Brought to you by Senior Research Analyst Wayne Shum

Valocity insight: New Zealand property market snapshot of November 2025

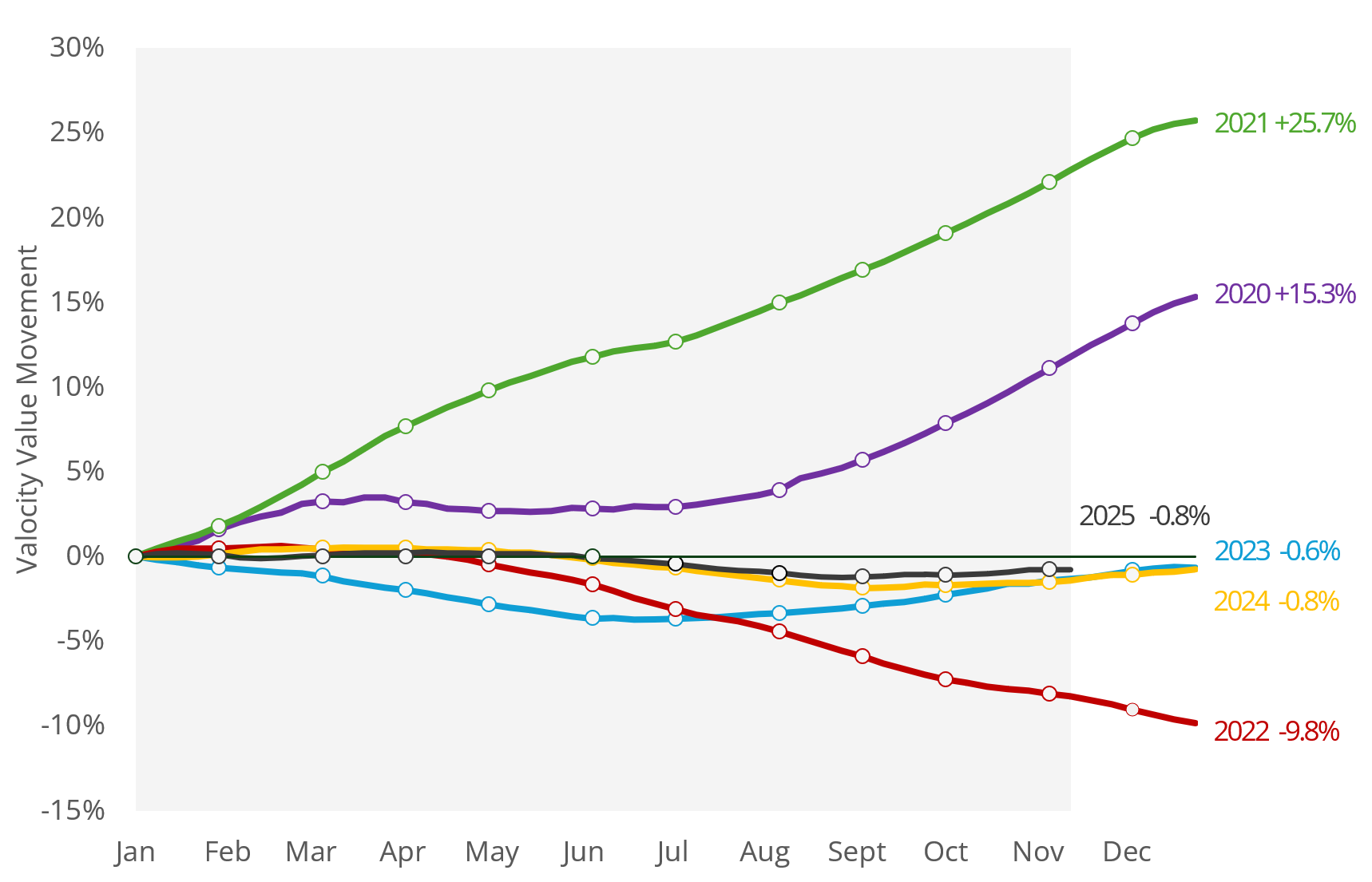

The year began with optimism in the property market. Falling mortgage rates fuelled expectations of strong annual growth, with some forecasts predicting increases of up to 9%. However, as the year progressed, this initial confidence softened. Market sentiment shifted from recovery to stabilisation, and current forecasts for 2026 are more subdued, now sitting in the mid 4% growth range.

