Background

With this survey we are aiming to give some insight into what is happening with the residential real estate market in New Zealand from the unique perspective of property valuers. This quarter’s survey has attracted 91 responses representing around 20% of active residential valuers in New Zealand.

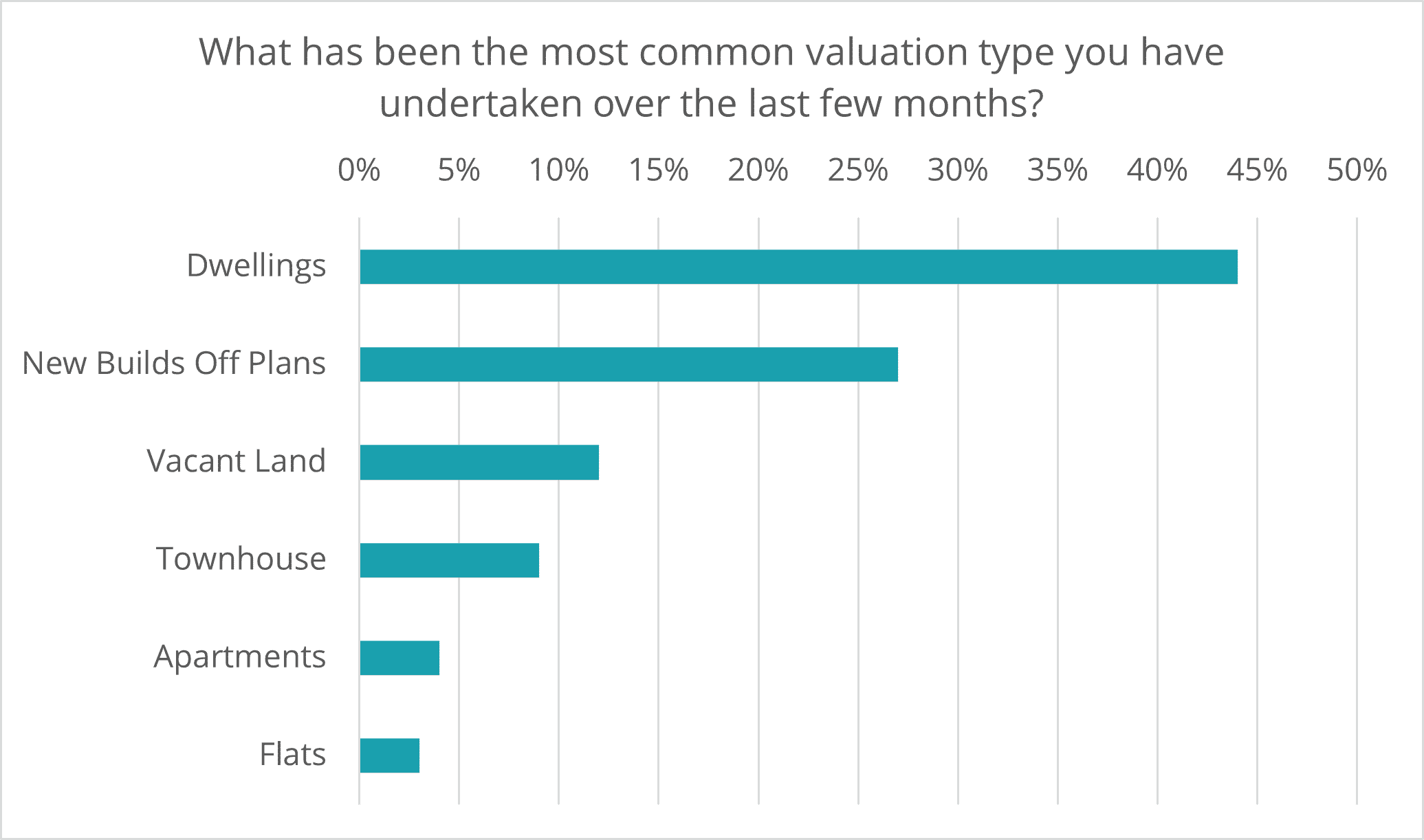

Most Common Valuation Type

44% of valuers have reported that their most common work in recent months has been on dwellings generally defined. 27% have chosen new builds which is well up from 11% in our last survey. This is one of the many measures revealing the intensity of the lift in house building activity around the country. Related to that, and the need to have some land to build on, 12% of valuers have indicated they are most busy with vacant land valuations. This is up from just 1% three months ago.

