Brought to you by Senior Research Analyst Wayne Shum

State of the nation: an overview of the New Zealand property market for the three months ending July 2025

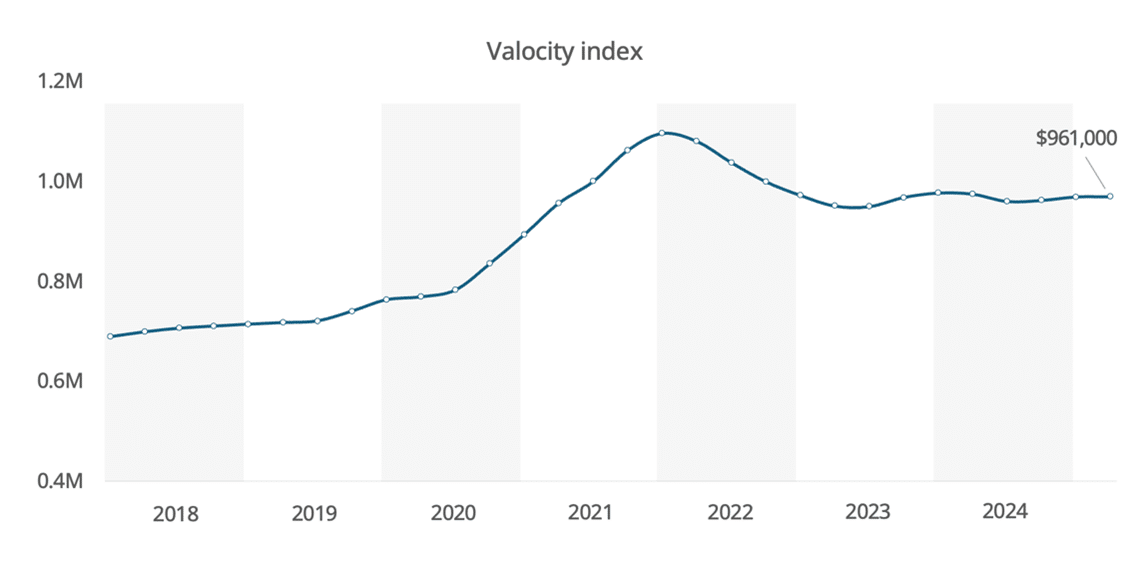

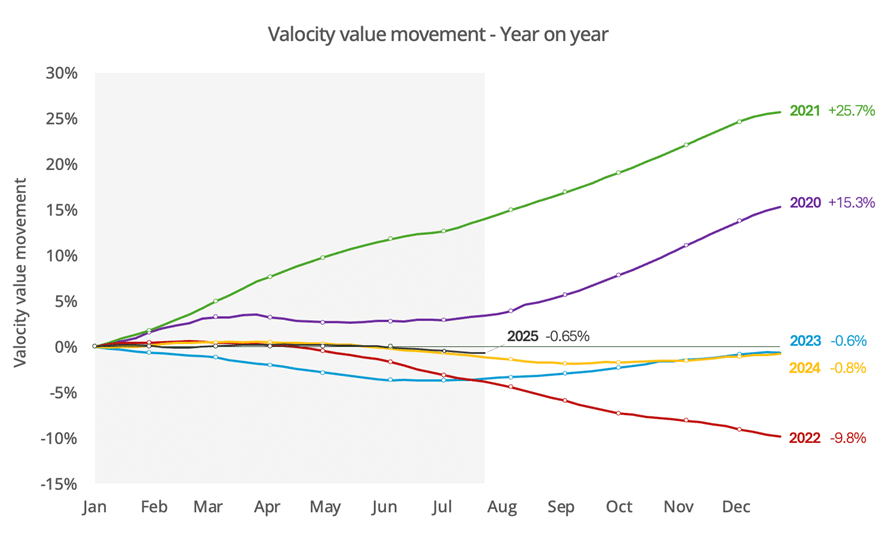

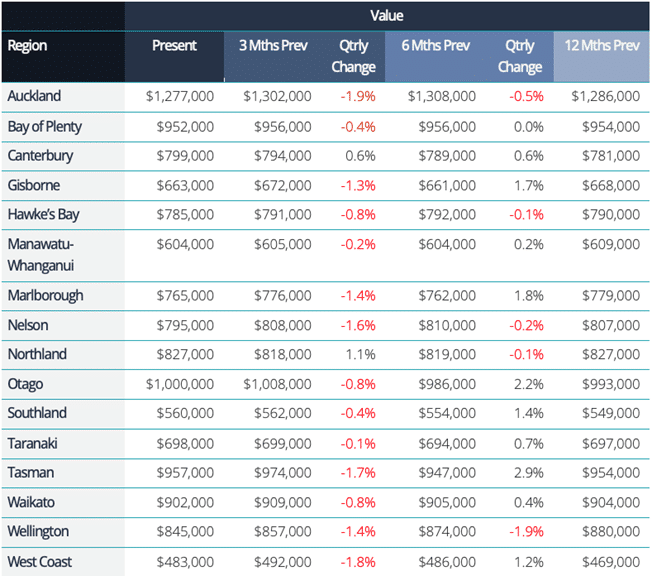

New Zealand’s property market is showing signs of renewed activity, with mortgage rate cuts over the past year offering relief to existing borrowers and lifting overall engagement. However, this renewed energy has yet to spark a rise in property values. The Valocity Value Index declined by 0.9% over the past quarter and is down 0.65% year to date, suggesting the market remains in a holding pattern as it navigates ongoing economic pressures.

Figure 1: Valocity Value – New Zealand

In the past quarter, 14 of New Zealand’s 16 regions experienced a decline in property values, with the pace of decline accelerating in Auckland. Canterbury was the notable exception, recording a 0.6% increase over the same period. Despite these regional variations, elevated stock levels persisted nationwide. Until this excess inventory is absorbed, a sustained recovery in home prices appears unlikely.

