by Valocity | Jul 5, 2024 | India, Company News

[New Delhi, 5th July 2024] Valocity, a leading global provider of property data and technology solutions, is pleased to announce the appointment of Mr. Manoj Kohli to its global board. Hailed by the Indian media as ‘Mr. Dependable’ and ‘Rainmaker’, Kohli brings a...

by Valocity | May 28, 2024 | India, Company News

Delhi, India | 28th May Karnataka Bank has selected Valocity’s award winning SaaS platform to digitise their mortgage valuation process. The partnership will empower Karnataka Bank with Valocity’s cloud native valuation ordering platform, digital valuation tools and...

by Valocity | Jul 27, 2023 | Resource Hub, India, Product News

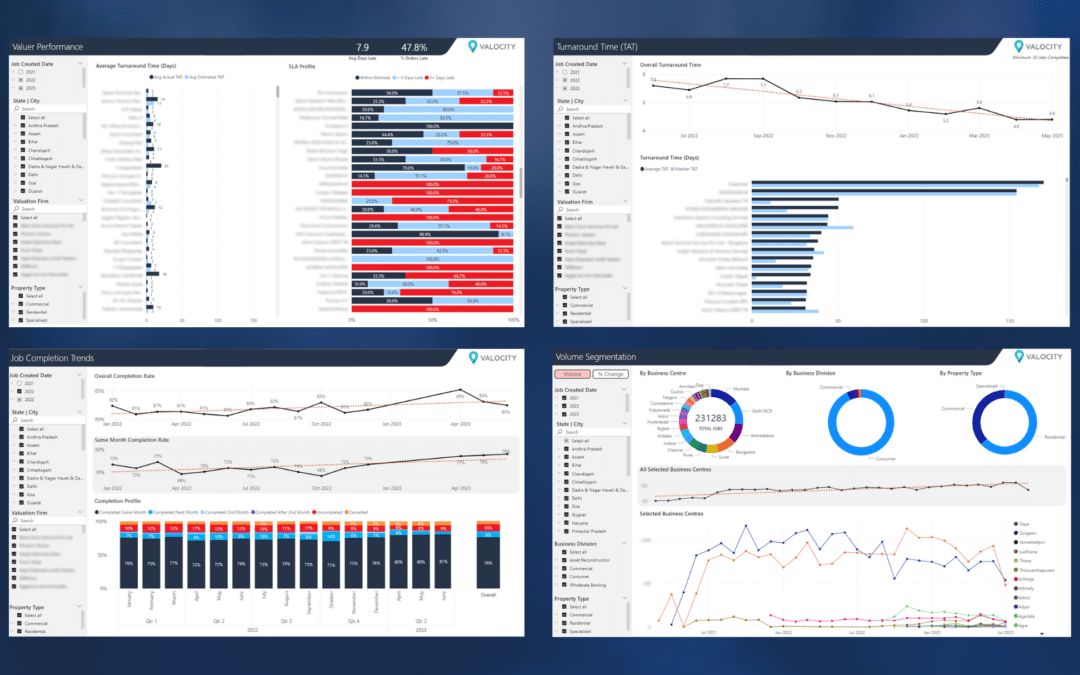

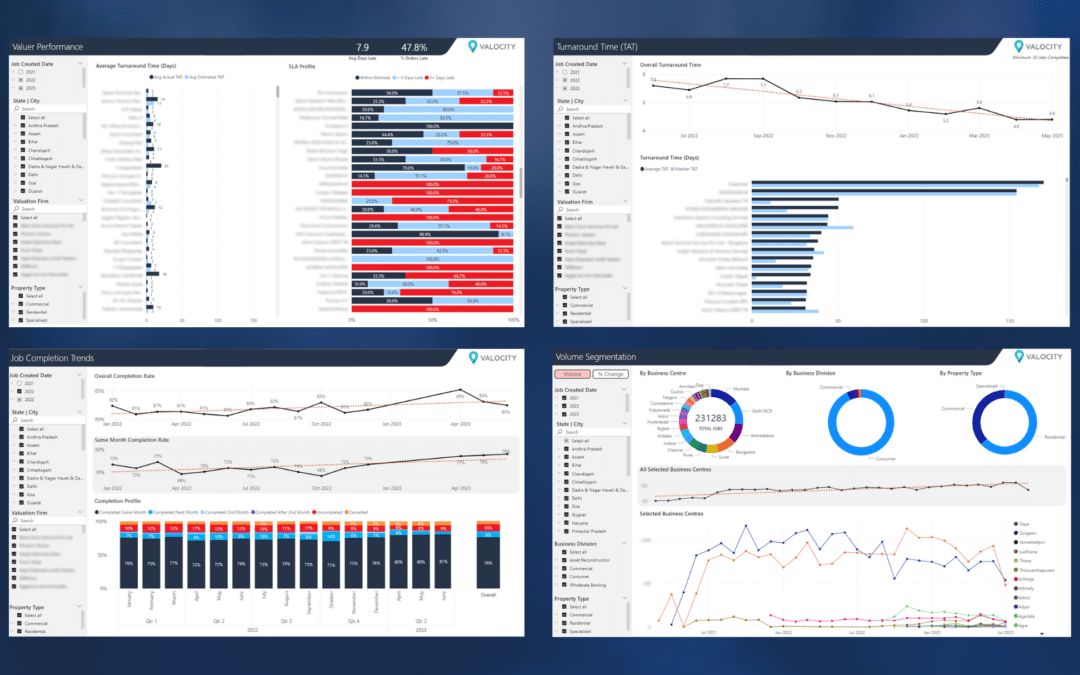

Every day, lenders using Valocity’s Valuation Ordering platform capture myriads of data about their lending portfolio. However, with so much data, it becomes challenging to have visibility over what is being recorded – or more importantly, what can be derived...

by Valocity | Jun 7, 2023 | India, Company News, Australia, New Zealand

The Australian Property Institute (API) recognise through their Property Profession Futures Consultation that the world of data and technology and the future is evolving quickly. The API is excited to be extending its strategic partnership with Valocity to continue to...

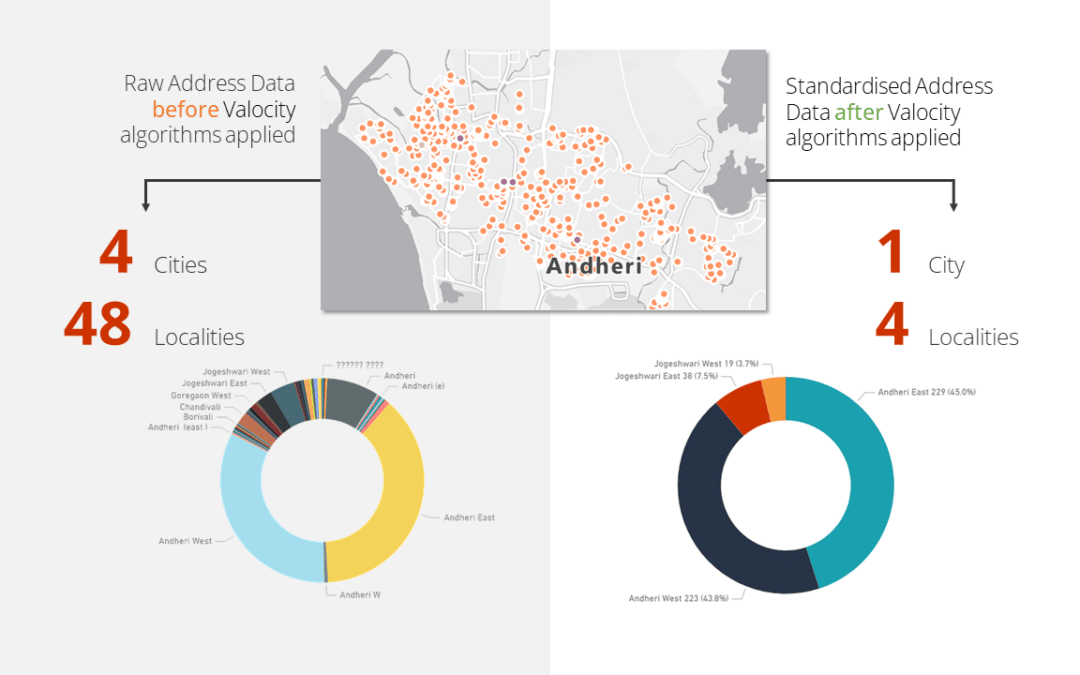

by Valocity | Jan 24, 2023 | Resource Hub, India, Product News

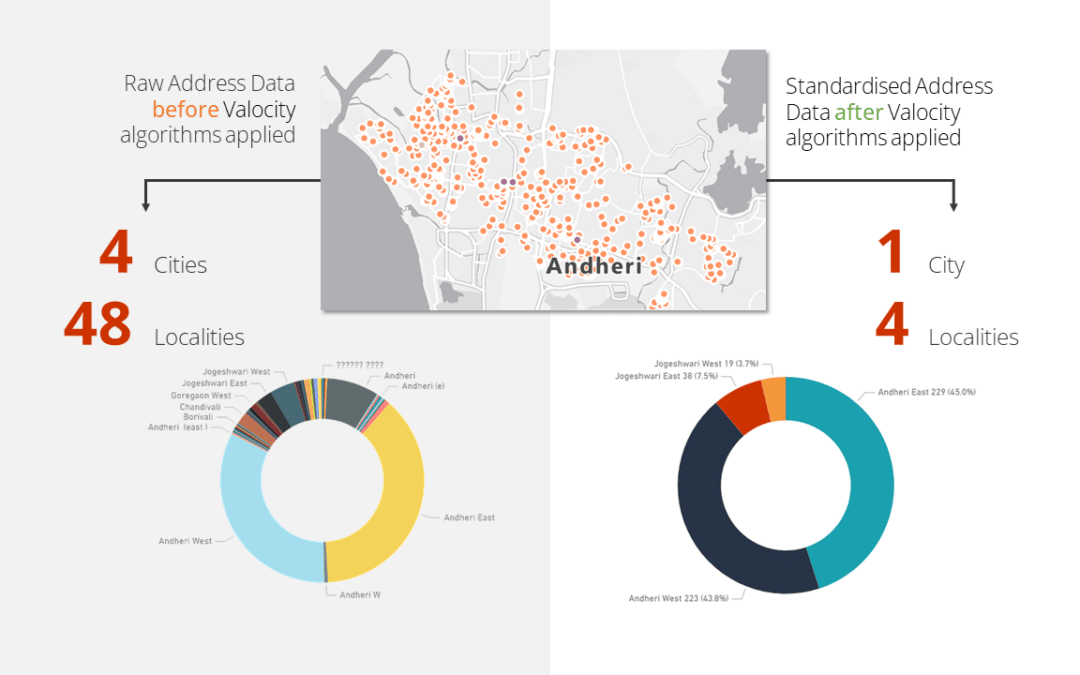

The challenges associated with property data and addresses are well recognised, particularly in banking where lenders increasingly lack accurate and timely data driven decisions. Missing property attributes, incomplete addresses, and non-standardised data...

by Vikas Arora Head of India Product and Technology | Aug 10, 2022 | Resource Hub, Global, India

A recent press release from Gartner stated that worldwide spending on IT is likely to reach US$4.4 trillion this year, of which almost US$675 billion will be on software. With technology playing a vital role in almost every aspect of business and IT investments...