Brought to you by Senior Research Analyst Wayne Shum

Housing market momentum: Early 2026 snapshot

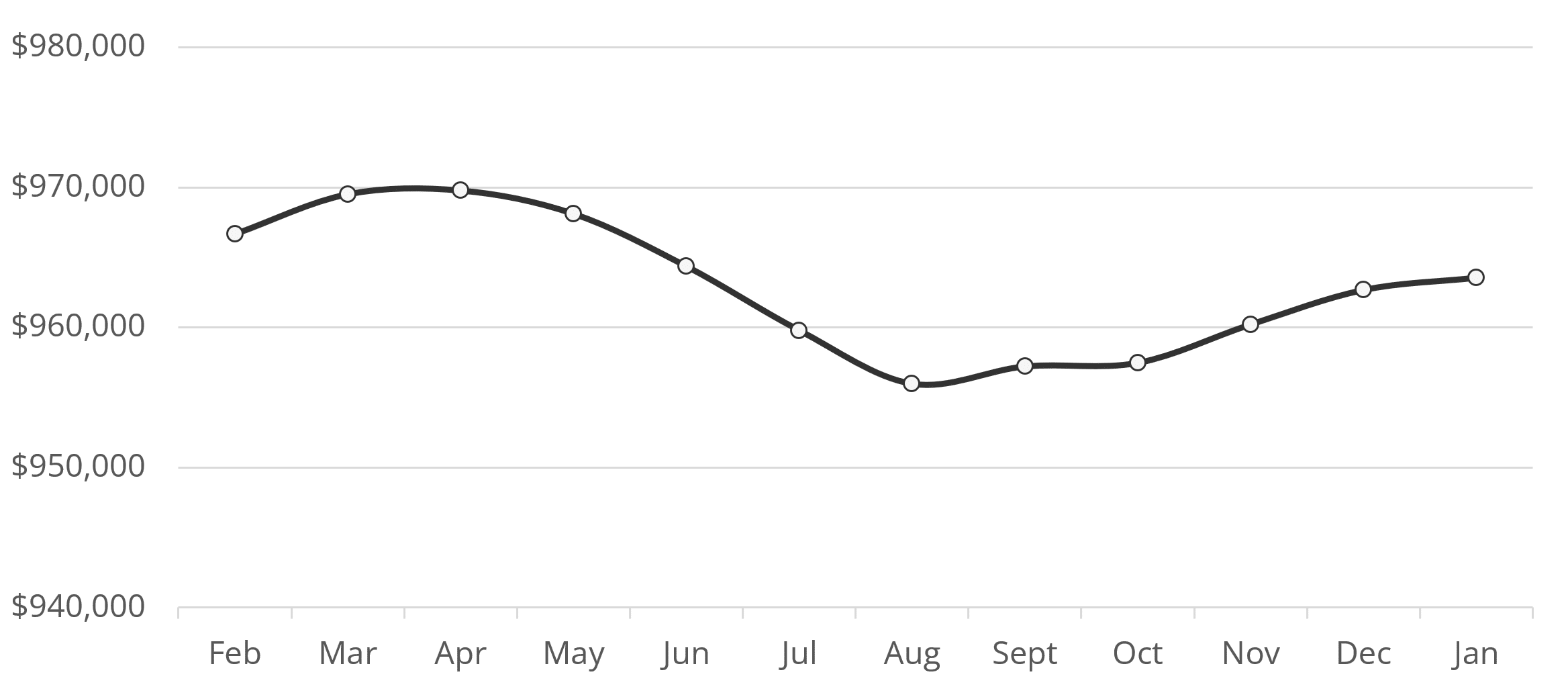

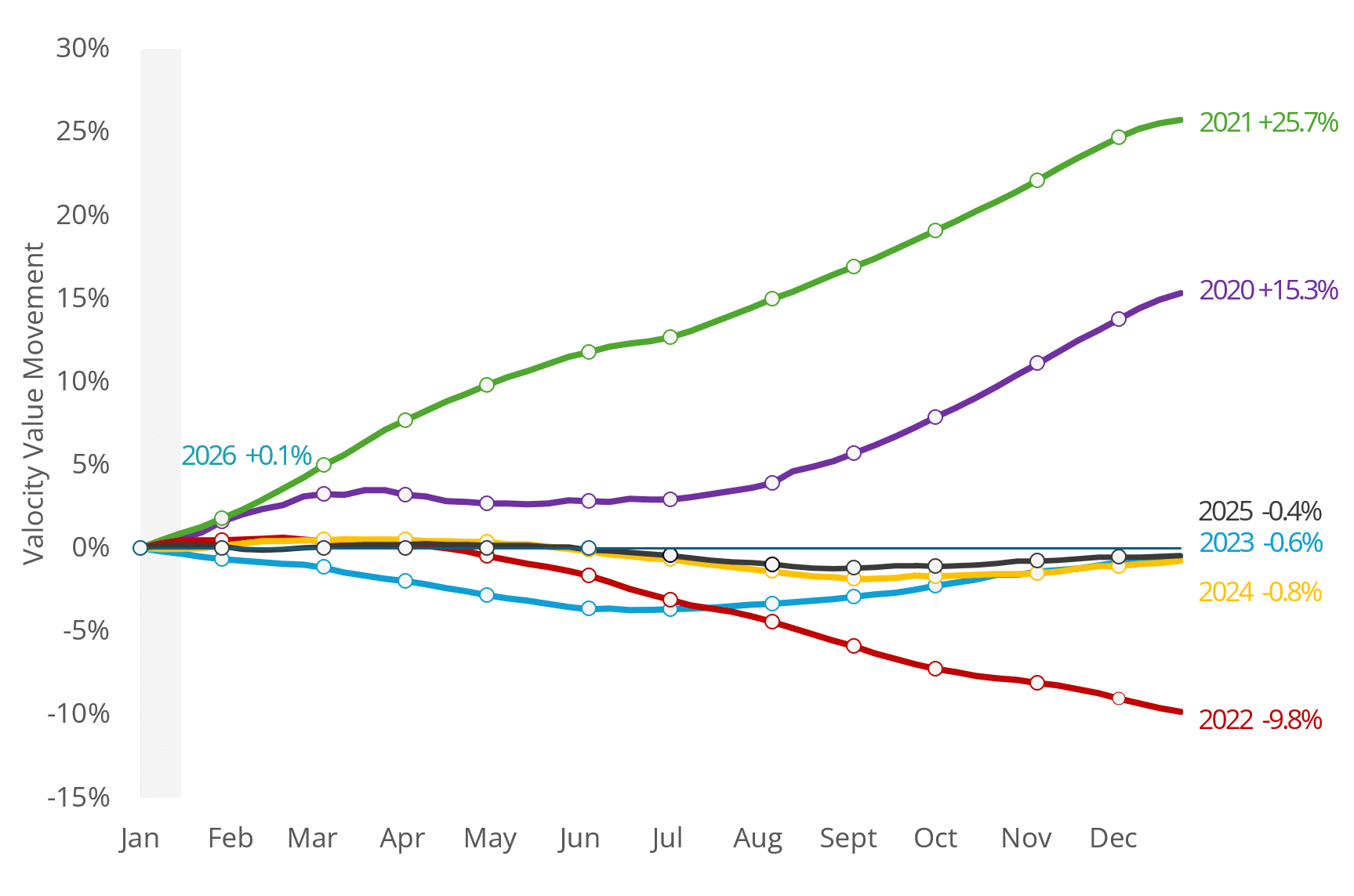

The housing market wrapped up 2025 on a cautiously optimistic note. While overall values fell 0.4% for the year, the final quarter saw prices climb 0.6%, supported by lower mortgage rates and modestly improving economic conditions.

The Valocity Value Index mirrored this uplift, rising 0.6% over the past quarter and building on the positive momentum that began in November. While encouraging, it’s still too early to confirm whether this growth is sustainable, especially as mortgage rates appear to have bottomed and the pace of economic recovery remains uncertain. Gradual price increases are expected through 2026.

Key economic indicators pointed to stabilisation. Unemployment likely peaked, net migration has levelled off, GDP showed improvement, and market confidence is slowly returning – evident in rising building consent volumes and stronger mortgage demand. However, inflation remains a concern, with the CPI finishing the year at 3.1%, above the RBNZ’s target range.

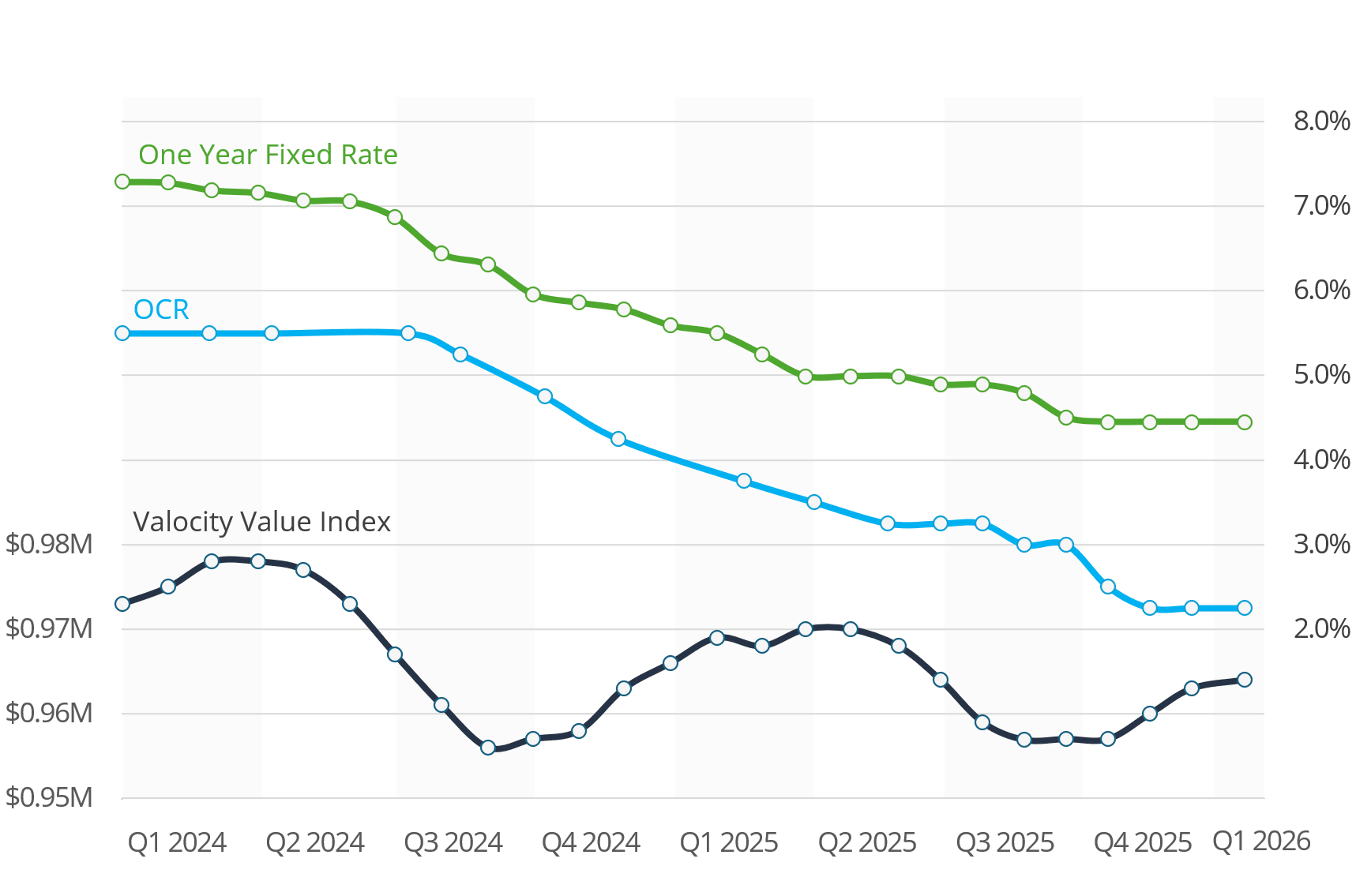

The RBNZ Monetary Policy Committee’s latest OCR decision indicated that further rate cuts are unlikely this cycle. Over December and January, longer-term mortgage rates increased due to wholesale funding pressures, while some short-term rates saw modest reductions.

