Brought to you by Senior Research Analyst Wayne Shum

The New Policy

The Government has established a series of funding assistance initiatives for First Home Buyers through Kainga Ora by offering First Home Grants and First Home Loans. Whilst such funding schemes are a positive way to encourage and support the transition towards home ownership for First Home Buyers, there have been assertions made by various commentators that the current price cap settings are not realistic, especially in New Zealand’s largest housing market, Auckland.

So how many homes falls under the price caps in Auckland?

Valocity wanted to investigate this, so using our valuation models we have analysed the number and types of homes falling under the Auckland Price Regional Price Cap of $625,000 for an existing property and $700,000 for a new property.

The Criteria

To qualify for a First Home Grant, the following criteria needs to be met:

- Have been making regular KiwiSaver contributions for 3 – 5 years

- Buyer to be over 18

- Have earned less than the income caps in the last 12 months

- Not currently own any property, this does not include ownership of Māori land

- Have been contributing at least the minimum amount to KiwiSaver (or complying fund or exempt employer scheme) for 3 years or more

- Purchase a property that is within the regional house price caps

- Agree to live in your new house for at least 6 months

The buyer may qualify for a single payment of up to $10,000.

To qualify for First Home Loan, the following criteria needs to be met

- Have earned less than the income caps in the last 12 months

- Purchase a property that is within the regional house price caps

- Agree to live in your new house

- To pay a Lender’s Mortgage Insurance (LMI) premium of 1% of the loan amount

The buyer may qualify for a mortgage with only 5% deposit, subject to lender approval.

Both these policies require the property to be below regional price caps. A New Build is defined as newly built dwellings that received a building code compliance certificate less than 12 months ago.

| Region | Existing/older properties | New properties |

| Auckland | $625,000 | $700,000 |

| Queenstown-Lakes District | $600,000 | $650,000 |

| Kāpiti Coast District, Porirua City, Upper Hutt City, Hutt City, Wellington City | $550,000 | $650,000 |

| Hamilton City, Tauranga City, Western Bay of Plenty District, Waipa District, Hastings District, Tasman District, Napier City, Nelson City | $525,000 | $600,000 |

| Waimakariri District, Christchurch City, Selwyn District | $500,000 | $550,000 |

| Waikato District, Dunedin City | $425,000 | $550,000 |

| Rest of New Zealand | $400,000 | $500,000 |

Number of individual properties under the price caps

| Region | Existing eligible homes | Percentage of all existing home stock | Eligible New Builds | Percentage of all new build stock |

| Auckland | 22,084 | 14% | 965 | 23% |

| Franklin | 2,458 | 19% | 111 | 18% |

| Manukau | 4,994 | 5% | 800 | 25% |

| North Shore | 1,337 | 2% | 62 | 4% |

| Papakura | 1,731 | 10% | 552 | 33% |

| Rodney | 1,528 | 4% | 65 | 3% |

| Waitakere | 1,946 | 3% | 331 | 11% |

| Grand Total | 36,078 | 8% | 2,886 | 18% |

Make-up of the eligible homes

In total there are approximately 36,000 homes falling under the Auckland Price Cap. Approximately 15,500 of these comprise apartments located in Grafton and Auckland Central which have traditionally been targeted by investors to provide accommodation for tertiary students, or waterfront apartments aimed at those higher up the property ladder, therefore ‘appetite’ among first home buyers to purchase such stock may be limited.

Summary

- Apartments generally have lower entry cost, but buyers must account for body corporate fees. Banks are generally less willing to lend on smaller apartments, or apartment blocks with a checkered history.

- For First Home Buyers under the price caps still seeking the “quarter acre dream”, it is unlikely to be achieved in the Auckland Region except in the fringe suburbs.

- Units, flats, or townhouses are the most common options for First Home Buyers under the price cap. They offer lower entry prices compared to free standing homes and provide a similar level of accommodation. The market is catering for these buyers, with the number of off-plan townhouse developments on the rise across suburban Auckland.

Appendix

Below are the top 25 suburbs by number of eligible new and existing homes.

| Top 25 Suburb | Eligible New Apartment | Eligible New Dwelling | Eligible New Unit / Townhouse | Total New Eligible Home |

