Brought to you by the Valocity Research Team: Wayne Shum and James Wilson

Background

Under the Rating Valuations Act 1998, all Territorial Authorities are required to revalue the district within a three-year period. The last Auckland General Revaluation was in 2017. The COVID-19 lockdown in April 2020 made it difficult to conduct a reliable revaluation, and as a result, and at Auckland Council’s request, the Office of the Valuer-General agreed to defer the 2020 General Revaluation to 2021.

The Auckland property market has grown significantly since the Revaluation in 2017. Ratepayers and media were questioning whether the substantial rise in rating valuations expected in 2021 may lead to the same proportional increase in rates payable. However, this is not the case. For example, in the previous General Revaluation in 2017, the residential sector showed an average increase of 46%. The general rates however, increased only 2.5% when the valuations were used to calculate rates.

The 2021 Revaluation will be as of 1 June 2021 and will be released to the public after October 2021. Ratepayers will have the opportunity to object to valuations should they disagree with the outcome. The valuations will be used to set rates from 1 July 2022.

How Rating Valuations are set

Rating Valuations are calculated by comparing recent sales in an area, with considerations made for:

- Property type

- Zoning

- Size, age, condition and quality of the home and amenities

- Location

- School zones

- Desirable outlook

The valuations are calculated using mass-appraisal methods – not all properties are physically inspected by valuers.

A rating valuation comprises of three parts;

- Capital Value, which is the appraised fair market value excluding chattels

- Land Value, which is the appraised fair market value of the unimproved land

- Value of Improvement which is the added value of improvements to the land at time of valuation e.g. dwellings

All Rating Valuations are set on freehold basis and are exclusive of chattels.

So how are the Rates set?

The Rating Valuation of a property is only one of the factors used to determine annual rates payable by households. The overall changes in valuation does not equate to the changes in rates. Other factors involved are:

- Actual use of the property

- Targeted Rates applied for a location

- Growth in number of property assessments

- Overall Council Budget requirements

The 2021 General Revaluation will be used for Rates for the 2022/2023 financial year. Auckland Council hopes to raise $2.249 billion from rates for the 2022/2023 financial year, an increase from the previous 2021/2022 year which contributed $2.138 billion.

Potential Impact of Capital Value Movement

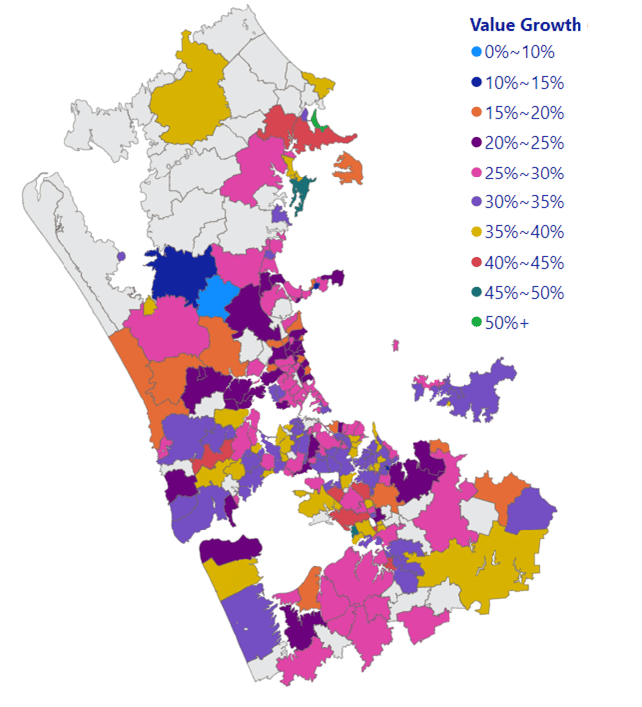

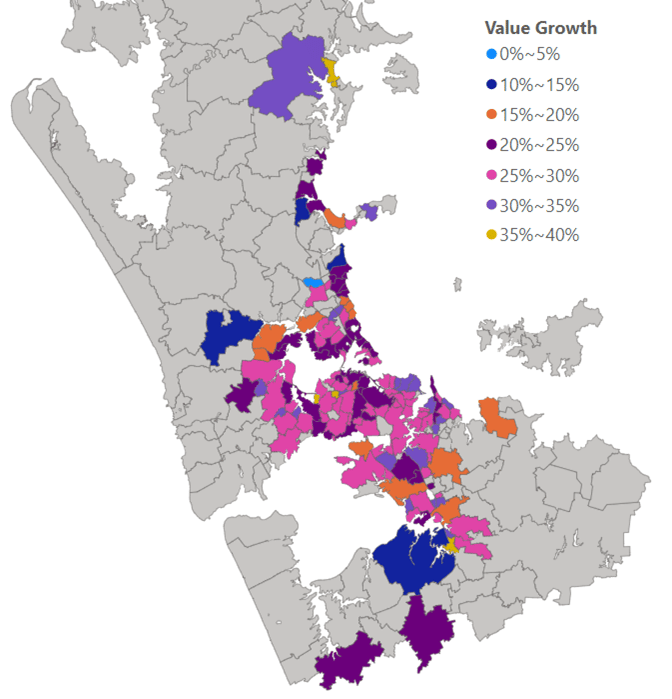

To understand the impact that the increase in capital values might have on ratings, we have compared the median Capital Value to the median Valocity AVM estimate by suburb and property type to determine the value movements since the last Rating Valuations were set.

| Property Type | Median Capital Value | Median AVM Value | Percentage Change |

| Apartment | $560,000 | $640,000 | 14.3% |

| Dwelling | $970,000 | $1,251,184 | 29.0% |

| Unit / Townhouse | $680,000 | $850,131 | 25.0% |

Table 1 – Overall movement for Auckland

Conclusion

- Lower priced suburbs have experienced higher increases since 2017

- Suburbs near town centres and arterial roads such as Panmure, Mangere East and Waterview that are primed for redevelopment also experienced higher than average value growth – perhaps a result of unitary plan zoning incentivising developers to outbid occupiers

- While rates increase year on year, only those with higher than average increase to their valuations will receive higher than average increase to their rates, relative to other property owners

- It is anticipated that this revaluation may introduce new apportionments between Capital Value, Land Values and Improvement values which take into account the fact that land values are driving growth, with zoning changes facilitating further intensification

For further information or if you would like to understand how the Auckland Revaluation may impact your portfolio please contact wayne.shum@valocityglobal.com or james.wilson@valocity.co.nz

Appendix:

Overall movement for Auckland by Suburb

| Dwellings | Units / Townhouses | Apartments | ||||||

| Suburb | Change | No of Properties | Suburb | Change | No of Properties | Suburb | Change | No of Properties |

| Omaha | 57% | 1256 | Snells Beach | 38% | 62 | Mangere | 43% | 118 |

| Clendon Park | 47% | 1865 | Morningside | 36% | 350 | Flat Bush | 38% | 116 |

| Mahurangi East | 46% | 104 | Waterview | 35% | 194 | Point Chevalier | 35% | 50 |

| Matakana | 45% | 259 | Rosehill | 35% | 89 | Mount Roskill | 33% | 90 |

| Otara | 44% | 3145 | Ranui | 35% | 428 | Avondale | 31% | 158 |

| Rosehill | 43% | 942 | Mangere East | 35% | 484 | Onetangi | 30% | 50 |

| Tawharanui Peninsula | 43% | 231 | Botany Downs | 34% | 196 | Otahuhu | 30% | 53 |

| Henderson Valley | 43% | 405 | Kohimarama | 33% | 382 | Kingsland | 29% | 258 |

| Mangere East | 42% | 4077 | Warkworth | 33% | 132 | Panmure | 29% | 86 |

| Manurewa East | 42% | 903 | Gulf Harbour | 33% | 321 | Oteha | 28% | 178 |

| Wiri | 41% | 508 | Sunnyvale | 33% | 283 | Gulf Harbour | 27% | 134 |

| Waiatarua | 40% | 246 | St Heliers | 33% | 769 | East Tamaki | 27% | 117 |

| Red Hill | 40% | 658 | Kelston | 32% | 94 | Birkenhead | 25% | 271 |

| Westmere | 39% | 1493 | Sunnynook | 32% | 209 | Manurewa East | 25% | 71 |

| Golflands | 39% | 822 | Randwick Park | 32% | 54 | Kohimarama | 25% | 153 |

| Kingsland | 39% | 522 | Clendon Park | 32% | 149 | Mount Wellington | 24% | 344 |

| Wellsford | 39% | 688 | Manurewa East | 32% | 142 | New Lynn | 23% | 535 |

| Manurewa | 39% | 7211 | Pahurehure | 31% | 74 | Remuera | 23% | 1131 |

| Panmure | 39% | 1501 | Mellons Bay | 31% | 96 | Orakei | 23% | 122 |

| Algies Bay | 39% | 396 | Totara Vale | 31% | 341 | Onehunga | 22% | 535 |

| Mangere | 39% | 3515 | Glendowie | 31% | 169 | Hobsonville | 22% | 571 |

| Waterview | 39% | 954 | Kingsland | 31% | 75 | Papakura | 22% | 62 |

| Clover Park | 38% | 1830 | Otara | 30% | 66 | St Heliers | 22% | 351 |

| Leigh | 38% | 474 | Golflands | 30% | 144 | Stanley Point | 21% | 60 |

| Point Chevalier | 38% | 2434 | Half Moon Bay | 30% | 593 | Papatoetoe | 21% | 70 |

Table 2 – Top 25 Suburbs by Category: only Suburbs/Category with more than 50 properties are displayed

Price Movement for Dwellings:

Price Movement for Units/Townhouses:

Price Movement for Apartments: