Brought to you by Senior Research Analyst Wayne Shum

Market momentum: A snapshot of the New Zealand property market – three months to August 2025

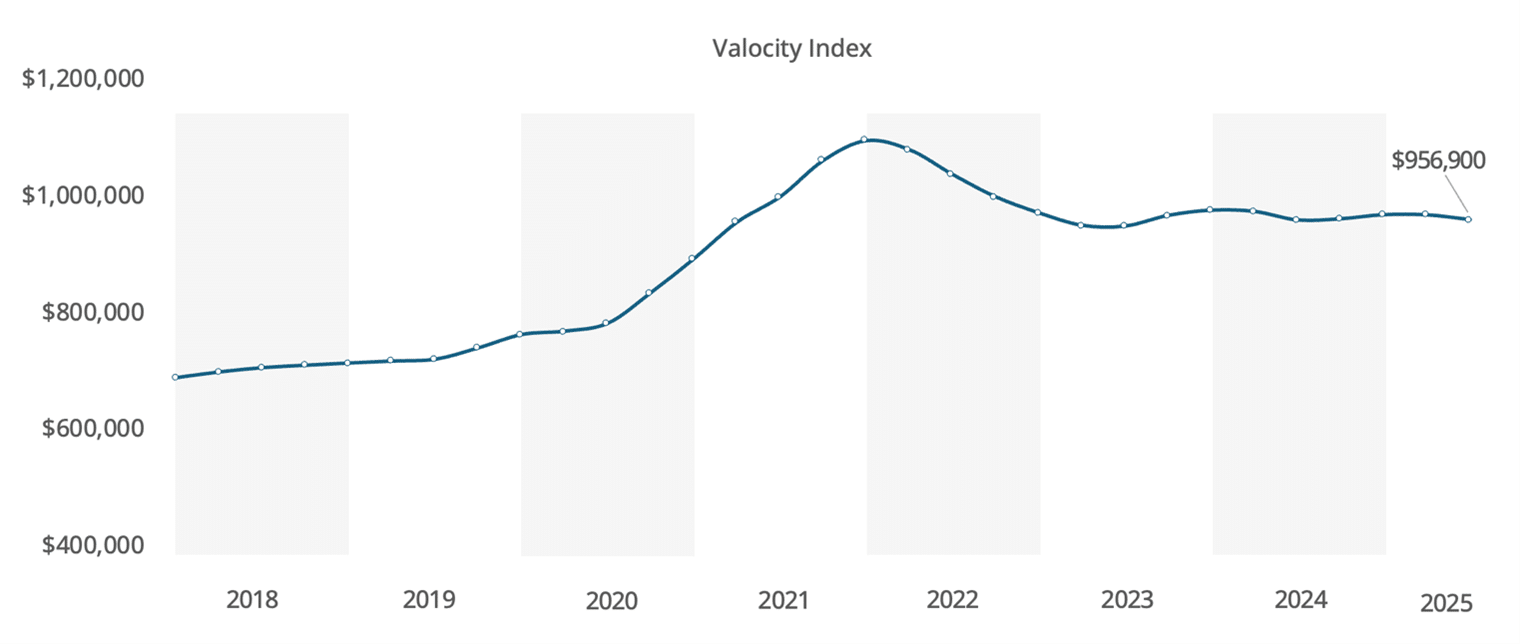

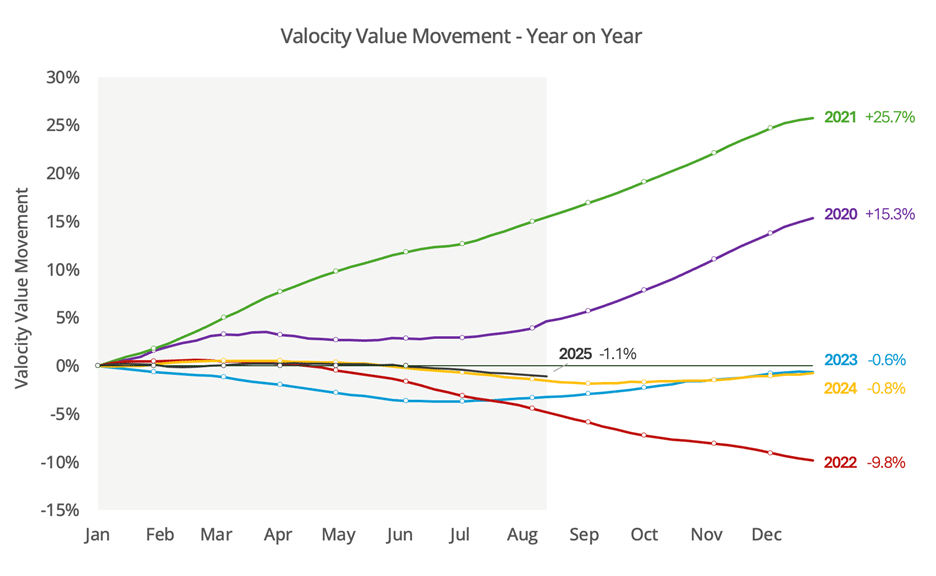

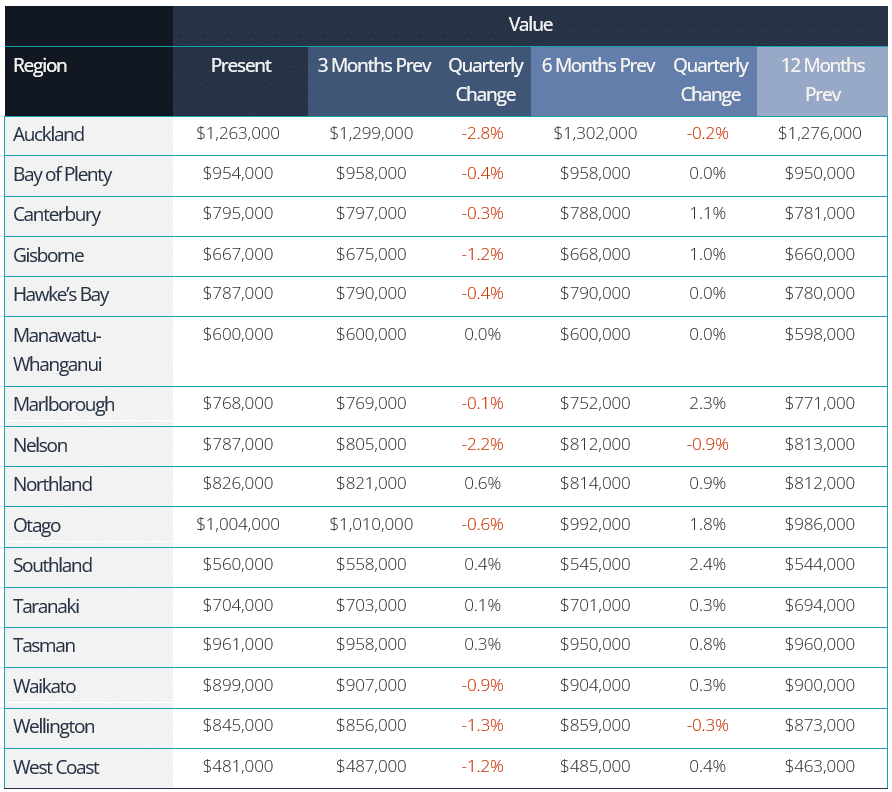

The New Zealand property market continued its subdued run through the three months ending August 2025, with national property values slipping 1.2% ($12,000). This brings the year-to-date decline to 1.1%, reinforcing the market’s stagnation over the past two years, where values have fluctuated within a tight $40,000 band. The slowdown was widespread: 11 of 16 regions posted quarterly declines, a sharp contrast to the May quarter when only three regions recorded falls.

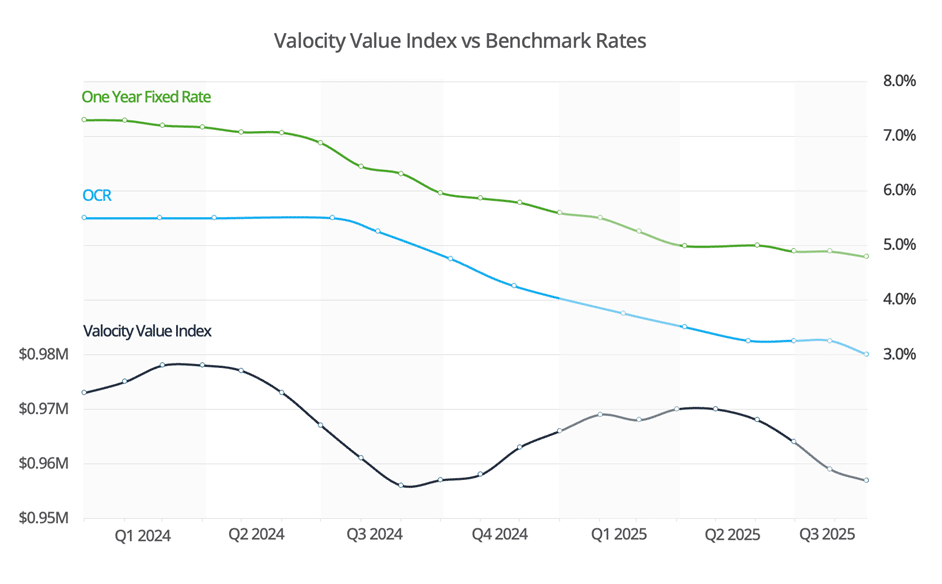

The Reserve Bank of New Zealand (RBNZ) paused its cycle of Official Cash Rate (OCR) cuts in July before resuming with a 0.25% reduction in August. More easing remains possible if inflationary pressures continue to ease, with the OCR projected to settle in the mid-2% range by mid-2026. Reflecting this, the RBNZ revised its house price outlook to a 0.3% decline in 2025, followed by a more meaningful 3.9% growth in 2026. Lenders responded to the August cut by trimming mortgage rates in the latter part of the month.

Rate cuts have provided some relief for households rolling off higher fixed terms, with refinancing and lender switching activity still elevated. However, the RBNZ noted that not all borrowers have yet benefited – many remain locked into higher 2023–24 rates.

Lower mortgage rates have also encouraged more buyers to test the market. Mortgage registrations linked to purchases climbed 7.8% over the past three months compared with the prior quarter. Yet, with further rate cuts expected and prices holding steady, many prospective buyers are biding their time to avoid overpaying.

Figure 1: Valocity Value – New Zealand

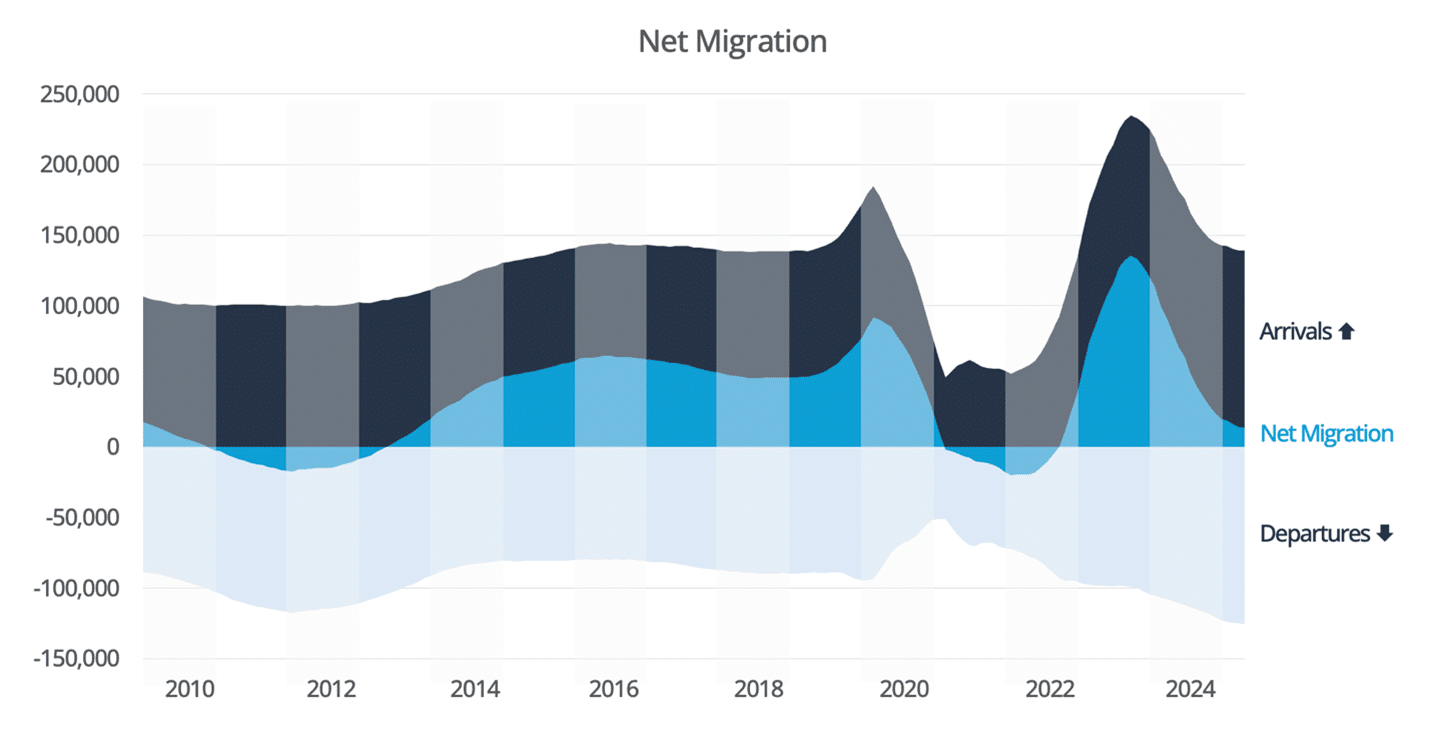

A sustained recovery in property values will depend on economic conditions, especially employment and migration trends. The unemployment rate edged up slightly to 5.2%, from 5.1% in the previous quarter. Meanwhile, net migration remains soft, with just 13,700 arrivals in the 12 months to June, continuing a downward trend.

Figure 2: Valocity Value Index and One-Year Fixed Rate

Figure 3: Valocity Value Movement – Year on Year Comparison

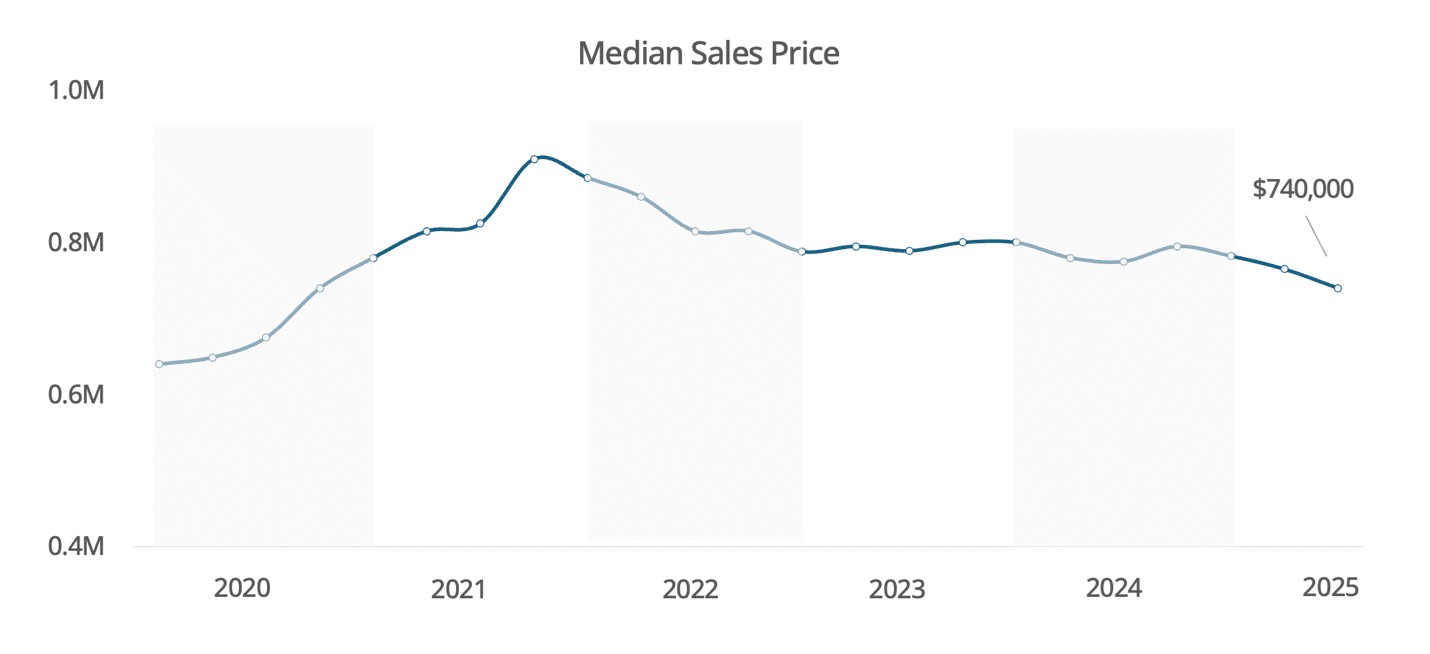

The national median sales price has eased from its 2021 peak, reaching $740,000 in Q3 2025, although not all transactions for the quarter have yet settled.

Figure 4: Median Sales Price (Settled Sales Only)

Annualised net migration fell to a post-COVID low of 13,700 for the year ended June. On 1st September, the government announced an amendment to the restrictions of foreign buyers, allowing those with “Active Investor Plus” visas, which require a minimum $5 million investment in New Zealand, to purchase or build one home, with a minimum value of $5 million. This affects less than 1 per cent of the New Zealand housing stock.

Figure 5: Annualised Net migration (Statistics NZ)

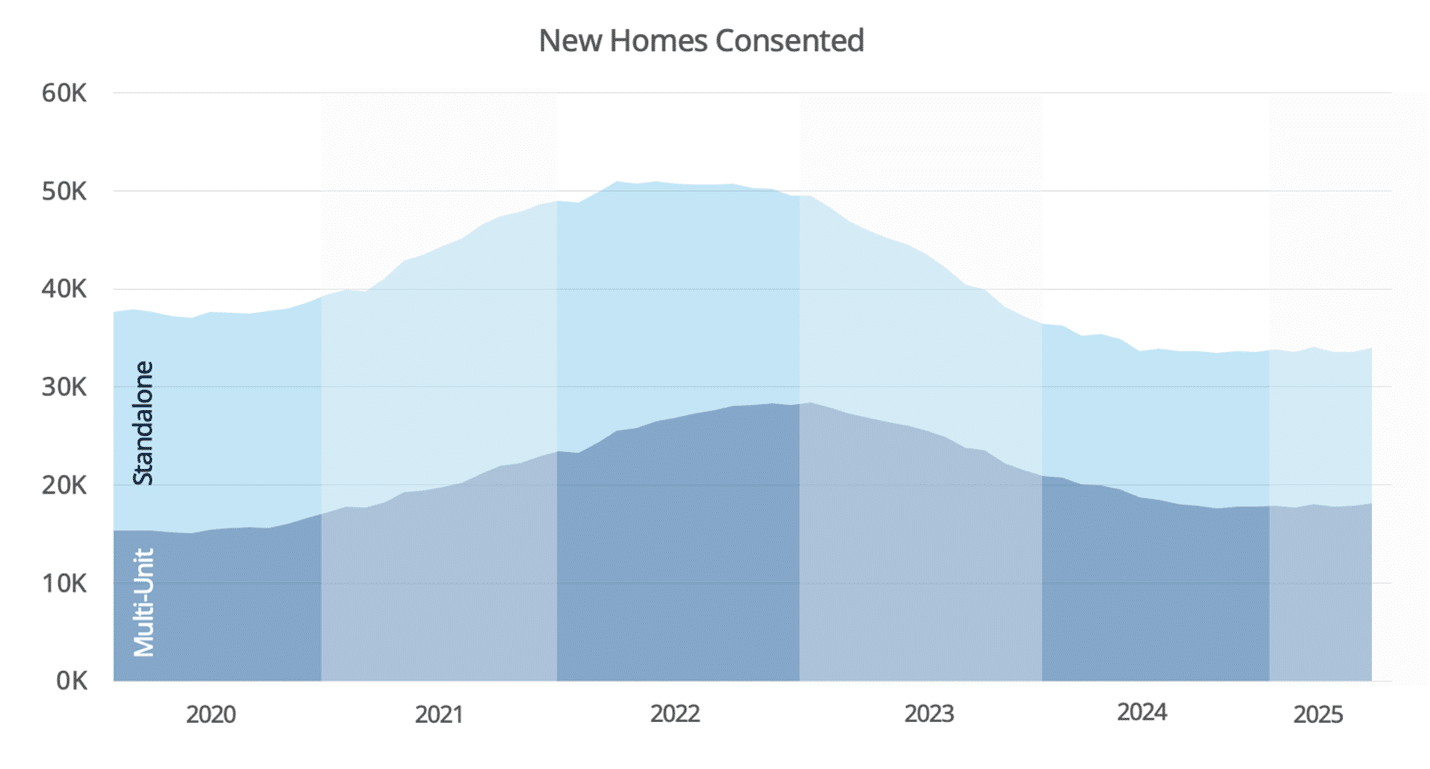

Construction

Building consent activity continues to soften. In the 12 months to June 2025, a total of 33,979 new homes were consented, down 3.8% from the previous year. Within this, standalone dwelling consents rose 6.3%, while multi-unit approvals fell 3.2%.

The sector is operating with surplus capacity, which has helped ease construction cost pressures. However, there is growing concern as some skilled tradespeople are seeking opportunities in Australia.

Several regulatory changes are on the horizon that could influence the market. The upcoming “Granny Flat” amendment to the Resource Management Act, expected in 2026, will allow secondary dwellings of up to 70sqm to be built without requiring resource consent, potentially encouraging more building activity and boosting housing supply over the medium term. In Auckland, a proposed revision to Plan Change 78 would permit buildings of up to 15 storeys around transport hubs, although demand for suburban high-rise developments remains weak, limiting near-term impact.

Figure 6: Composition of New Homes Consented – Annualised (Statistics NZ)

Valocity values

On the horizon

- Release of Gross Domestic Product (GDP) – 18th September 2025

- Monetary Policy Review and OCR – 8th October 2025

- Release of Consumers Price Index (CPI) – 20th October 2025

For further information, or if you would like to understand more about New Zealand housing market insights please contact [email protected].