Brought to you by Senior Research Analyst Wayne Shum

Executive Summary

The NZ housing market has remained highly active for the last five years, with significant value growth occurring during this time, accelerating rapidly since the market ‘unlock’ post the Covid-19 lockdown in 2020.

Valocity wanted to understand the impact such a high level of market activity and value growth has had on key market participants and buyer types.

The New Zealand property market consists of four leading groups of private buyers:

First Home Buyers: People buying their first home having never previously owned a property

Investors: An existing property owner of at least three properties

Multi Homeowners: An existing property owner with two properties

Movers: The owner has moved out of one property into another

Characteristics by Buyer Type

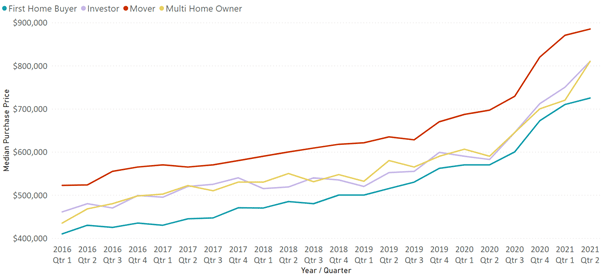

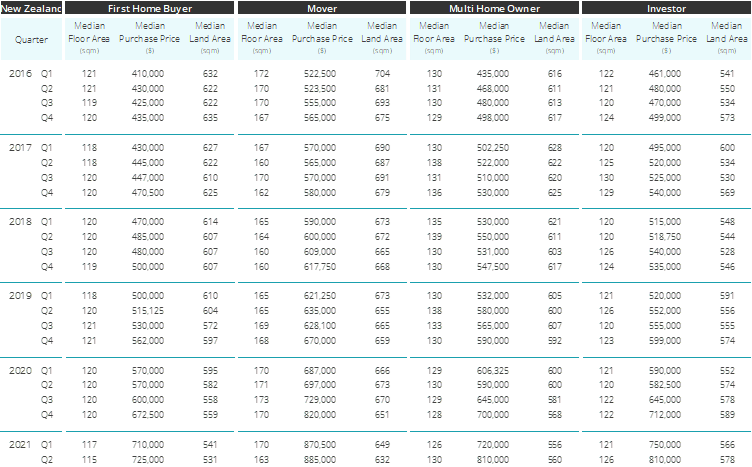

Figure 1: National Median Purchase Price by Buyer Type

First Home Buyers were the most budget-conscious of the buyer groups, as they stretched financially to get onto the property ladder, without the benefit of the rising equity accumulated during ownership by existing owners. Their median purchase price in New Zealand had reached $725,000 by mid-2021. However, their desire and ability to purchase reflects the robust market across New Zealand, coupled with low interest rates enabling them to afford larger mortgages.

Purchase prices for Investors and Multi Homeowners were both similar throughout the same period. Perhaps one of the key restrictions to entry, is the deposit. Multi Homeowners and investors tend to have enjoyed capital gain from their existing homes to enable the purchase of additional properties, without the need for deposit saving such as First Home Buyers. Purchase prices for these two buyer groups tended to be higher as they purchased larger homes or homes on large sites to fulfil their investment goals. The tax policy announced in March 2021 may have affected their buying decision in the medium term.

Movers had the highest purchase price amongst the main buyer groups. Generally, they enjoyed the capital gains achieved on their existing homes, allowing them to move into larger homes or to a more desirable area. While downsizing may also occur, this is a smaller portion of the market.

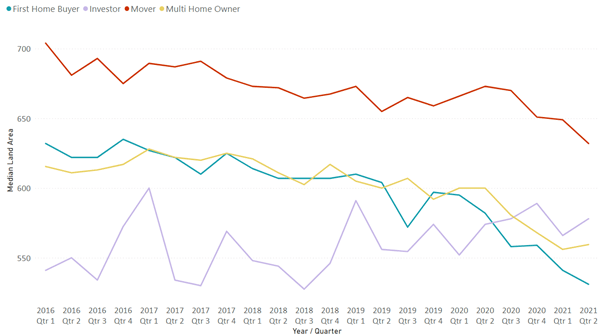

Figure 2: National Median Land Area by Buyer Type

The section size has been declining for First Home Buyers, Movers and Multi Homeowners, reflecting the overall intensification of our cities. The trend is reversed for Investors over the same period, as they purchased sites with development and subdivision potential.

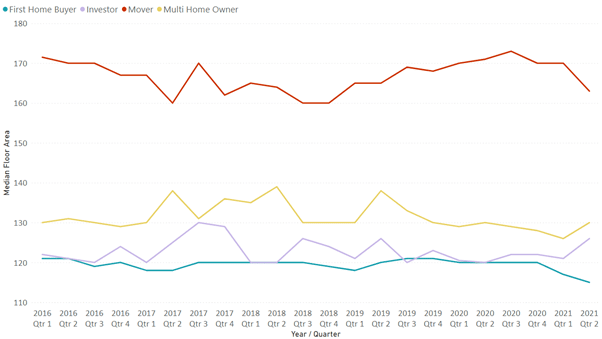

Figure 3: National Median Floor Area by Buyer Type

The median floor areas have declined slightly for First Home Buyers and Movers since 2016. There was little change for Investors and Multi Homeowners over the same period. Overall, the trend reflects the intensification of housing in our cities coupled with a reduction in average home size.

New Zealand Purchasing Characteristics

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

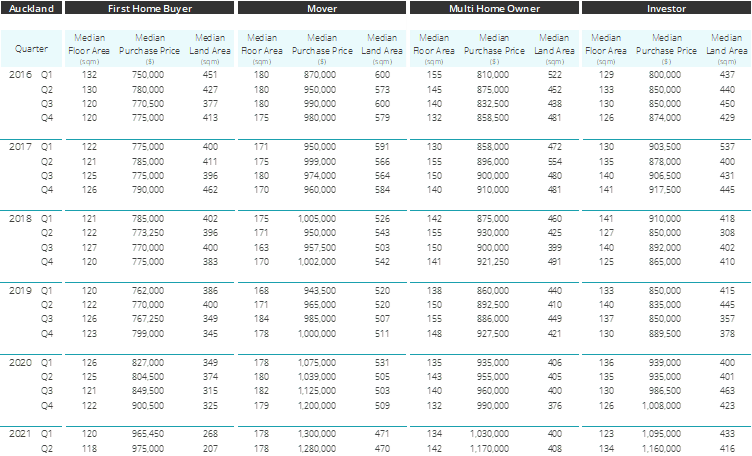

Characteristics by City

Purchasing Characteristics

In Auckland, the First Home Buyer’s median purchase price was close to $1 million by mid-2021. This group had the difficult task of saving nearly $200,000 to meet the 20% deposit requirement. Yet their purchase price was lowest amongst the main buyer groups reflecting in the type of property that they purchased, being predominantly smaller homes and sections.

Purchase prices for Investors and Multi Homeowners were similar throughout the same period in Auckland, as they share similar investment goals and criteria in selecting properties.

Similar to the national trend, Auckland Movers had the highest purchase price amongst the main buyer groups. Generally, they enjoyed the capital gains made on their existing homes, allowing them to move up the property ladder into larger more upscale homes.

Dwelling sizes were reduced for First Home Buyers but not for the other buying groups. Section sizes declined for all groups, but noticeably more for First Home Buyers, who increasingly purchased apartments and townhouses with little exclusive land area.