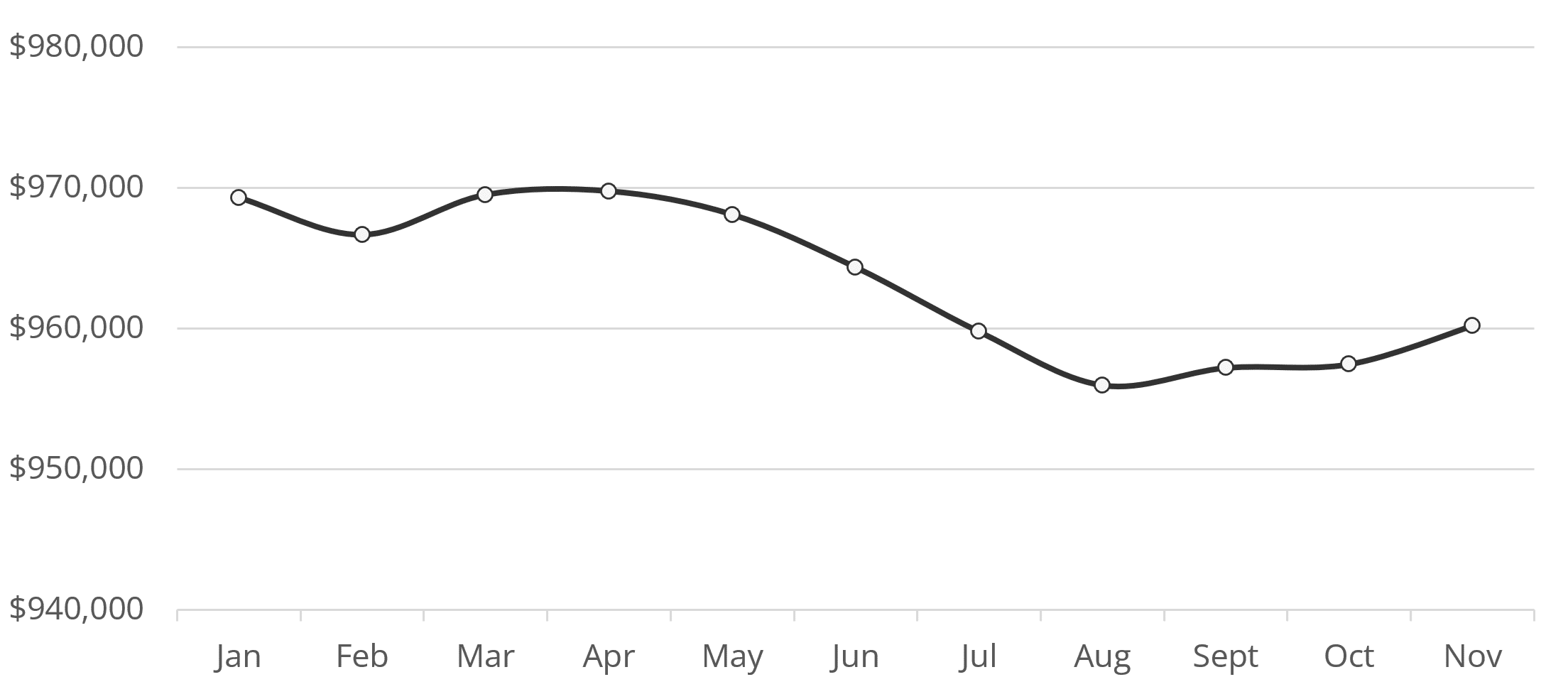

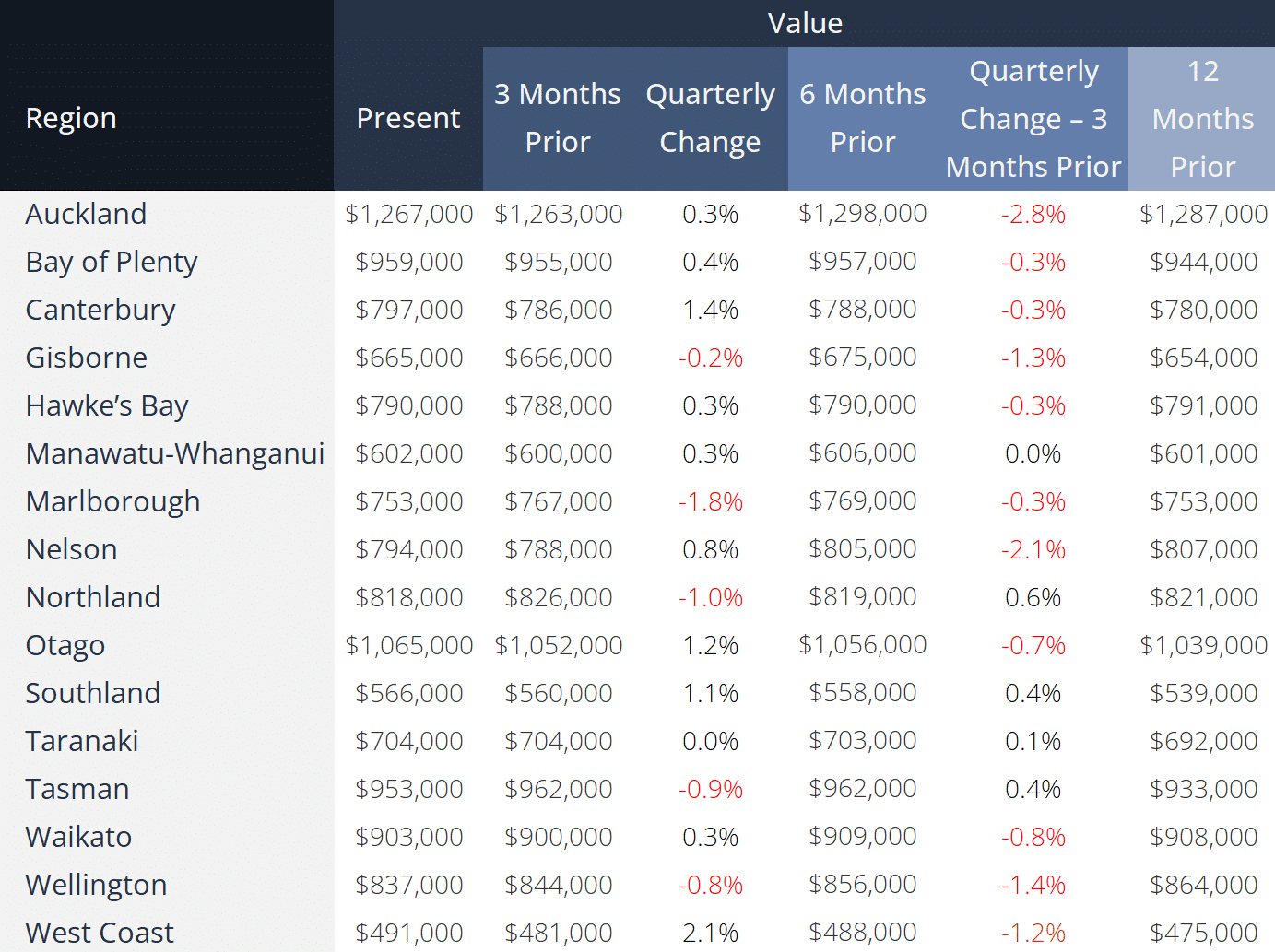

While 2024 was widely seen as a favourable environment for buyers – particularly first-home buyers benefiting from lower mortgage rates and reduced competition – broader economic uncertainty acted as a drag on market momentum. The Valocity Value Index has declined by 0.8% year-to-date and is on track to finish the year with a modest overall decrease.

