Resource hub

Stay up-to-date on the latest industry news with our most recent blogs.

Valocity Welcomes Industry Heavyweight Manoj Kohli to Global Board

Innovative property data platform Valocity continues to scale globally, appointing industry heavyweight Manoj Kohli to its global board.

Karnataka chooses Valocity to transform mortgage lending processes

Karnataka Bank has selected Valocity’s award winning SaaS platform to digitise their mortgage valuation process.

Implementing a successful digital transformation strategy

Sovan Mandal, CEO of Valocity India, discusses what factors to consider when implementing a successful digital transformation strategy.

Avoiding Common Valuation Myths: What Not to Believe

While investing in any property one of the most important things to do is to get a house valuation done to identify the market value of the property as per the market standards.

Repco Home Finance Limited (RHFL) digitising mortgage valuation process with Valocity’s One Smart Platform

Repco Home Finance Limited (RHFL) has partnered with Valocity to accelerate the digitisation of their mortgage appraisal process.

The future of data analytics in mortgage valuation

Valocity Analytics Hub leverages real-time data capture to provide a central hub for insights to empower lenders to make data-driven decisions, monitor performance, and mitigate risks effectively.

Digitisation in mortgage lending: A CEO’s view

Valocity India CEO, Sovan Mandal, explores the mortgage valuation industry’s digitisation journey, and the opportunities and challenges they face.

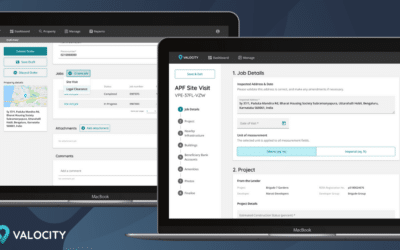

Valocity Approved Project Financials (APF)

Valocity’s unique Approved Project Financials (APF) module is specifically designed to facilitate pre and post build project approval, to address the current market challenges and digitises and automates the process for lending and valuation clients.

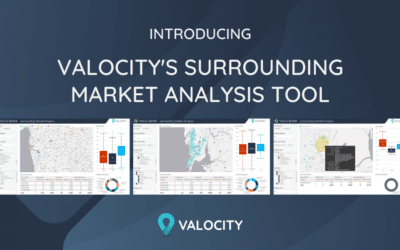

Delivering unique insights to lenders with Valocity’s Surrounding Market Analysis tool

Valocity’s Surrounding Market Analysis solution is a state of the art analytical tool which provides insights into property value rates of any type, any area, over any period. This visibility allows banking credit teams to develop and implement robust credit policies, as well as validate valuation reports with ease.

Revolutionising the Mortgage Valuation Industry: Empowering Valuers Through Digitisation

Valocity’s extensive experience working with over 70 lender partners across multiple geographies has been pivotal in revolutionising the mortgage valuation industry developing, an entirely digital workflow that empowers India valuers to digitise their processes, embrace global best practices, and expand their reach exponentially.