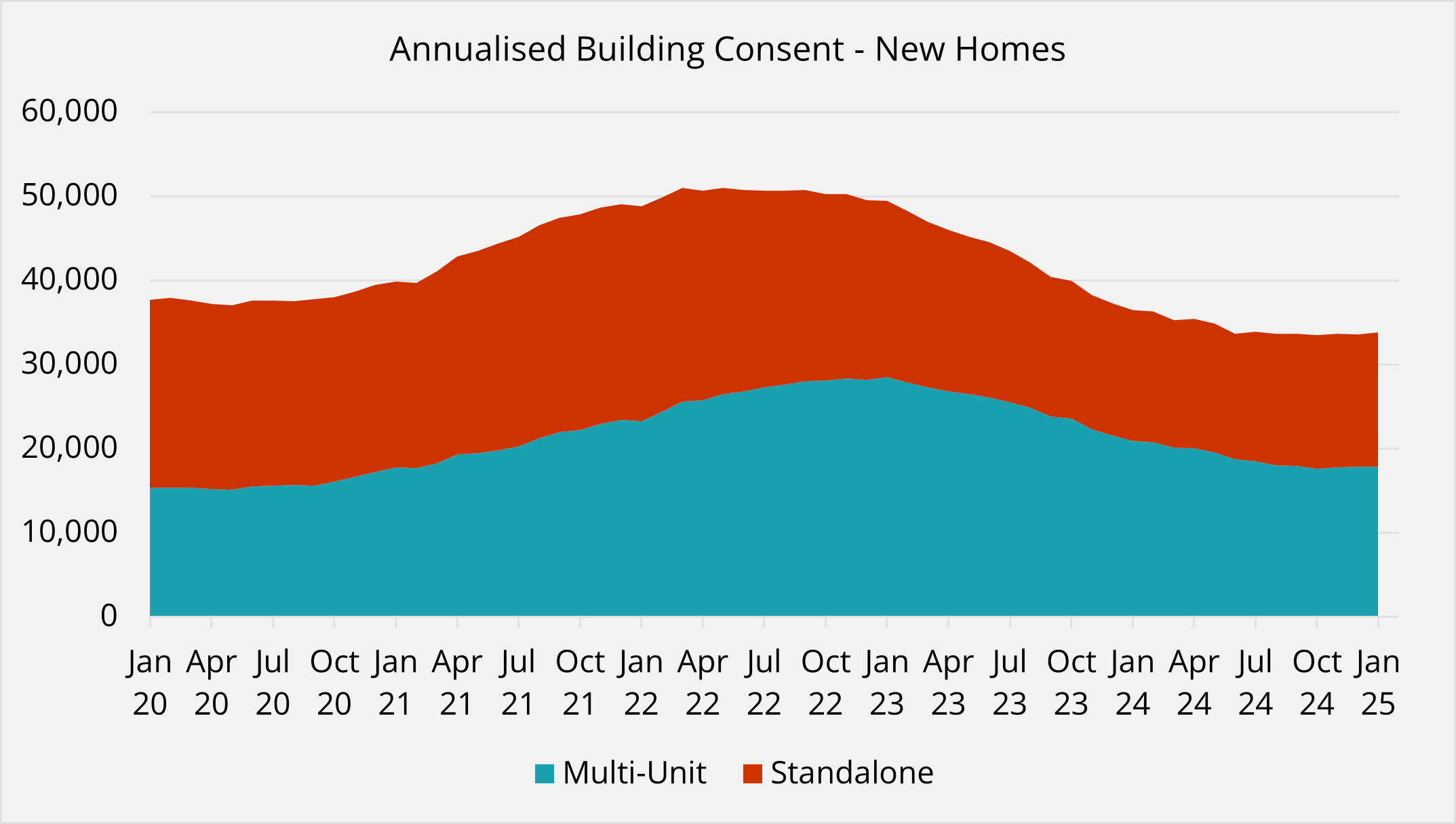

Building consent volumes have continued to decline in recent months. In the 12 months to February 2025, 33,595 new homes were consented, a 7.4% drop compared to the previous year. While overall numbers fell, stand–alone dwellings saw a modest increase of 2.3%. In contrast, consents for multi–unit developments decreased, partly influenced by development constraints in Auckland introduced by Watercare in late 2024.

Although building cost inflation has eased, the slowdown in construction activity raises concerns that more tradespeople may begin to seek opportunities in Australia.

Figure 5: Composition of new homes consented – Stats NZ

Things to watch

- Inventory levels remain high and show little sign of diminishing; this indicates sellers are active, placing a natural ceiling to price growth

- The pace of the housing market recovery will largely depend on the strength of the employment market, as job stability and income growth are key drivers of buyer confidence and borrowing capacity

- A sudden spike in inflation may slow or delay the pace of future interest rate cuts, potentially limiting the extent of stimulus to the housing market

Valocity values

| Region | Value now | Value – three months ago | Quarterly change | Quarterly change – three months ago | Value six months ago | Value one year ago |

| Auckland | $1,302,000 | $1,308,000 | –0.5% | 2.1% | $1,281,000 | $1,319,000 |

| Bay of Plenty | $957,000 | $956,000 | 0.1% | 1.2% | $945,000 | $960,000 |

| Canterbury | $794,000 | $789,000 | 0.6% | 0.8% | $783,000 | $789,000 |

| Gisborne | $672,000 | $661,000 | 1.7% | 0.3% | $659,000 | $642,000 |

| Hawke’s Bay | $792,000 | $792,000 | 0.0% | 1.8% | $778,000 | $808,000 |

| Manawatu–Whanganui | $605,000 | $604,000 | 0.2% | 0.3% | $602,000 | $613,000 |

| Marlborough | $776,000 | $762,000 | 1.8% | –1.3% | $772,000 | $776,000 |

| Nelson | $810,000 | $810,000 | 0.0% | 0.5% | $806,000 | $812,000 |

| Northland | $819,000 | $819,000 | 0.0% | 0.5% | $815,000 | $847,000 |

| Otago | $1,007,000 | $986,000 | 2.1% | –0.9% | $995,000 | $987,000 |

| Southland | $562,000 | $554,000 | 1.4% | 0.5% | $551,000 | $545,000 |

| Taranaki | $699,000 | $694,000 | 0.7% | 0.4% | $691,000 | $697,000 |

| Tasman | $975,000 | $947,000 | 3.0% | –1.0% | $957,000 | $953,000 |

| Waikato | $909,000 | $905,000 | 0.4% | 0.6% | $900,000 | $912,000 |

| Wellington | $855,000 | $874,000 | –2.2% | 1.3% | $863,000 | $902,000 |

| West Coast | $492,000 | $486,000 | 1.2% | 2.3% | $475,000 | $470,000 |

On the horizon

- Financial Stability Report – RBNZ – 7th May

- Unemployment Rate – Stats NZ – 7th May

- Auckland Council General Revaluation – 2025

- Hamilton City Council General Revaluation – June (Tentative)

For further information, or if you would like to understand more about New Zealand housing market insights please contact wayne.shum@valocityglobal.com.