Aggressive cashback offers of up to 1.5% from several lenders in November and December spurred both new and existing borrowers into action, pushing mortgage switching volumes to record highs. The loosening of Loan-to-Value Ratio restrictions from 1 December is also expected to further support buyer activity, with its full impact likely to become clearer in 2026.

High listing levels are expected to temper rapid price growth, particularly in the townhouse segment. Across the five major banks, the average house price growth forecast for 2026 is 4%, with the speed of recovery closely tied to global uncertainties, trade and tariff developments, and the upcoming General Election.

Building consent issuance for new homes continued to rise, signalling a gradual return of confidence in the construction sector. Despite bouncing back from the 2023–24 lows, industry capacity remains unconstrained. Regulatory changes may further boost activity, including exemptions allowing granny flats of up to 70 sqm to be built without building consent (subject to conditions), and a proposed self-certification scheme enabling some builders to sign off on their own work.

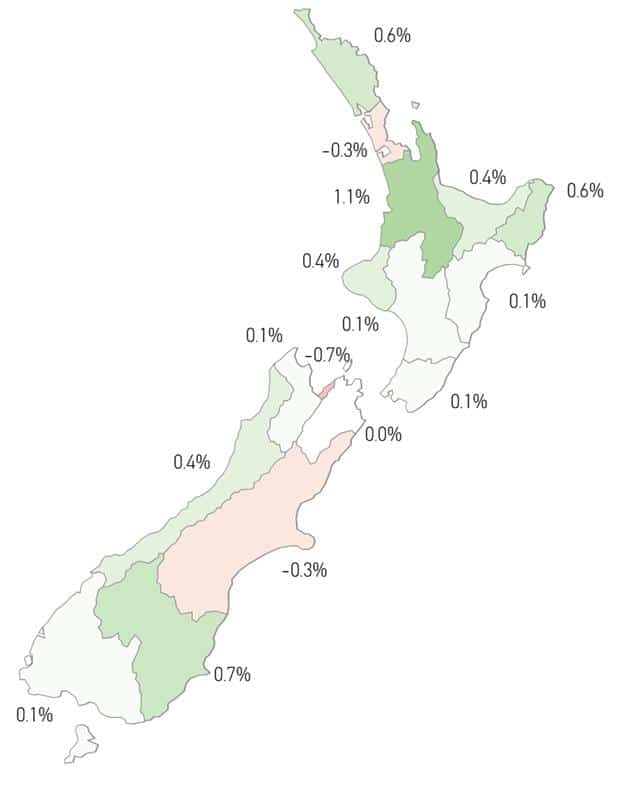

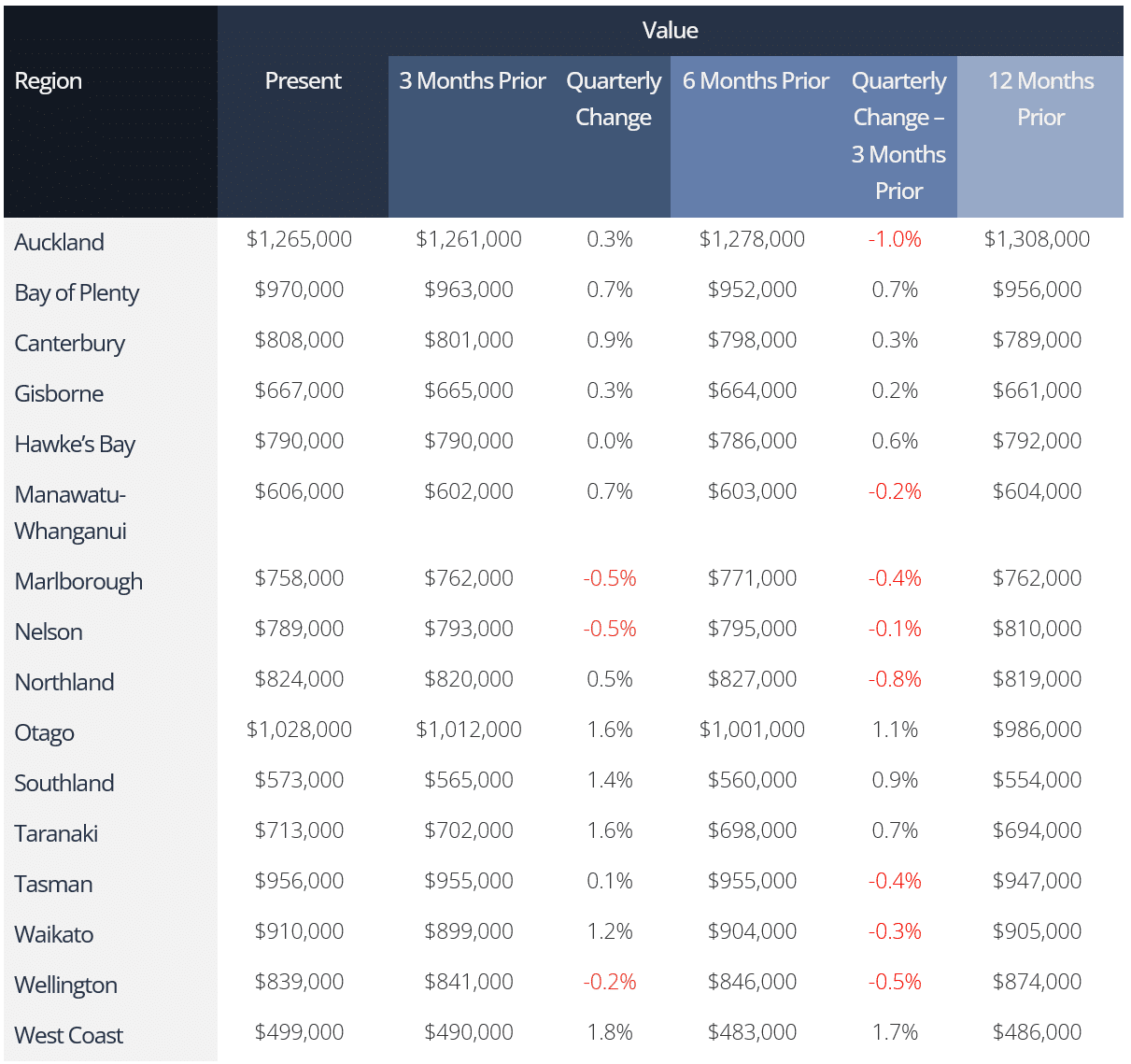

Regionally, 11 of 16 regions recorded annual value growth, led by Otago (+4.3%) and Southland (+3.4%), while Auckland (-4.0%) and Wellington (-3.3%) weighed on the national result. On a quarterly basis, 13 regions saw growth, with Wellington, Nelson, and Marlborough experiencing modest declines, reflecting weaker local economic conditions.

Over the past month, market activity softened during the holiday period, with month-on-month value declines in Auckland, Nelson, and Canterbury.

Figure 1: Valocity Value Index Movement by Region

Figure 2: Valocity Value – New Zealand – Past 12 Months

The RBNZ Monetary Policy Committee closed out 2025 with a 25-basis-point cut to the Official Cash Rate in November, taking it to 2.25%, its lowest level since June 2022. While the move was widely anticipated and largely priced into mortgage rates, the accompanying guidance was more telling, signalling that this cut marked the bottom of the current rate cycle. In response, some longer-term mortgage rates edged higher over December and January.

The next OCR review – and the first under the newly appointed Governor – is scheduled for February. In the meantime, inflation remains elevated, with the CPI at 3.1%, sitting above the RBNZ’s target range and reducing the likelihood of further OCR cuts in the near term.