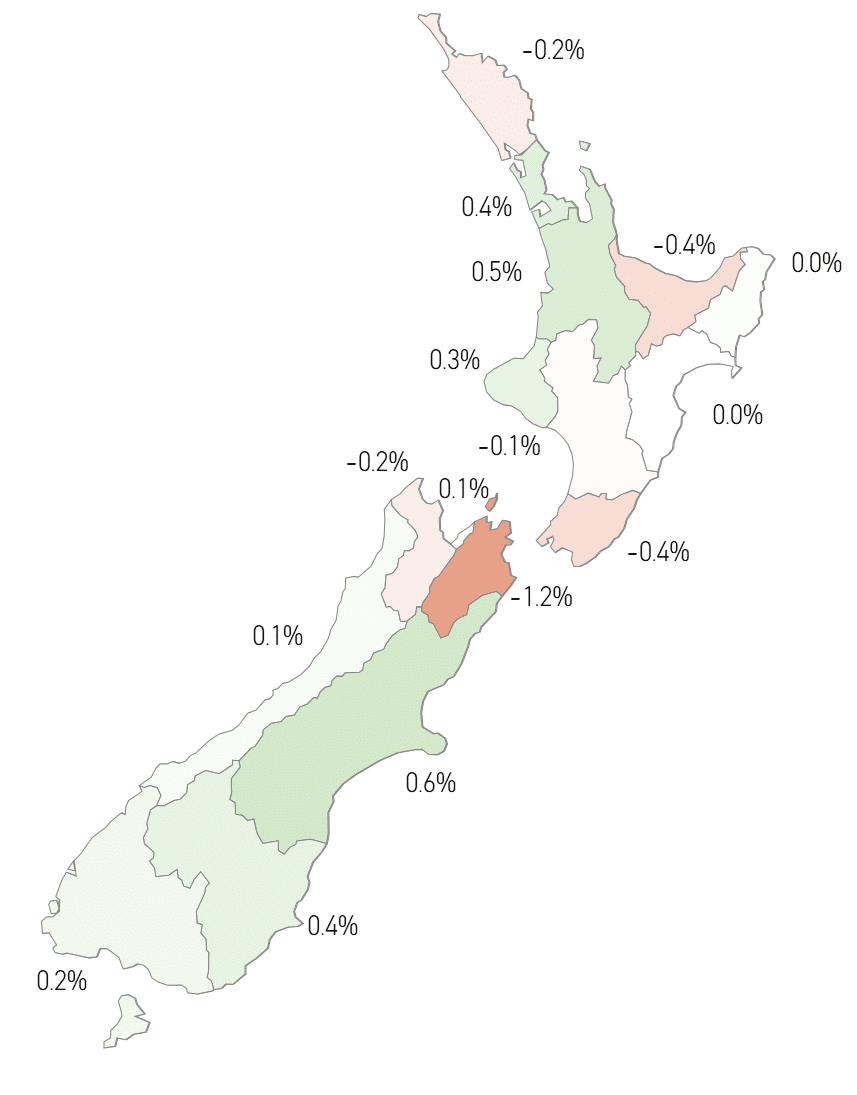

Despite this, the spring period brought early signs of a turnaround. Quarterly growth returned, with the national Valocity Value Index rising 0.3% in the three months to November and 0.2% over the past month. Transaction volumes and mortgage registrations also increased, signalling strengthening activity, even if rapid price gains remain unlikely. Of the 16 regions, 10 recorded quarterly value growth, and 10 experienced monthly gains.

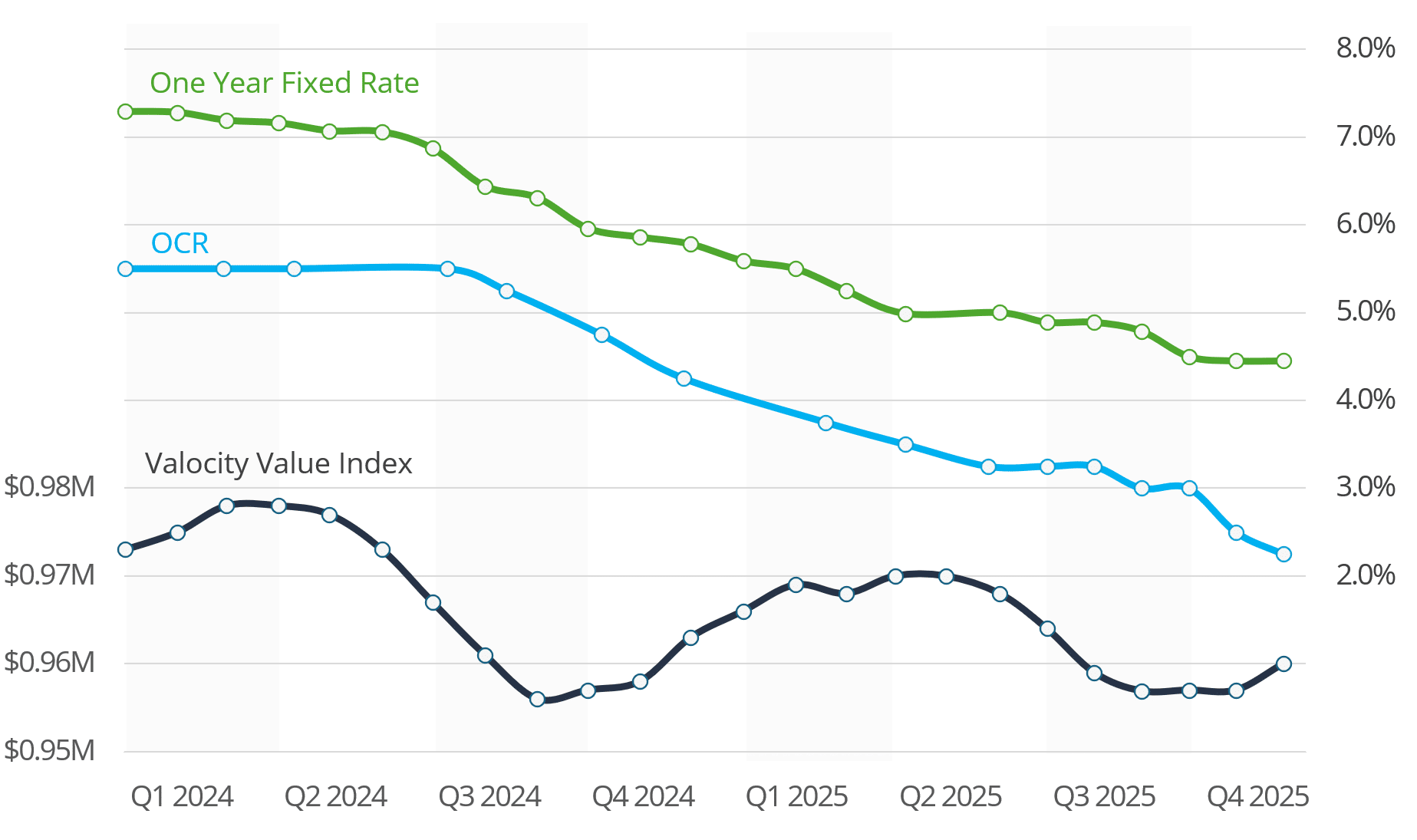

Several factors are driving the recent surge in activity. Mortgage rates have been a key influence over the past 12 months, and while some forecasts suggest rates may be near the bottom of this cycle, low rates continue to encourage potential buyers to enter the market. The upcoming loosening of the Loan-to-Value Ratio by the Reserve Bank of New Zealand, effective 1 December, is also expected to enable more buyers to enter the market.

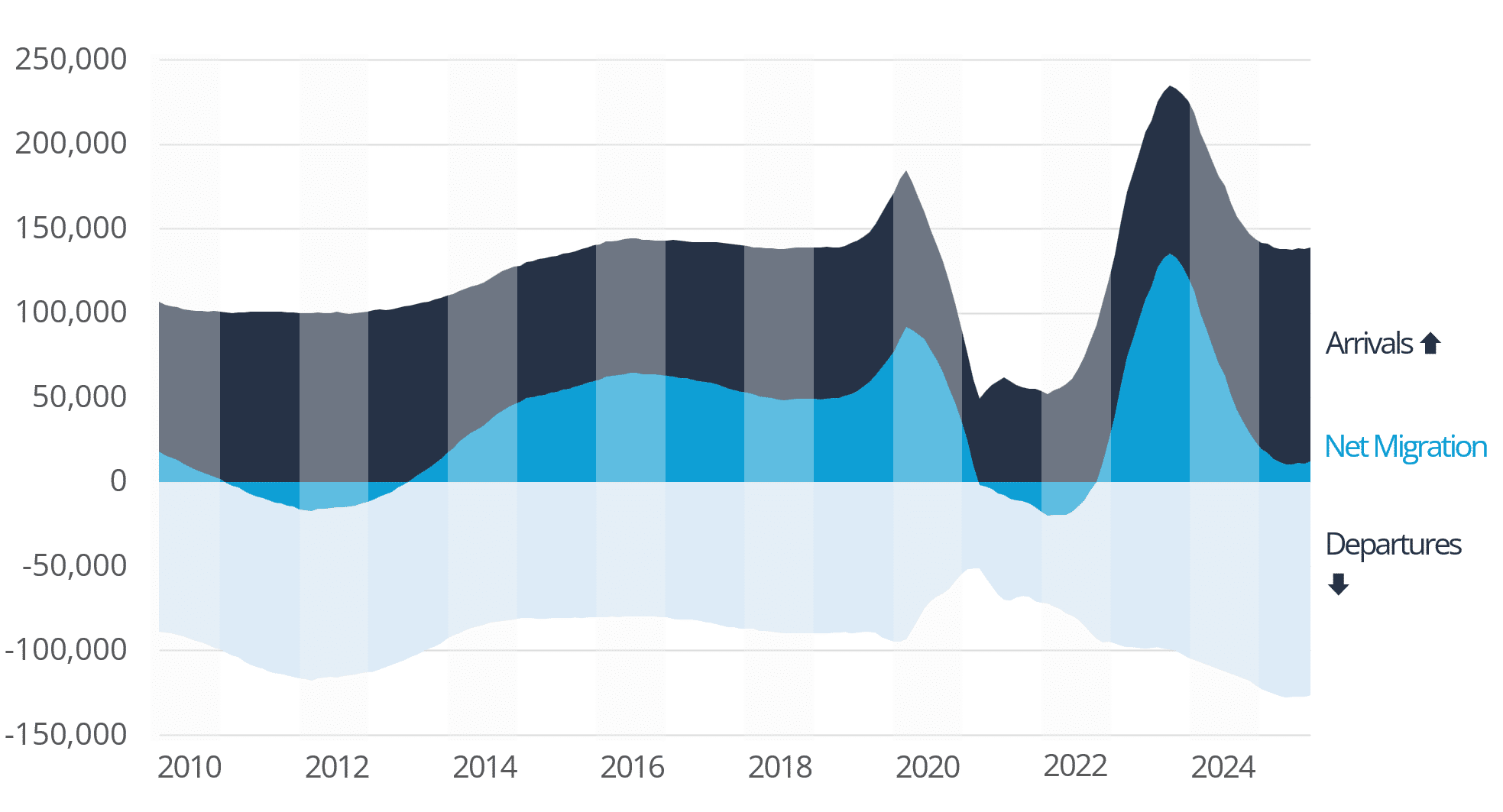

Other macroeconomic trends may support a gradual property recovery. Net migration saw a modest increase in the 12 months to September, though it remains well below the highs of 2023. Building consents for new homes have risen, reflecting growing confidence in the construction sector. Meanwhile, household bank deposits – particularly term deposits that offered over 5% risk-free returns in 2022 and 2023 – are now earning lower returns, prompting some investors to return to the property market.

The unemployment rate reached an eight-year high of 5.3%, but it appears to have peaked. Early signs of improvement in the labour market are emerging, with Stats NZ’s most recent Monthly Employment Indicators showing an increase in filled job numbers.

Figure 1: Valocity Value Index Movement by Region

Figure 2: Valocity Value – New Zealand – 2025

The Monetary Policy Committee concluded its final meeting of 2025 by reducing the Official Cash Rate (OCR) by 0.25 percentage points, bringing it to 2.25% – its lowest level since June 2022. The decision was widely anticipated and had largely been priced into the market, resulting in minimal changes to fixed retail lending rates, though some floating mortgage rates were reduced.

The outlook suggests that the OCR has likely reached the bottom of this rate cycle. The next review, and the first under the newly appointed Governor, is scheduled for February.

Figure 3: Valocity Value Index and Benchmark Rates

Figure 4: Valocity Value Movement – Year on Year Comparison

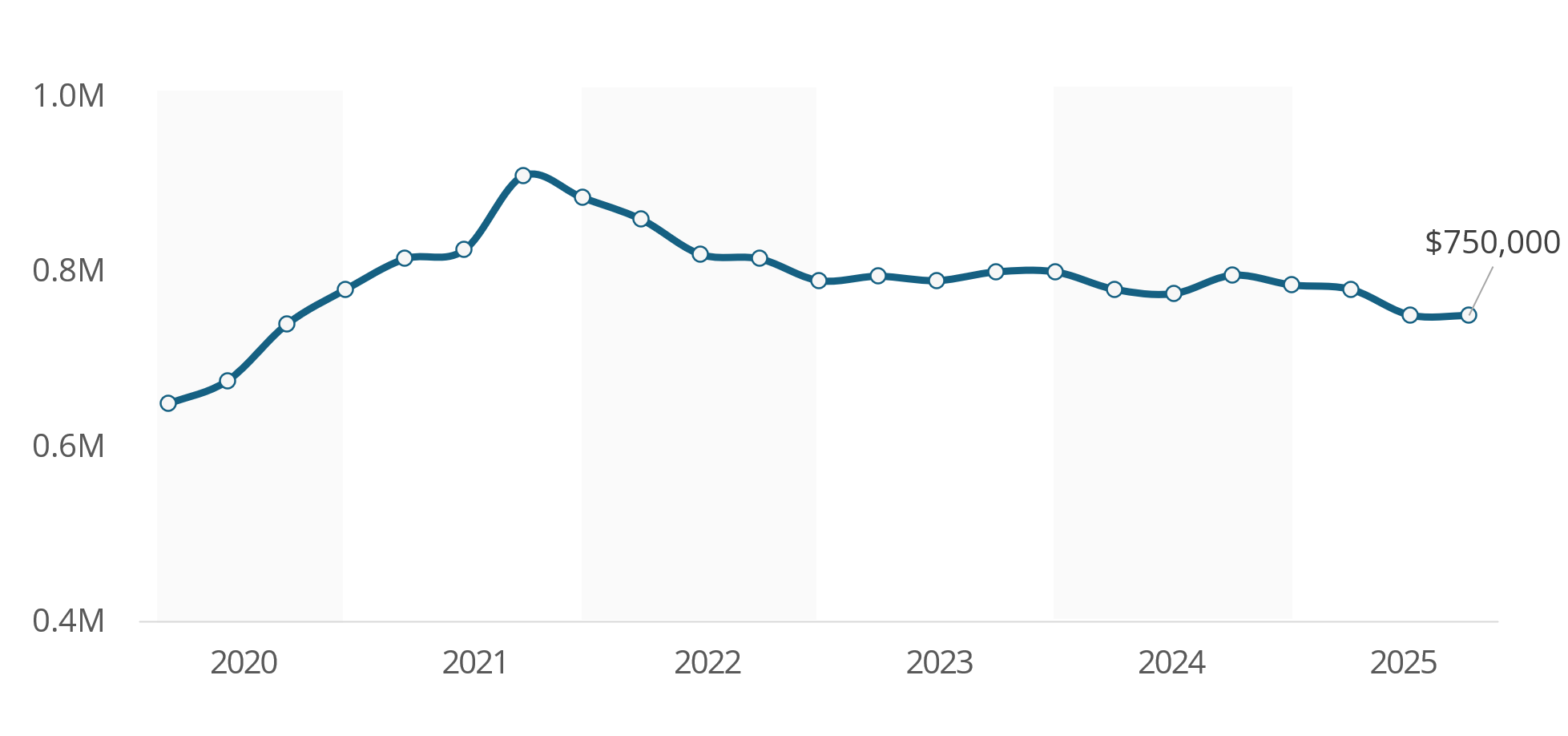

The national median sale price stayed steady at $750,000 in Q4 2025, unchanged from Q3. This pause after the earlier decline may suggest the market has reached its floor. The usual springtime boost in activity is expected to help clear some of the existing listings, setting the stage for a more balanced market as we head into 2026.

Figure 5: Median Sales Price (Settled Sales Only)

Net migration appears to have reached its low point, with the year ended September showing an improvement compared with August. However, a key concern over the past 12 months has been the high number of New Zealanders leaving the country, totalling 72,700 departures. Attractive opportunities abroad have been a major driver of this outflow, adding to overall migration pressures.

Figure 6: Annualised Net migration (Statistics NZ)

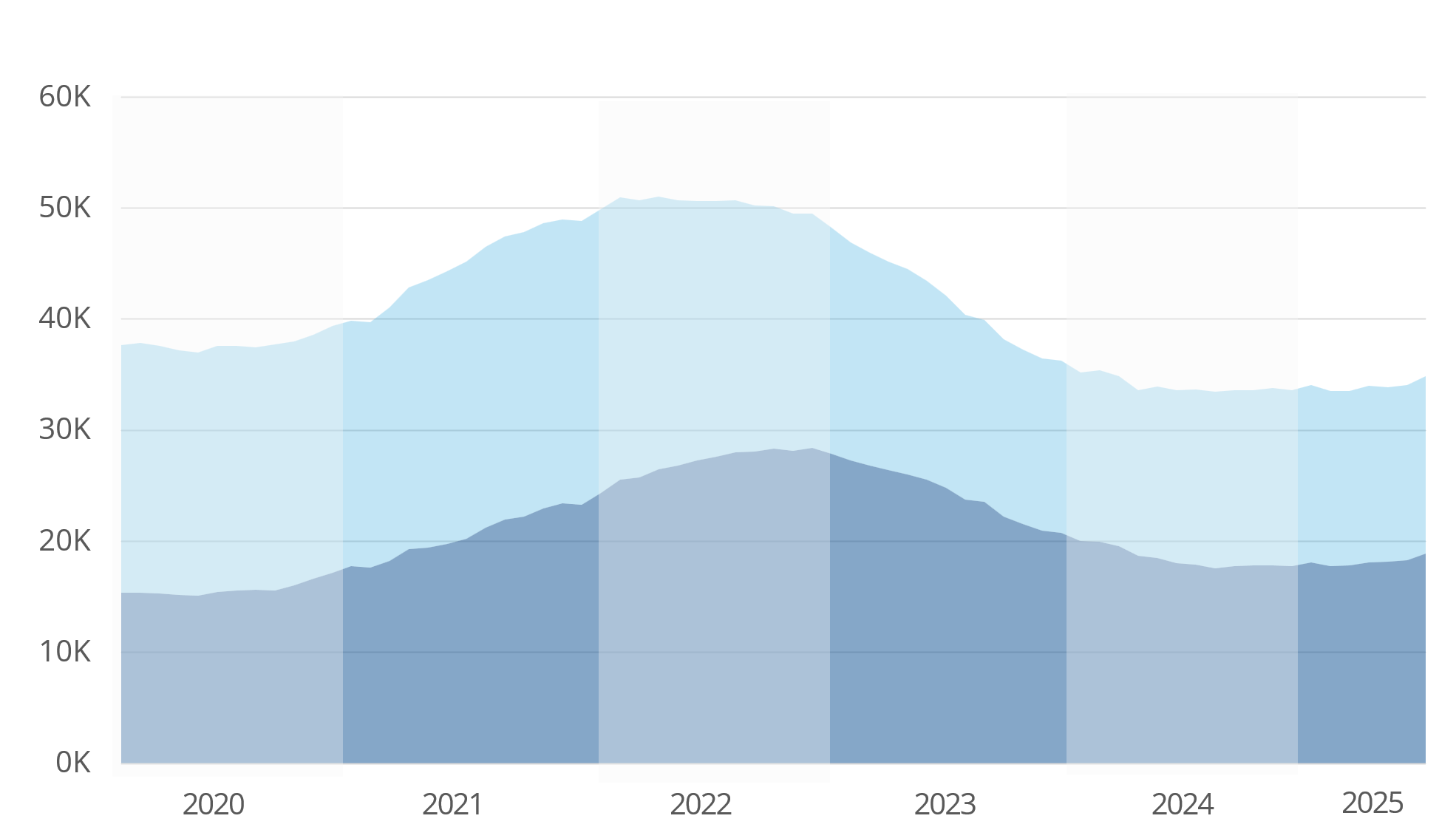

Construction

A total of 34,882 new homes were consented in the 12 months to September 2025, marking a 3.6% increase compared with the previous year. Auckland showed particularly strong momentum, with consents rising 6.8% year-on-year. These trends indicate that confidence is gradually returning to the construction sector.

In November, the government introduced a new policy requiring purchasers of new builds or those undertaking major renovations to obtain warranties for building work. This represents a move away from joint liability, ensuring that only the parties responsible for defects are held accountable. Preliminary estimates suggest these warranties will cost between 0.3% and 0.6% of total build costs. The policy is expected to be enacted into law in late 2026.

Figure 7: Composition of New Homes Consented – Annualised (Statistics NZ)

Valocity values

On the horizon

- Release of Gross Domestic Product figures by Stats NZ – 18th December

- Monetary Policy Statement and OCR Review – 18th February 2026

For further information, or if you would like to understand more about New Zealand housing market insights please contact [email protected].