Investor sentiment remains subdued, primarily due to the lack of rental and capital gains, alongside rising ownership costs. The average territorial authority rates rose by 11.9%, while insurance premiums increased by 6%. Without the prospect of capital appreciation, investors are unlikely to regain their previous market share in the near term.

Labour market conditions also remain under pressure. The unemployment rate held steady at 5.1% for the March 2025 quarter, despite expectations of an increase. GDP grew by 0.8% in the three months to May yet remains 1.1% lower year-on-year. Broader economic indicators continue to reflect a sluggish recovery.

Annualised net migration fell to a new post-COVID low of 14,800, reducing demand for both rental and owner-occupied housing. Continued high levels of New Zealander departures, along with headlines of redundancies and business closures, have further eroded market confidence.

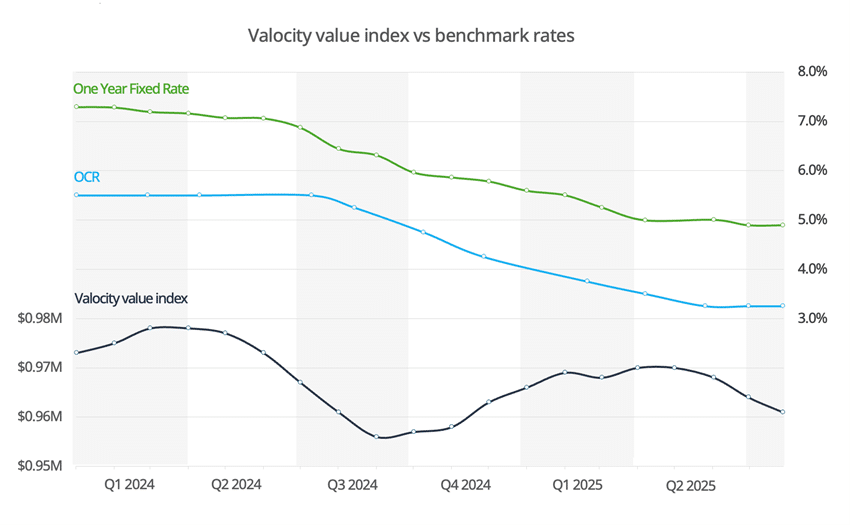

With mortgage rates nearing the bottom of this interest rate cycle, there is limited scope for additional reductions in borrowing costs to boost purchasing power. Market competition remains low, and as a result, first-home buyers continue to dominate, benefiting from improved affordability driven by falling prices, reduced competition, and lower interest rates.

The July Monetary Policy Review indicated that the Official Cash Rate (OCR) may be close to its trough, with only modest cuts anticipated in the coming months. The Consumer Price Index rose 2.7% in the year to March 2025, placing inflation within the Reserve Bank’s 1–3% target band. Some economists are now forecasting the OCR could fall as low as 2.5%.

Figure 2: Valocity Value Index and One-Year Fixed Rate

Over the past three months, the number of mortgage registrations linked to property purchases rose by 27% compared to the previous three-month period. This uplift reflects increased activity driven by lower mortgage rates; however, this has yet to translate into upward pressure on property prices.

As of July, seven months into 2025, the Valocity Value Index has declined by 0.65% – equivalent to approximately $8,500 – since the beginning of the year. The downward trend has become more pronounced over the past quarter, and a recovery is not anticipated during the winter months.

Figure 3: Valocity Value Movement – Year on Year Comparison

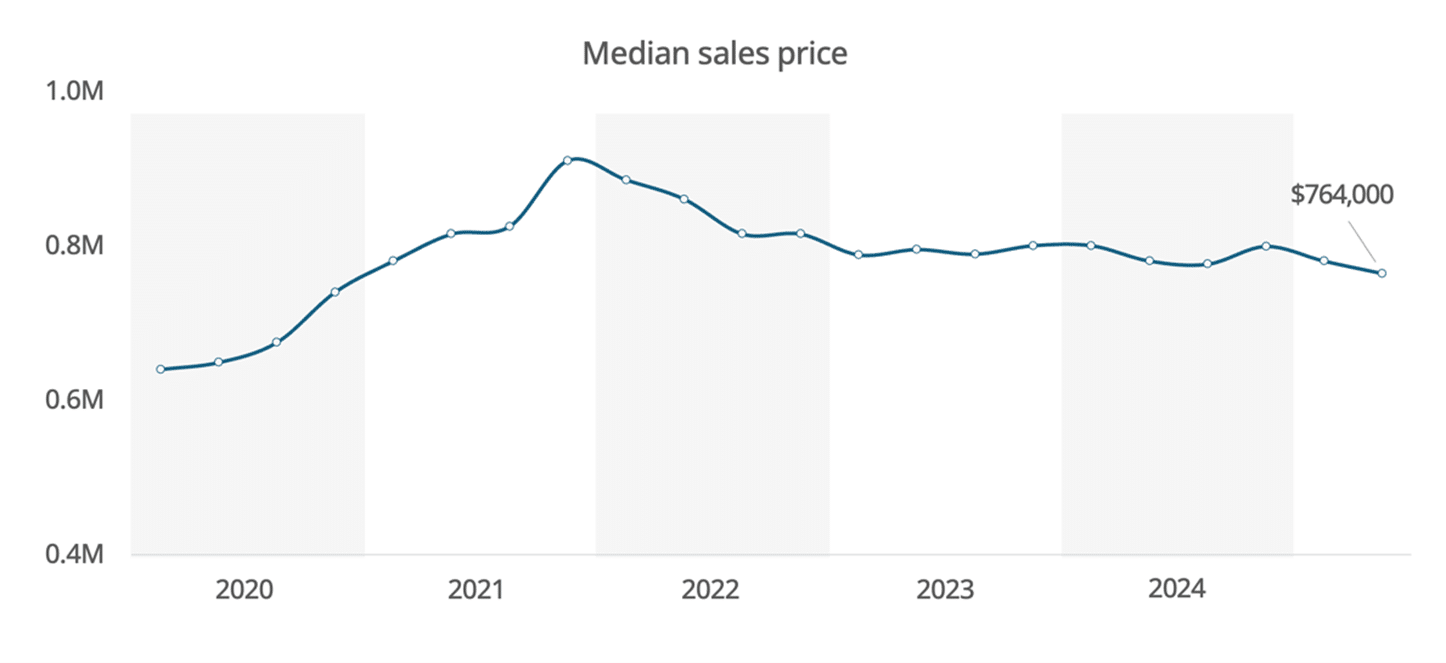

The national median sale price has declined from its 2021 peak and has remained near $800,000 since mid-2022. A meaningful recovery is unlikely until current inventory levels are absorbed.

Figure 4: Median Sales Price (Settled Sales Only)

Preliminary data from Stats NZ revealed a net migration loss of 30,000 people from New Zealand to Australia in the year ended December 2024 – an increase from 2023 and the highest calendar-year loss since 2012. However, Australia’s capacity to absorb further migration has softened, with its unemployment rate rising from 4% in January to 4.2% in June.