Figure 3: Valocity Value Index and Benchmark Rates

Figure 4: Valocity Value Index Movement – Year on Year Comparison

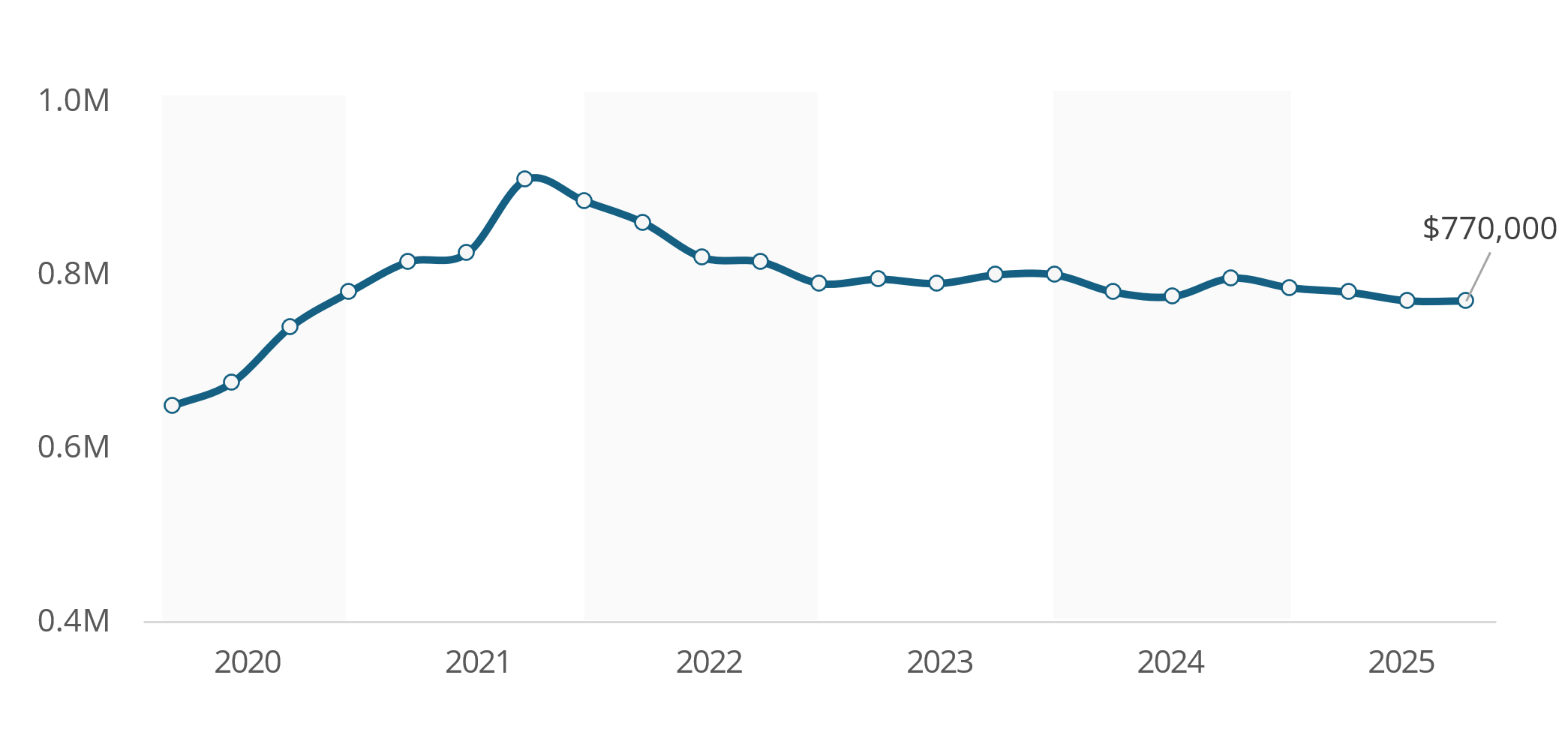

The national median sale price remained steady at $770,000 in Q4 2025, unchanged from Q3. This period of price stability suggests the market may have reached its floor, pointing to a shift toward more balanced conditions as 2026 gets underway.

While this signals growing confidence, elevated listing volumes are expected to moderate the pace of any price recovery, keeping growth measured in the near term.

Figure 5: Median Sales Price (Settled Sales Only)