| Auckland Central | 495 | 495 | ||

| Papakura | 35 | 58 | 257 | 350 |

| Manukau | 99 | 91 | 190 | |

| Takanini | 4 | 143 | 147 | |

| Mangere | 118 | 3 | 23 | 144 |

| Onehunga | 90 | 90 | ||

| Glen Eden | 78 | 6 | 84 | |

| Wattle Downs | 82 | 82 | ||

| Manurewa East | 71 | 1 | 72 | |

| Papatoetoe | 11 | 7 | 52 | 70 |

| Mount Wellington | 10 | 50 | 60 | |

| Avondale | 53 | 6 | 59 | |

| Pukekohe | 23 | 36 | 59 | |

| Hobsonville | 53 | 1 | 2 | 56 |

| Massey | 16 | 39 | 55 | |

| Mangere East | 43 | 2 | 6 | 51 |

| Panmure | 46 | 1 | 1 | 48 |

| Grafton | 44 | 44 | ||

| Manurewa | 18 | 26 | 44 | |

| Epsom | 40 | 40 | ||

| Wiri | 21 | 16 | 37 | |

| Eden Terrace | 36 | 36 | ||

| Mangere Bridge | 2 | 31 | 33 | |

| Otara | 4 | 29 | 33 |

| Top 25 Suburb | Eligible Existing Apartment | Eligible Existing Dwelling | Eligible Existing Unit / Townhouse | Total Existing Eligible Home |

| Auckland Central | 13,634 | 109 | 13,743 | |

| Papatoetoe | 57 | 36 | 1,528 | 1,621 |

| Grafton | 1,493 | 19 | 1,512 | |

| Pukekohe | 44 | 664 | 530 | 1,238 |

| Papakura | 16 | 394 | 692 | 1,102 |

| Waiuku | 628 | 234 | 862 | |

| Otahuhu | 42 | 58 | 756 | 856 |

| New Lynn | 263 | 2 | 484 | 749 |

| Mount Eden | 142 | 587 | 729 | |

| Manurewa | 68 | 614 | 682 | |

| Eden Terrace | 597 | 42 | 639 | |

| Mount Wellington | 141 | 35 | 438 | 614 |

| Albany | 263 | 318 | 581 | |

| Mount Albert | 410 | 145 | 555 | |

| Manukau | 420 | 2 | 76 | 498 |

| Clendon Park | 317 | 113 | 430 | |

| Parnell | 273 | 97 | 370 | |

| Mangere East | 34 | 310 | 344 | |

| Grey Lynn | 292 | 30 | 322 | |

| Glen Eden | 145 | 5 | 162 | 312 |

| Henderson | 67 | 24 | 215 | 306 |

| Flat Bush | 116 | 3 | 178 | 297 |

| Onehunga | 133 | 1 | 158 | 292 |

| Avondale | 59 | 230 | 289 |

The suburbs can be divided into 2 groups:

- Outer suburbs such as Wellsford, Pukekohe and Waiuku. They are rural suburbs located over 50km from Auckland Central, where land cost is generally lower and allows for more affordable housing.

- Established suburbs such as Papatoetoe, Otahuhu and New Lynn that are currently undergoing gentrification. The Unitary Plan allows for more intensive developments than the previous District Plans, therefore we are experiencing a growing gentrification of brownfield developments in these suburbs in the past 5 years.

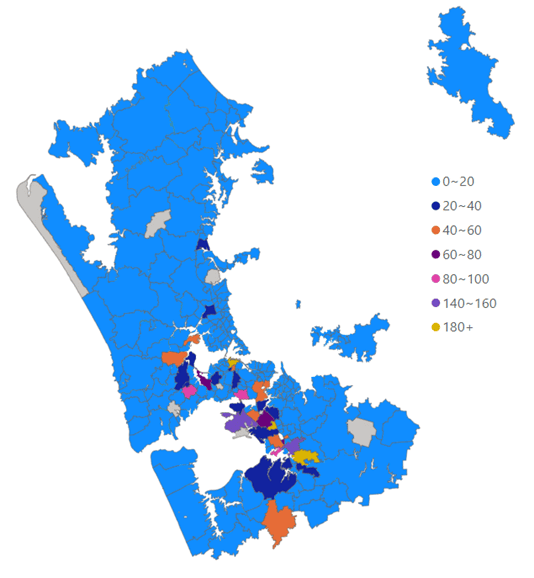

Location of the eligible existing homes:

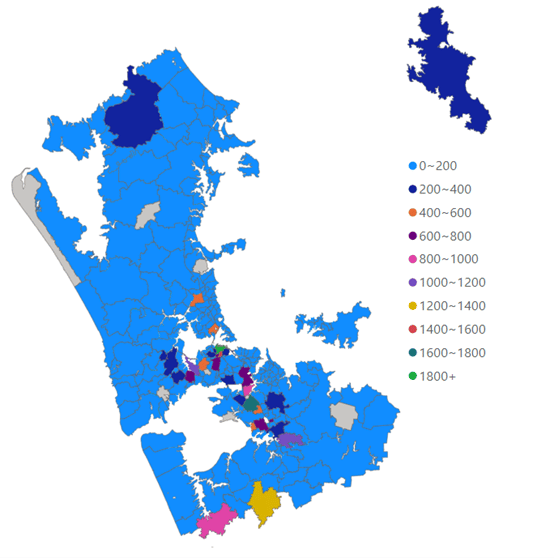

Location of the eligible new builds: