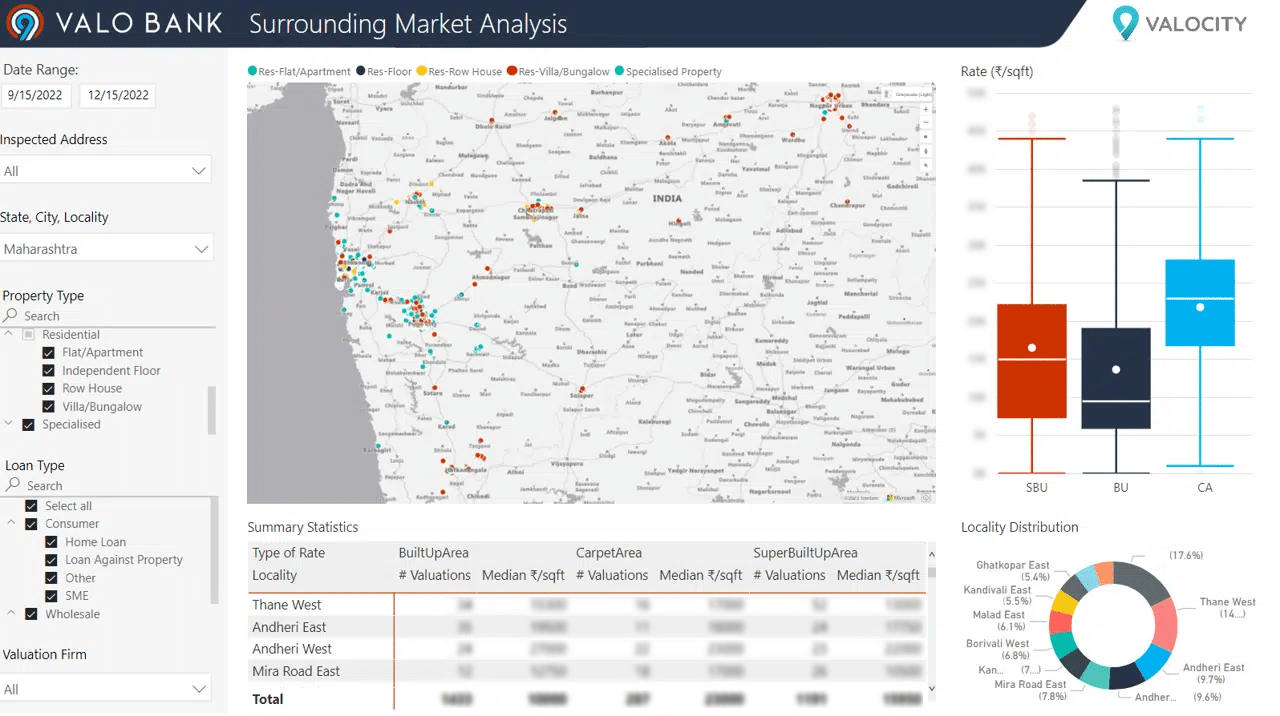

Valuations play a critical role in any lending decision. In the rapidly growing India market, the need to streamline the process of benchmarking and validating property valuations is more prevalent than ever. A multitude of property types condensed in a small area leads to extreme variation in property rates, posing huge challenges when it comes to validating inbound valuations.

Valocity’s Surrounding Market Analysis solution is a state of the art analytical tool which provides insights into property value rates of any type, any area, over any period. This visibility allows banking credit teams to develop and implement robust credit policies, as well as validate any incoming valuation reports with ease.

The solution:

- Delivers modern, interactive dashboarding

- Provides market medians, value ranges, and distribution, over any level of stratification e.g. state, city, locality

- Allows for users to view details of past valuations completed within the bank ecosystem, as well as benchmark past and future valuations against statistics for the surrounding area

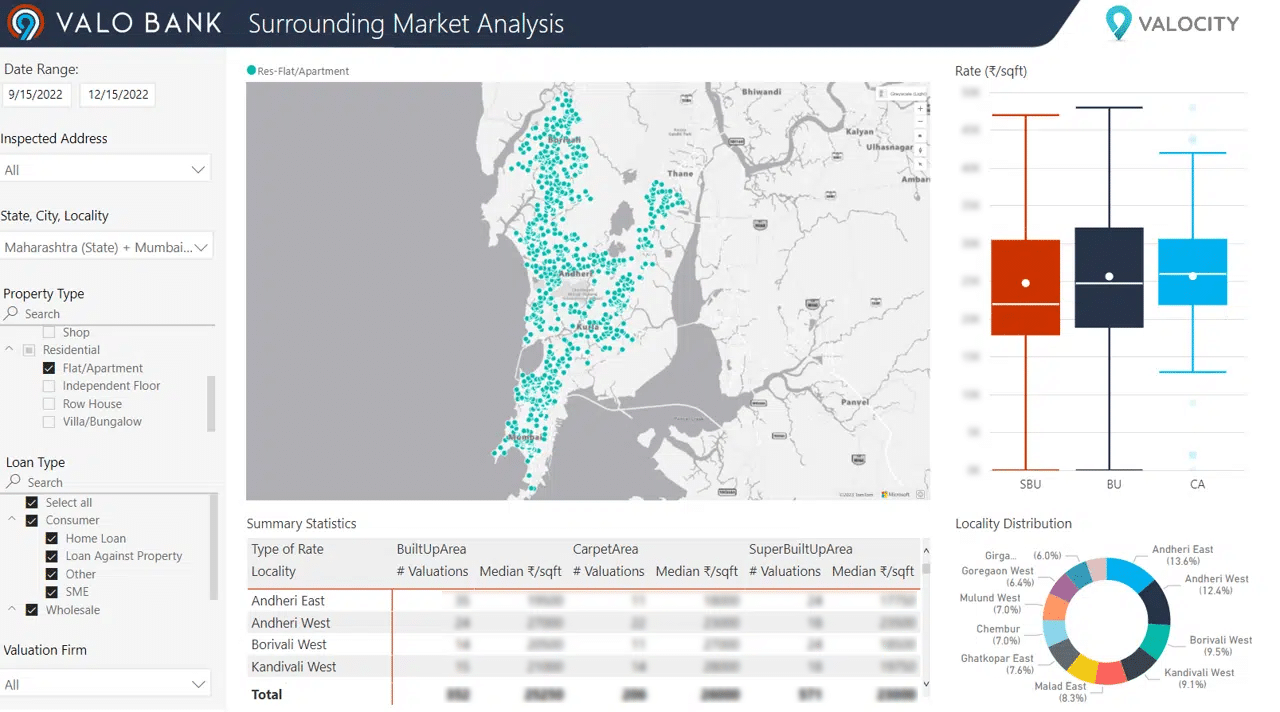

At a glance, the real-time dashboard:

- Gives meaningful statistics; average, median, range, distribution, about Flats/Apartments down to locality level e.g. Andheri West, Mumbai

- Allows the selection to be filtered by property/loan type

- Allows for the selection of a custom timeframe, giving a user the ability to benchmark values from any snapshot of the market

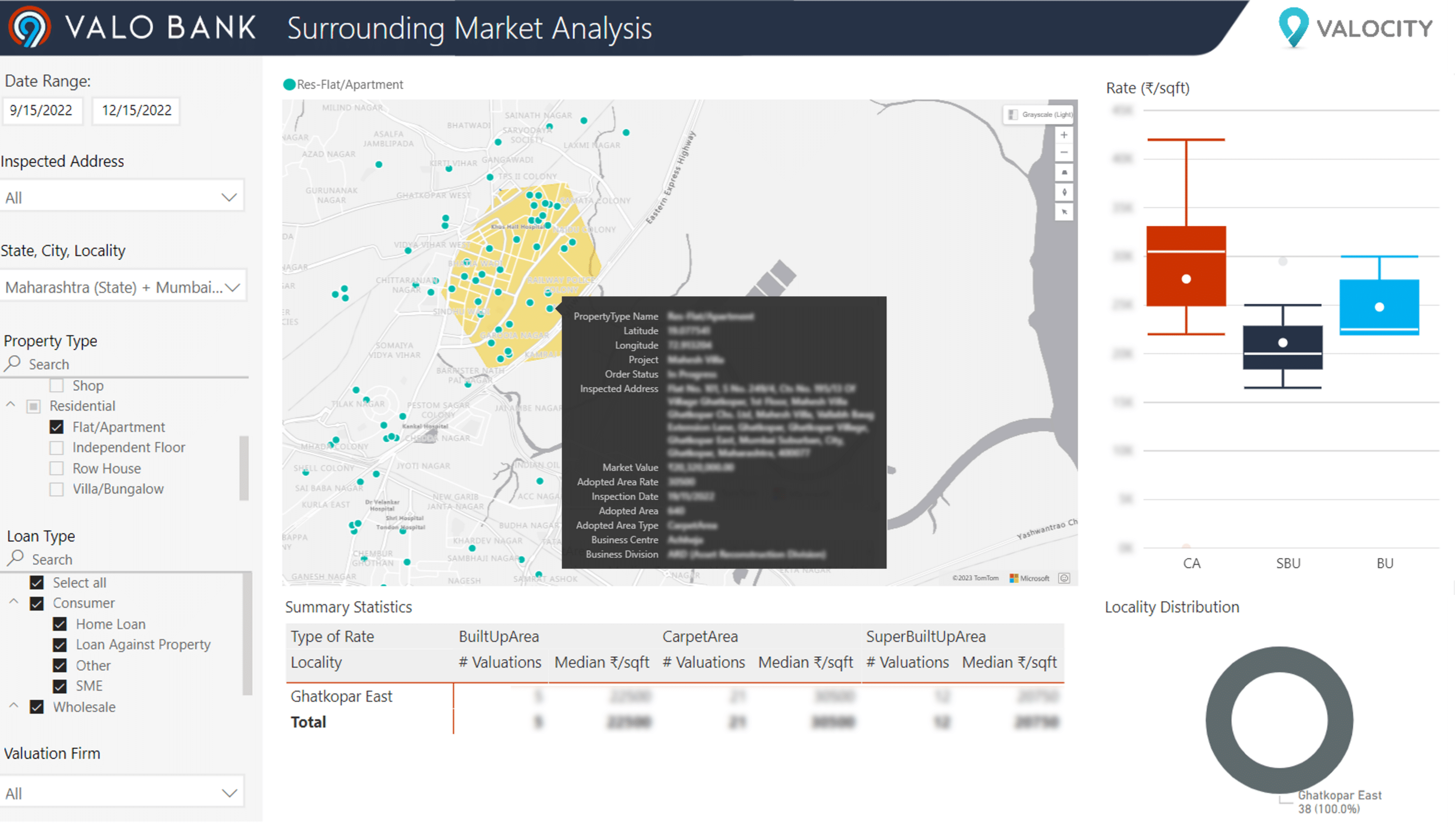

Diving deeper to a more granular level:

- A bounded region can be defined directly on a map in just a few clicks

- Gives market rate metrics for a very targeted area – in this case, all properties within a 1km radius of the subject property

- Rates from a single valuation can be viewed by hovering over the property on the map, which can in turn be compared to the surrounding area rates to validate the property’s position in the market

The Surrounding Market Analysis is a powerful tool for risk management and allows underwriters and technical managers to make more informed, data driven decisions. In practice:

- The Audit team can use the interquartile range for localised markets to determine what an acceptable value would be for a property of similar type

- Credit policies can be derived using real, up-to-date, and meaningful insights

- Lenders can ensure they always stay ahead of the curve