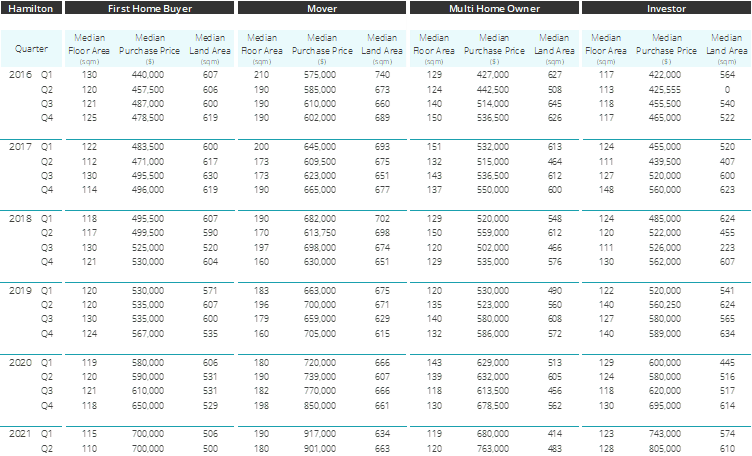

Purchasing Characteristics

The Hamilton market now exhibits a similar trend, where First Home Buyers had the lowest purchase prices and smallest section and dwelling sizes. Prices paid by First Home Buyers and Investors were similarly up until the latter half of 2020, as investors from Auckland entered the market, seeking higher returns and lower entry cost for their investments.

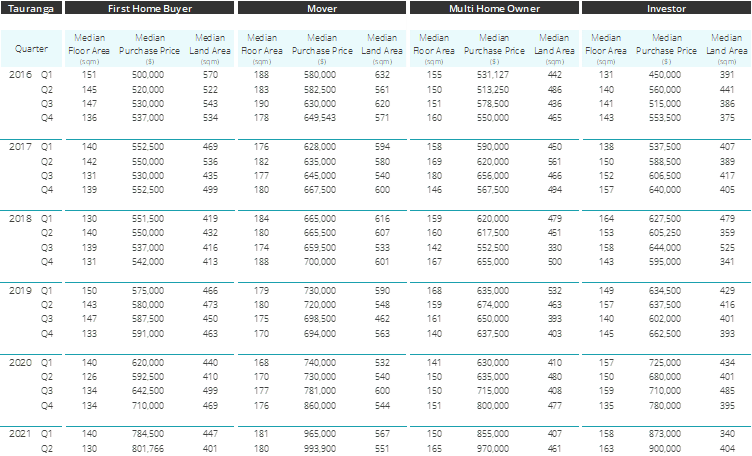

Purchasing Characteristics

First Home Buyers in Tauranga had the largest floor area first homes of all main urban centres monitored as did multi homeowners when compared to other main centres. This may be as the result of buyers from main centres purchasing a second home in this city as a gateway in the new remote working environment.

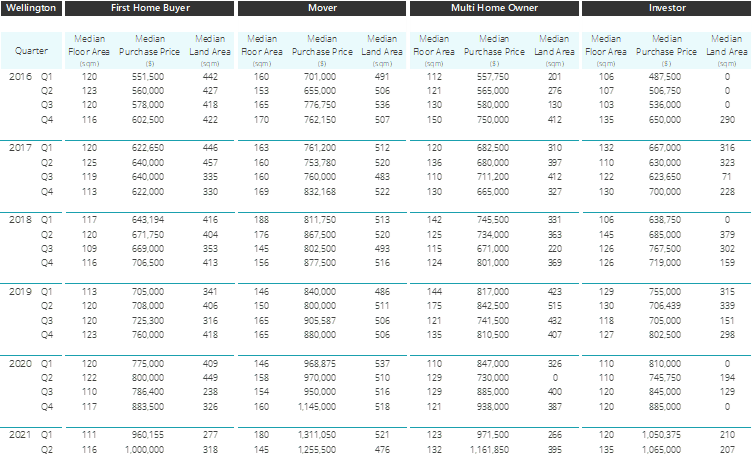

Purchasing Characteristics

Over the last full quarter, the median sale price for First Home Buyers in Wellington City was $1 million, more than Aucklanders during the same period – considered a result of the sales composition during that period with Wellington FHB still preferring to remain in central locations. During the same quarter, Multi Homeowners and Movers paid a similar amount to Aucklanders. The trend is different for Investors, as they tended to invest in properties outside of the central area, for example, up the Hutt Valley where prices were generally lower. Section sizes continued to decline for First Home Buyers.

Purchasing Characteristics

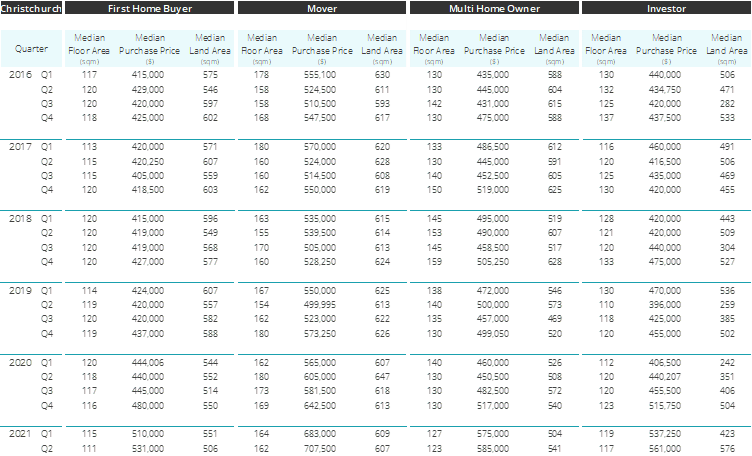

The price difference amongst First Home Buyers, Investors, and Multi Homeowners did not differ significantly in 2021. In line with the national trend, Movers purchased more expensive properties to satisfy their needs. Section sizes did not fluctuate due to the availability of land for new development in the post-quake city.

Purchasing Characteristics

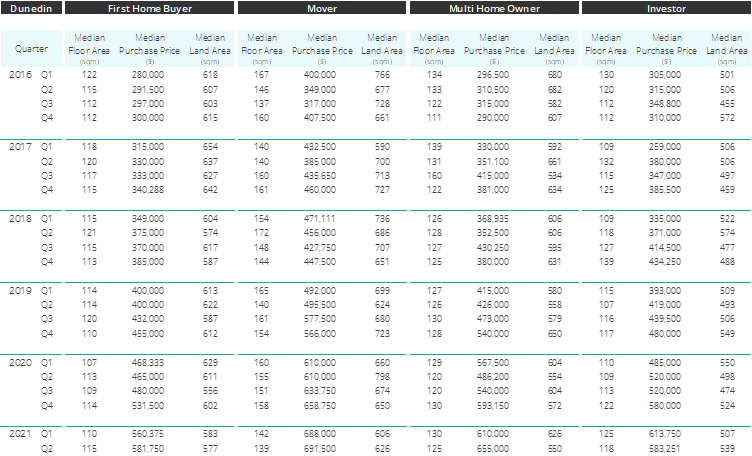

The Dunedin market exhibited a similar trend to the rest of the country. The differentiation between First Home Buyers and Investors was minor at the end of Q2 2021, reflecting the market share shift from Investors to First Home Buyers.

Conclusion

- The impact on first home buyers as they chase affordable housing stock is very notable over the past five years, evidenced by increasing prices, smaller homes, and smaller sections

- The recent policy shift by the government may tilt the balance from Investors to First Home Buyers, but the full impact is yet to be seen

- Movers continued to purchase larger homes to cater to their lifestyle needs. In this post COVID era, occupiers are seeking additional spaces for home office and schooling

- Investors have had to look for other means to maintain their returns in the low-interest rate and low rental return environment. Trends are evident of increased demand for properties on large sections for their development potential to capture the future capital gain

For further information or if you would like to understand more about historic sales prices in relation to buyer types, please contact wayne.shum@valocityglobal.com.