Total departures from New Zealand reached 124,500 in the year ended May 2025 – an all-time high – contributing to a significant decline in both rental and purchasing demand. Annualised net migration fell to a new post-COVID low of just 14,800, further weakening housing market fundamentals.

Persistent high departure levels, coupled with ongoing reports of redundancies and business closures, have continued to weigh on consumer confidence.

Figure 5: Annualised Net migration (Statistics NZ)

Construction

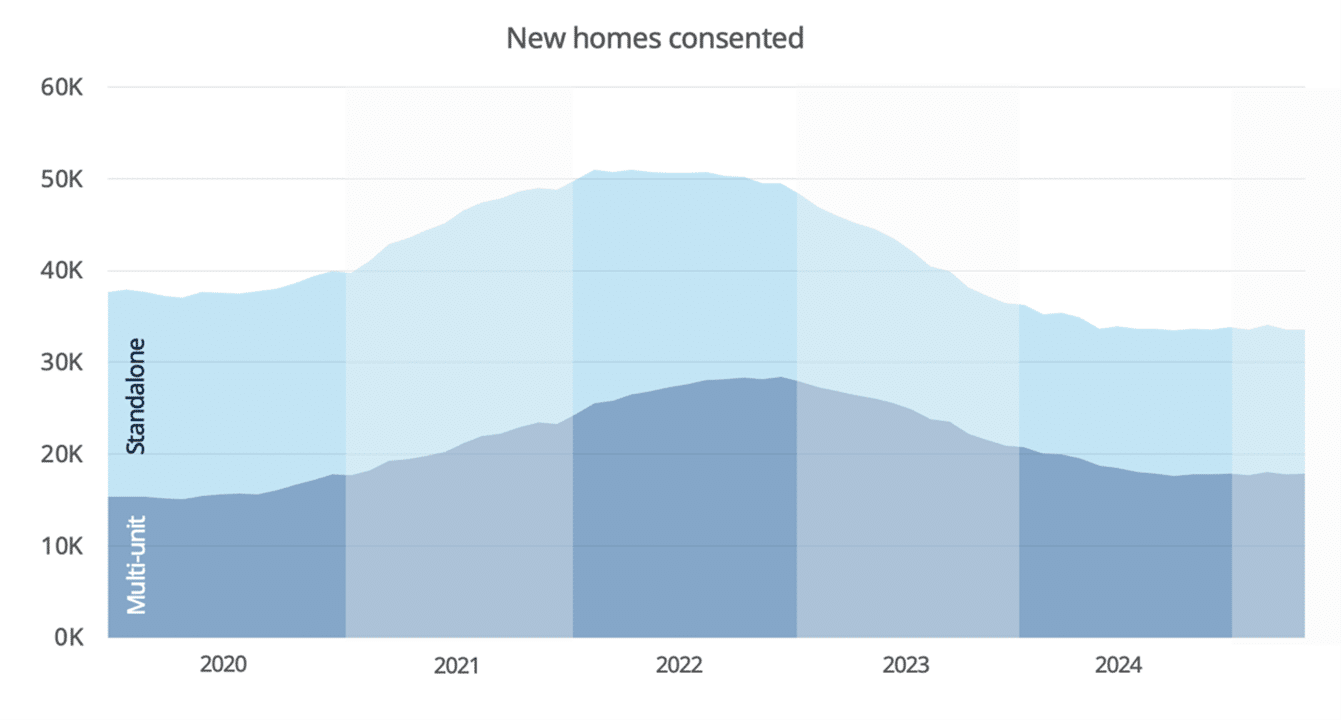

Building consent volumes have continued to decline. In the 12 months to May 2025, a total of 33,530 new homes were consented – down 3.8% compared to the same period in 2024. While consents for standalone homes rose by 2.4%, multi-unit dwellings saw a notable decrease of 8.6%.

The construction sector is currently operating with surplus capacity, which has helped ease upward pressure on construction costs.

Figure 6: Composition of New Homes Consented – Annualised (Statistics NZ)

Valocity values

On the horizon

- Release of Unemployment Statistics – 6th August 2025

- Monetary Policy Review and OCR – 20th August 2025

For further information, or if you would like to understand more about New Zealand housing market insights please contact [email protected].