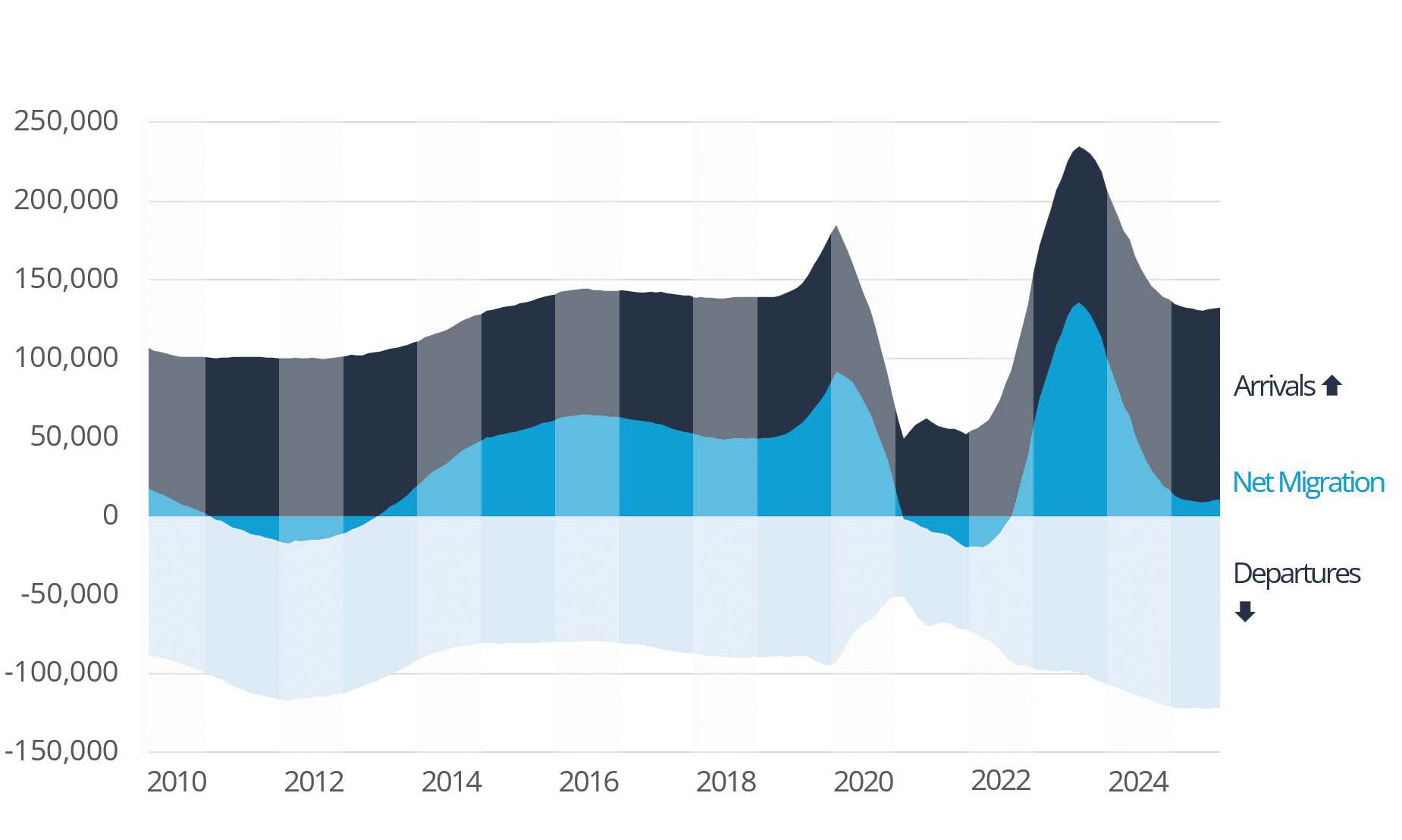

Net migration appears to have reached its low point, with the year ended November recording net gains of 10,681, an improvement on October and an early sign of stabilisation.

That said, migration dynamics over the past 12 months remain under pressure. Departures of New Zealand citizens stayed elevated, with 67,800 leaving the country – up 1% on the previous year – resulting in a net loss of 40,800 citizens. Stronger employment and income opportunities offshore have been a key driver of this outflow, continuing to weigh on overall migration trends.

At the same time, arrivals of non-New Zealand citizens declined 14% compared with the previous 12 months, further reshaping the migration landscape and reinforcing the cautious outlook moving into 2026.