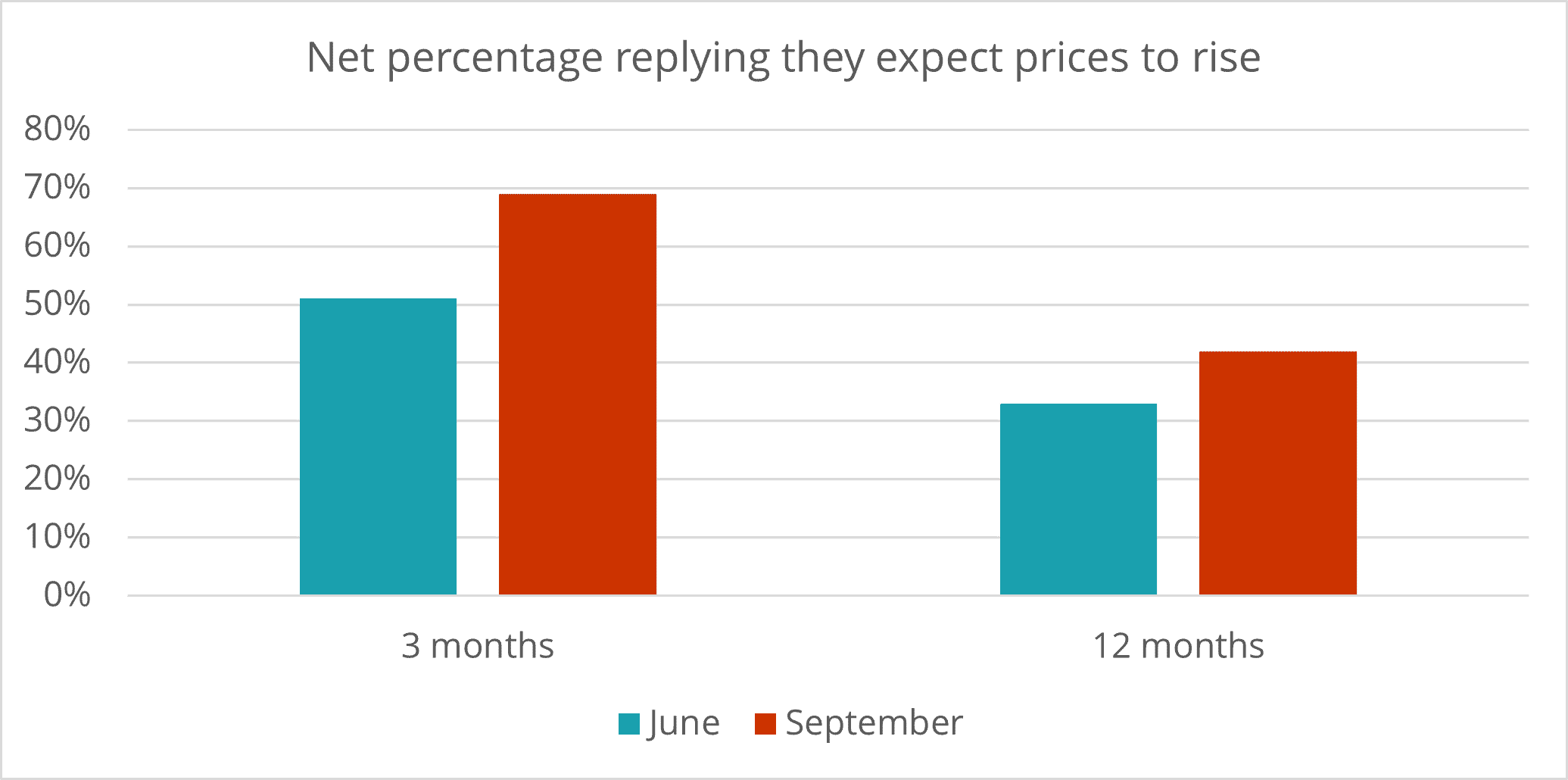

Price Expectation

Compared with our June survey there has been a noticeable lift in expectations for price gains. Three months ago 51% of valuers expected their valuations to increase over the coming three months. Now that proportion stands at 69%. In June 33% expected their valuations to rise over the coming year. Now, that proportion stands at 42%. These results line up with those from other surveys as well as data from Valocity, showing still firm average price rises around the country.

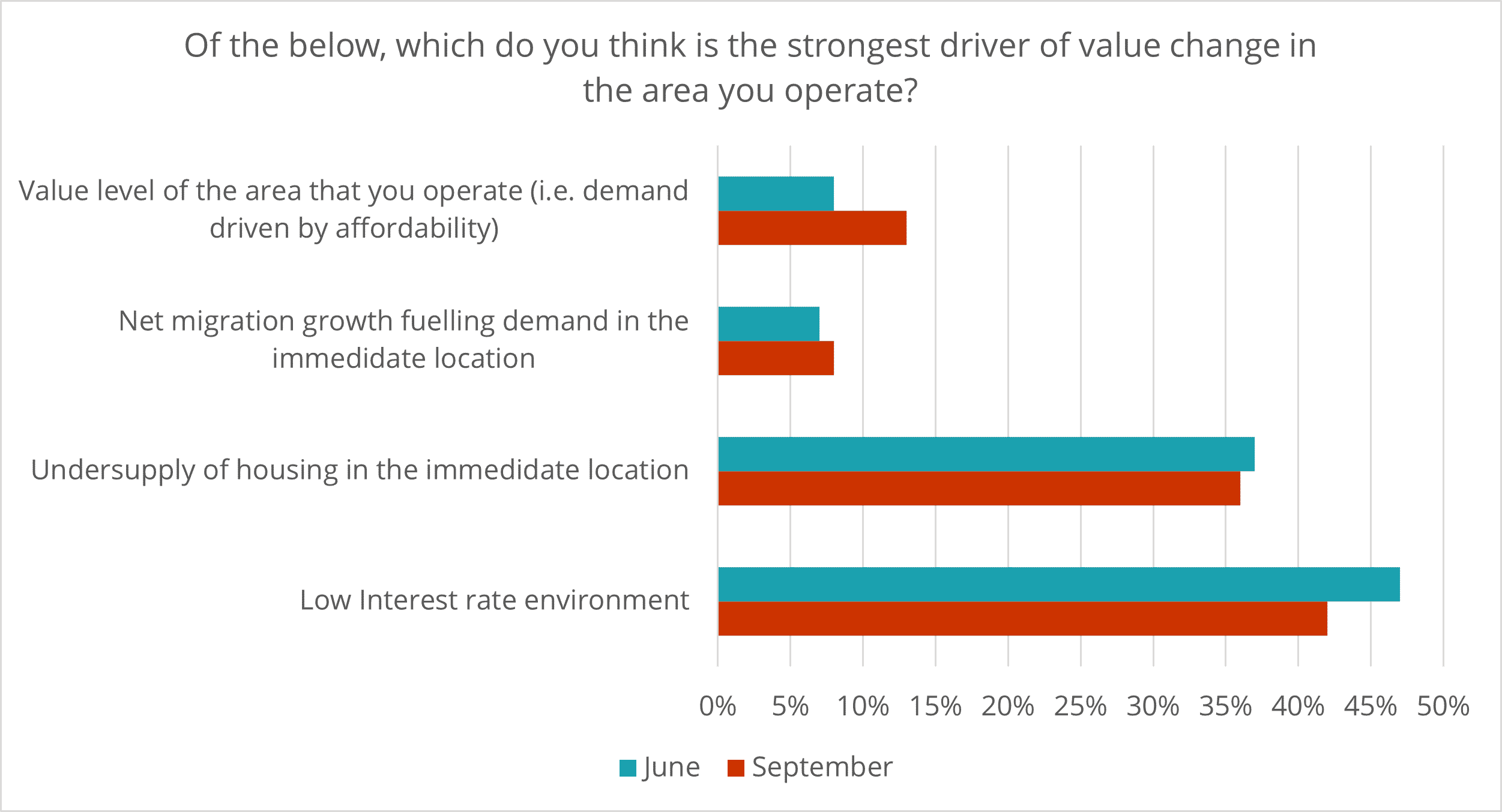

Market Driver

Valuers are asked to rate what they feel are the strongest drivers of property values in their area of operation. As was the case three months ago, low interest rates are rated as most important, but the proportion citing this factor has decreased marginally from 47% to 42%. There has been essentially no change in the proportion citing lack of supply, sitting at 36%. Small rises have been reported for the relevance of net migration and the existing level of property prices from an affordability point of view.

It will be interesting to see how these ratings change as the Reserve Bank engages in monetary policy tightening in the near future.

