Our solutions at a glance

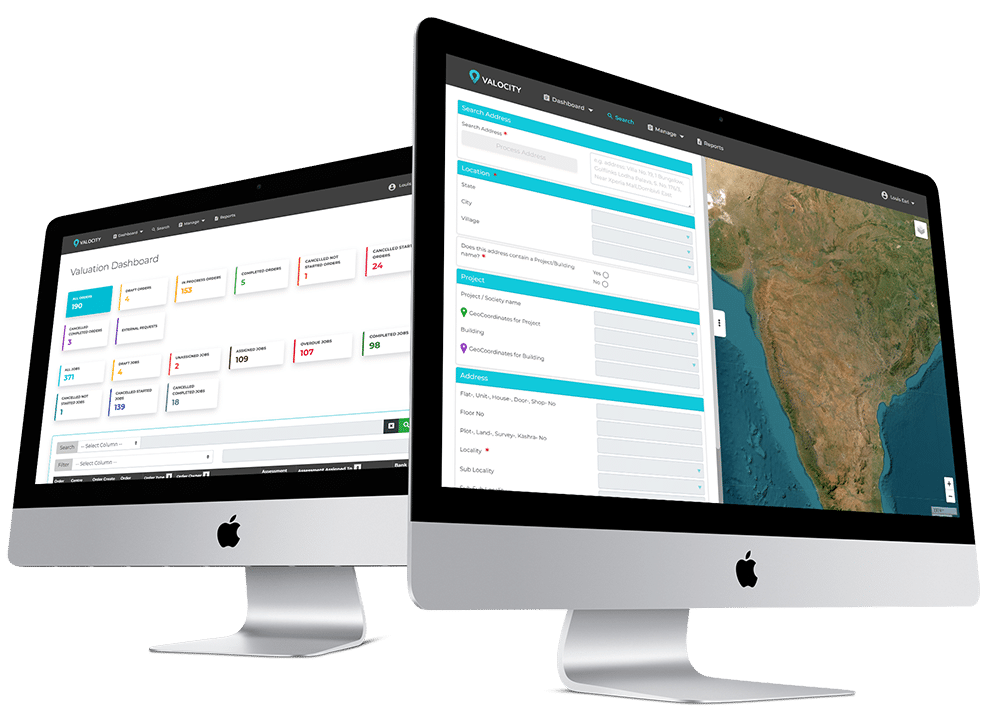

Digital valuation management platform

Digitally connecting the entire valuation ecosystem for the first time with end-to-end digital workflow management.