Figure 6: Annualised Net migration (Statistics NZ)

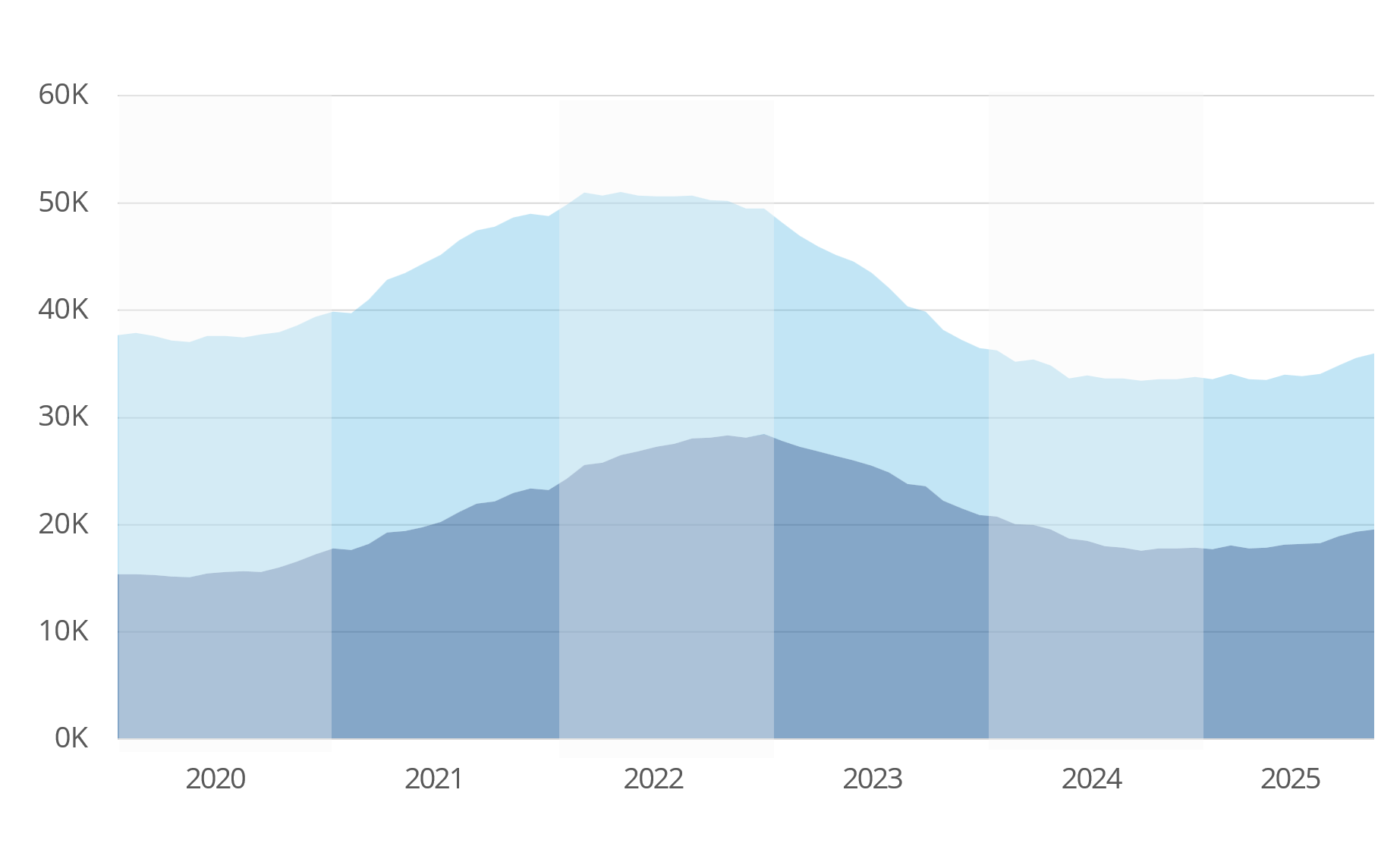

Construction

A total of 35,969 new homes were consented in the 12 months to November 2025, up 7.0% on the previous year. Auckland showed particularly strong momentum, with consent volumes increasing 9.7% year on year. These trends indicate that confidence is gradually returning to the construction sector.

Figure 7: Composition of New Homes Consented – Annualised (Statistics NZ)

Valocity values

On the horizon

- Release of Unemployment Rate data by Stats NZ – 4th February 2026

- Monetary Policy Statement and OCR Review – 18th February 2026

For further information, or if you would like to understand more about New Zealand housing market insights please contact [email protected].