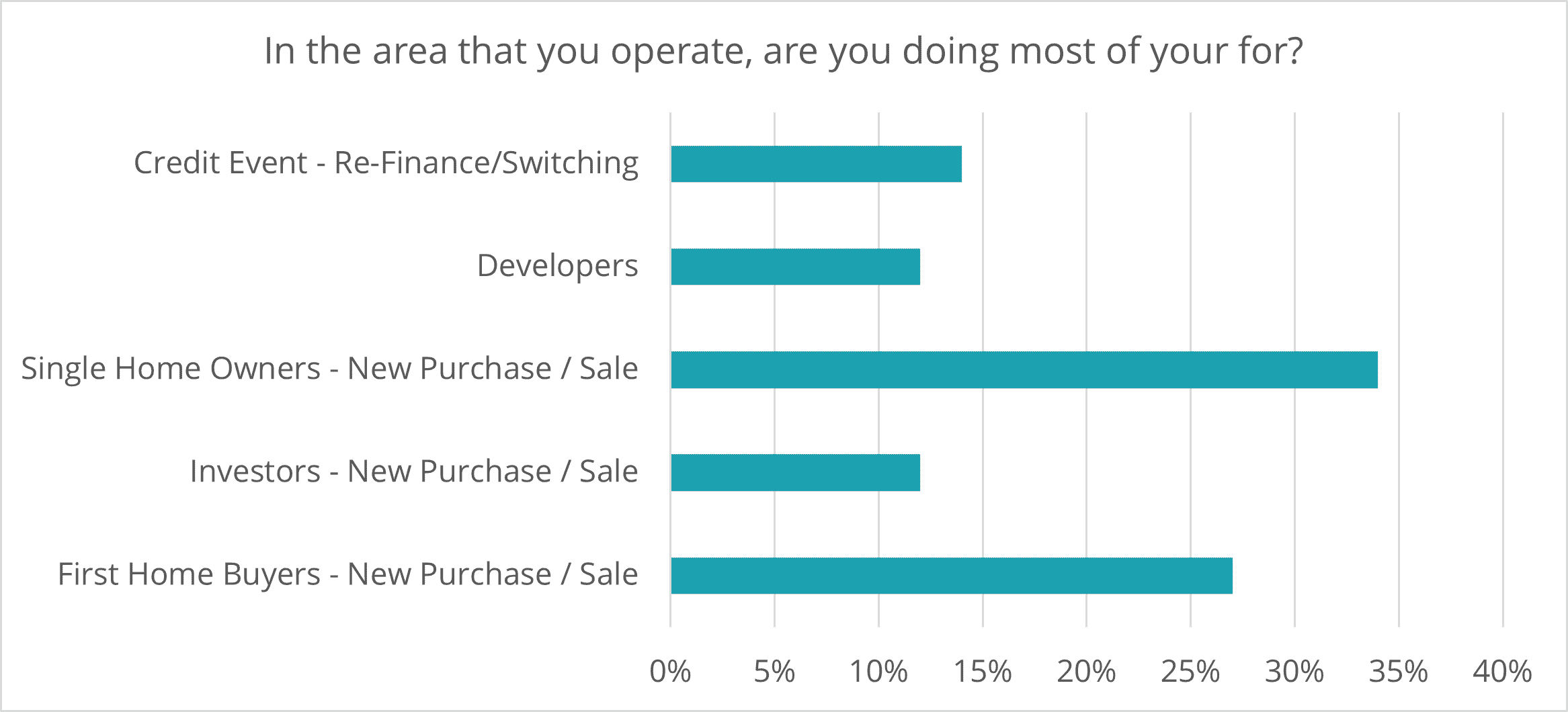

Buyer Type

Most of the work which valuers are doing around New Zealand is for existing single home owners looking to sell or buy, or first home buyers. Just 12% is for investors, with 12% also for developers, while 14% is for an event such as refinancing or switching lenders.

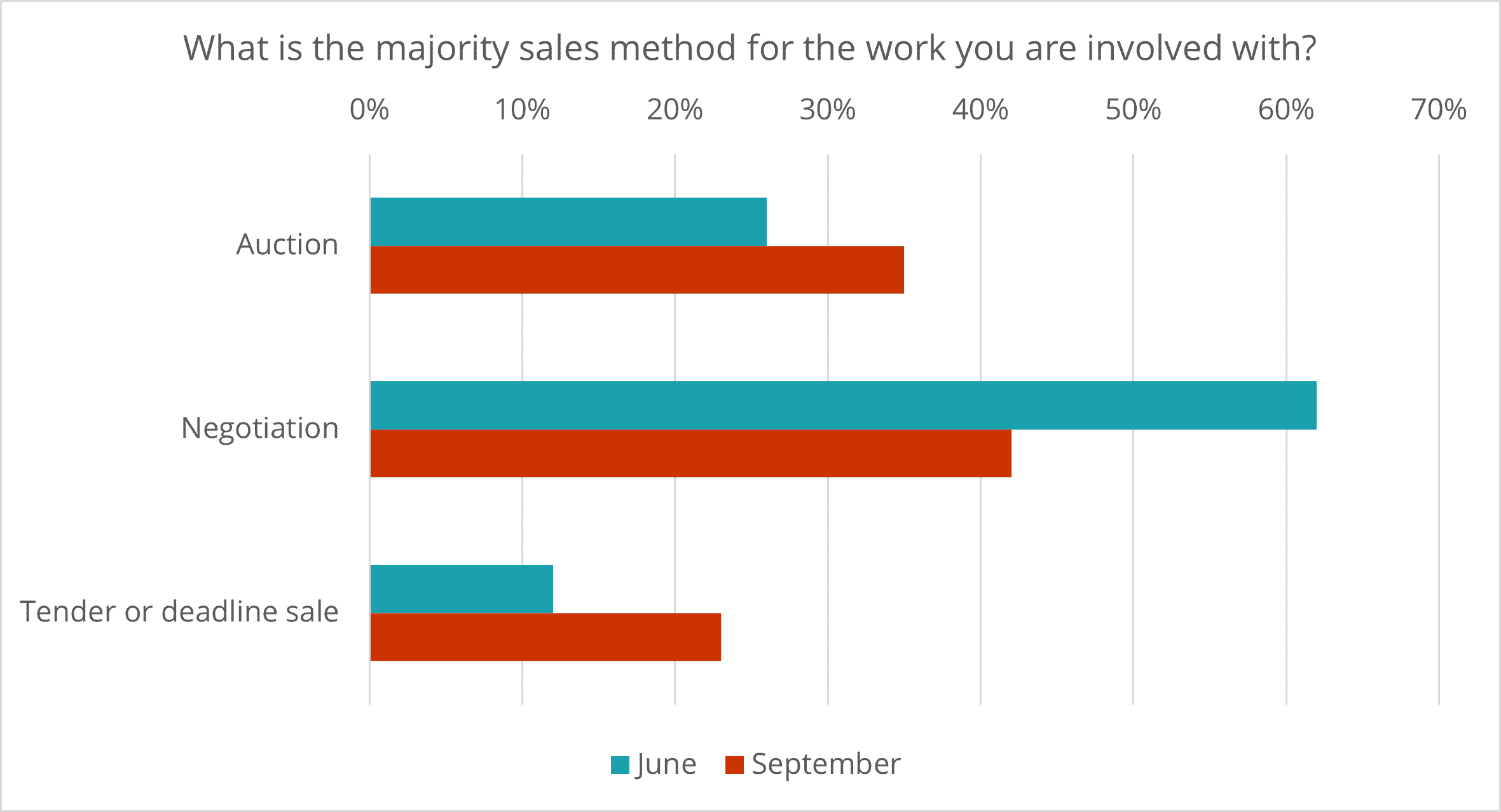

Sale Methods

Perhaps reflecting the decreasing availability of listings around the country, (now running over 70% down from ten years ago and over 30% below levels of February 2020), an increasing proportion of sales are being undertaken by auction. The latest proportion of 35% compares with 26% three months ago. There has also been a rise in the proportion of sales undertaken by tender or deadline sale, to 23% from 12%.

Conclusion

The responses from valuers mainly came in immediately ahead of last month’s lockdown announcement. However, a comparison of those received before with those received after reveals no difference in price expectation gauges and only small alterations in the other measures.

Overall, the results show the following:

- A rise in expectations of the extent to which property prices are likely to increase as compared with three months ago

- The tightening up in listings availability has encouraged a move more towards selling via auction and tenders

- There is firming underlying growth in the new build sector

This survey and the resulting insights are part of an ongoing series. Keep an eye out for future valuer surveys to be undertaken by Valocity in collaboration with Tony Alexander.

Follow us on Linked In to ensure you are up to date with the latest property news and insights.

For any feedback, please get in touch at: hello@valocityglobal.com