- Easily integrate with lender’s credit rules and workflows

- Automate work allocation and valuation frameworks

- Increase confidence with accurate property identification and validation

- Reduce Turn Around Time (TAT) and cost and improve portfolio visibility

- Gain control and improve transparency through audit trails

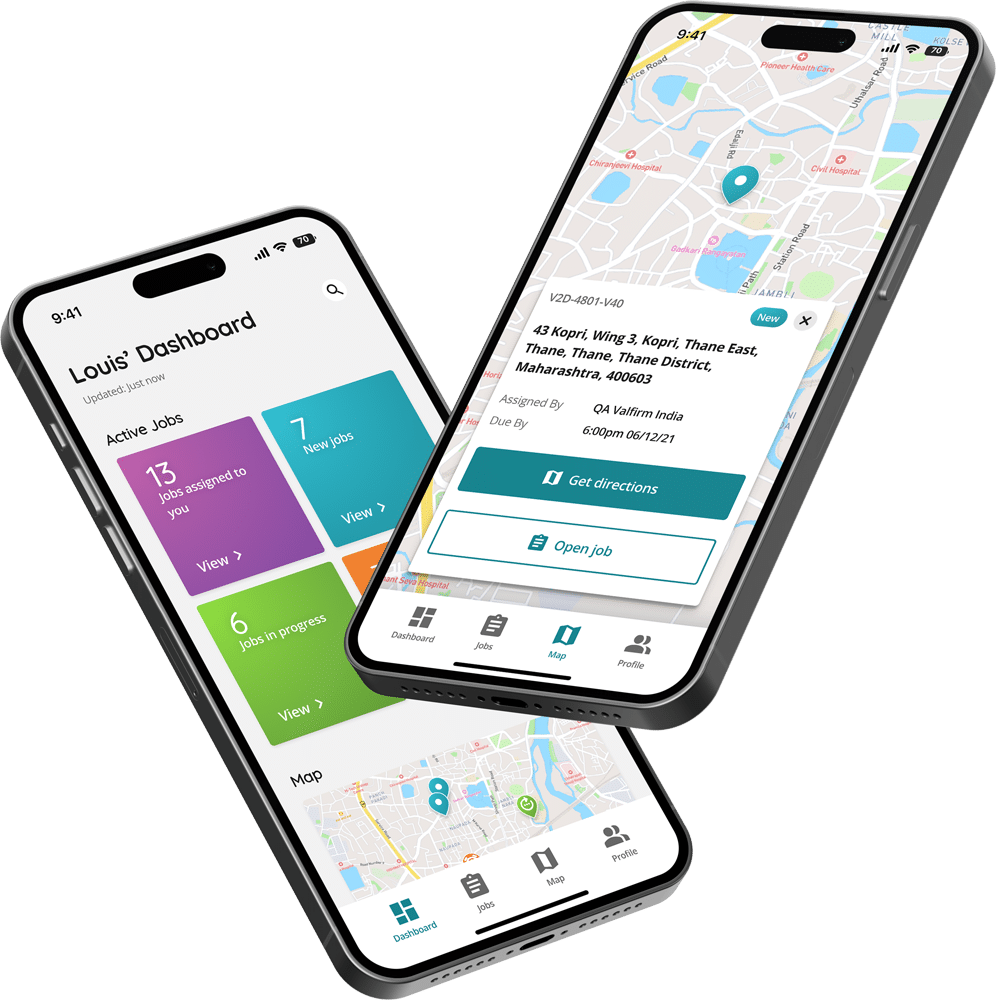

In-field data capture tool for valuers

For the first time, nationwide valuers can digitally and accurately complete valuation reports/appraisals in field.

- Simplify valuations with an end-to-end digital solution

- Leverage auto calculations and smart validations to reduce the risk of human error

- Digitally connect with lenders for secure communication

- Gain efficiency and speed with standardised valuation templates and customised workflows

Digital approved project financials and legal workflow

Designed to facilitate pre and post-build project approval, BuildIQ delivers an entirely digital workflow to streamline the approved project financial (APF) process including technical and legal due diligence.

- Go completely paperless with a secure end-to-end digital workflow

- Gain visibility of legal and technical due diligence activities and documentation throughout the APF process

- Reduce delays and remove bottlenecks with a transparent workflow

- Avoid cost process automation

- Increase control over subsequent monitoring

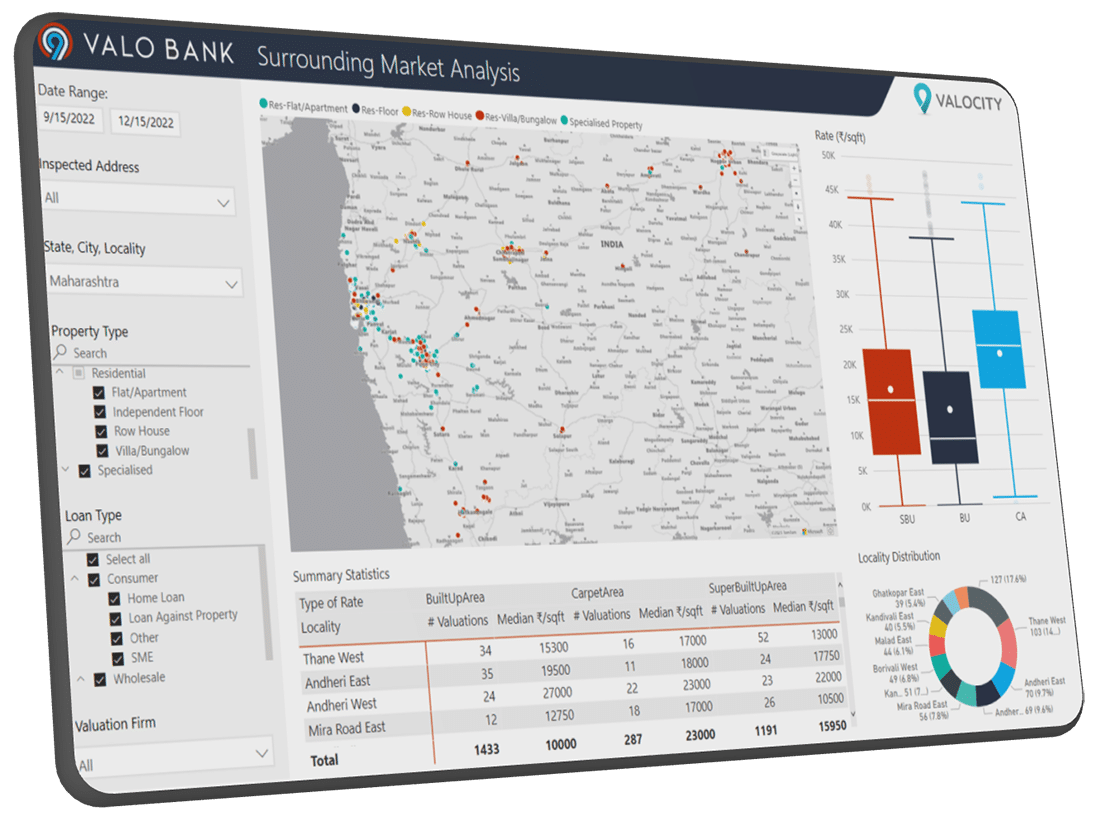

Turning insight into foresight

Combining valuation data with proprietary market data, Valocity delivers advanced insights across multiple dimensions; portfolio management, market analysis, price trends, property level profiling and operational management.

- Benchmark against aggregated industry data

- Leverage interactive mapping to explore areas of interest

- Visualise portfolio concentration vis-à-vis market trends

- Monitor valuer performance and turnaround time (TAT)

- Monitor regulatory compliance matrices e.g. ‘early warning signs’ of the portfolio

From manual to digital

Harnessing technology and data to deliver digital transformation and significant value.

Configurable valuer allocation for quality control

Proactively mitigating risks through portfolio analytics, unlocking cost savings and smarter decision-making

Digital data capture and insights with standardised bank template

Ensuring authenticity and reliability of information through geo-coded addresses and verifiable digital data sources

Bank-grade security to stay ahead of increasing regulatory compliance and evolving external cyber risks

Fully digital end-to-end workflow, enhancing productivity and reducing turnaround time (TAT)

Portfolio analytics and SLA reporting for data-driven decision-making around valuer performance

Reliable digital data capture enables bench-marking, indices, and trend analytics to provide a competitive advantage

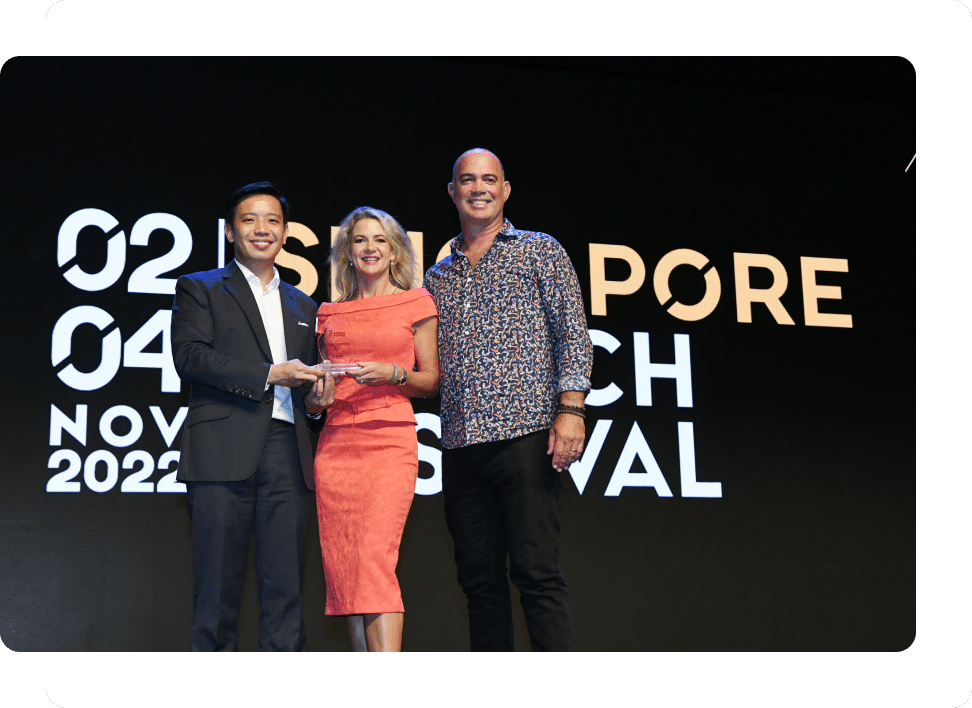

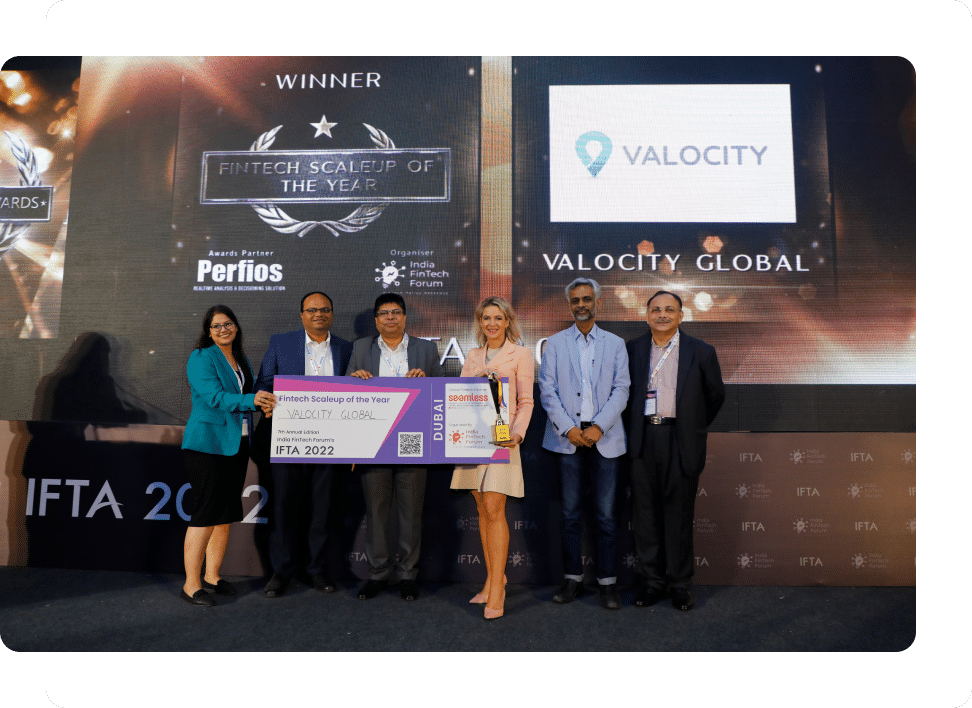

Global recognition

NZDM Nexus Supreme Winner Award 2015

Innovation Award 2016, Property Institute NZ

2017 CIO award for ‘Best Business Transformation using Digital and IT’

Finalist Excellence in Innovation, Export NZ Awards 2018

Finalist Best Medium Business, Export NZ Awards 2018

Finalist Global Fintech Awards, Singapore Fintech Festival 2018

Fintech Startup of the Year Award, India Fintech Forum 2019

Finalist Global Fintech Hackcelerator Awards, Singapore Fintech Festival 2019

Finalist, IFTA India Fintech Award for Innovation 2019

Microsoft ISV Partner Award 2020

Winner of The Search NZ, Abu Dhabi Fintech 2020

Fintech Scale Up of the Year, India Fintech Forum Awards (IFTA) 2022

Runner Up Global Fintech of the Year, Singapore Fintech Festival 2022

Excellence in Innovation Technology Award 2022

Future of Living Challenge Winner, Cityscape 2024

Request a demo

Customer testimonials

Our clients

Stay informed with Valocity Hub

How a 70-year-old valuer inspired a digital lending revolution

A 70-year-old valuer doubled his output and helped spark a 40% uplift in valuation capacity, all by going digital with Valocity Connect. This is how human-first innovation transforms lending.

How leading lenders are gaining a competitive advantage in a market that demands speed, precision, and agility

India’s top lenders and over 7,000 valuers have transformed mortgage valuations by adopting Valocity’s one-stop digital solution, replacing manual inefficiencies with automation. This shift has accelerated credit approvals, enhanced compliance, and delivered a significantly better experience for borrowers.

Valocity further strengthens Global Board with appointment of investment MENA Region strategist Andrew Williams

Valocity continues to expand its global leadership bench with the appointment of international investment veteran Andrew Williams, bringing a wealth of global expertise in real estate and capital markets.