India is the fastest growing economy with the highest volume of construction projects in the world. At the time of application for a home loan in a particular real estate project, a bank/housing finance company typically follows a long necessary due diligence process. A lender must validate the financial health and feasibility of the project before approving the home loan. This involves checking the Approved Project Financials (APF), details such as the total cost of the project, the sources of funding, the projected cash flows, and the estimated revenue from the project as well as requesting a project valuation.

The lender can then determine the risk associated with funding the project and approve the home loan accordingly. This process helps to ensure that the project is financially viable and that the home loan applicant is making a safe investment.

In India 60-70% of the real estate market is currently under construction and only larger lenders in Tier 1 (or Tier 2) cities undertake the APF process due to several challenges:

- The current initiation of project valuations is entirely manual with no central repository or visibility of APF in flight projects or in their current state.

- Some developers may not provide accurate or complete information about a project’s financials, which can make it difficult for banks and housing finance companies to make informed decisions about approving home loans.

- Completed via emails there is no secure communication between developers and lenders.

- Consumers are at risk of losing money over insolvent or at-risk developers and have no visibility of legal sign-off throughout the workflow.

- The APF process is further complicated due to the number of parties involved, the transaction cost and the time-consuming nature which can lead to delays in the disbursement of home loans to buyers.

- Builders do not give access to documents and finance to all banks.

- In some cases, developers may engage in fraudulent activities such as inflating the project cost or misrepresenting the financials, which can lead to losses for both the bank and the home loan borrowers.

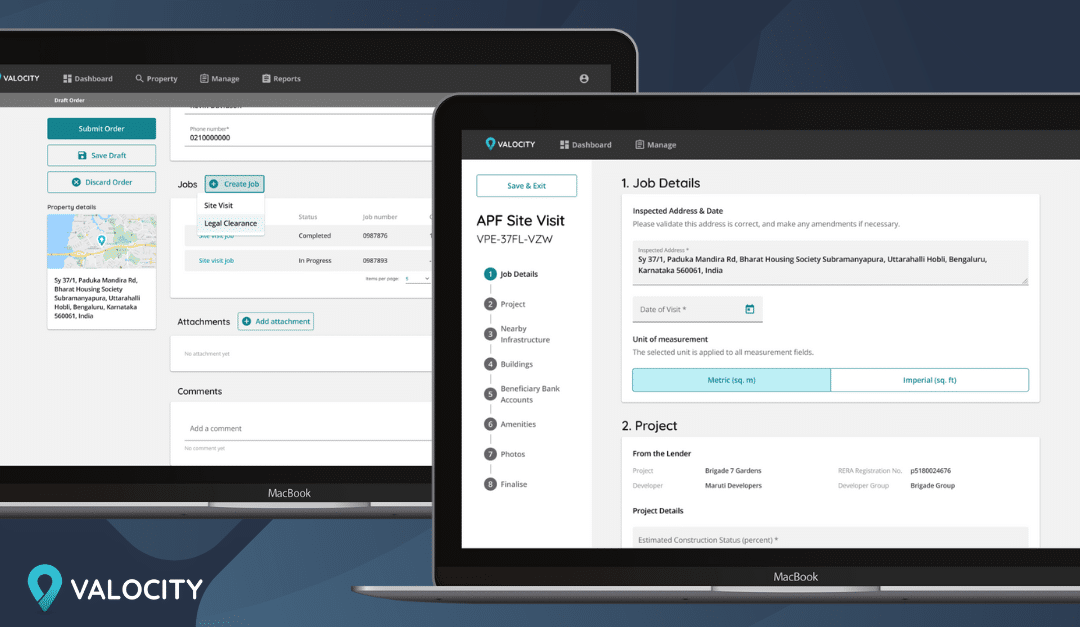

Valocity’s One Smart Platform connects the entire ecosystem of lenders and valuers in India to digitally transform property decisioning processes through a combination of the latest technology and data innovation.

Valocity’s unique APF module is specifically designed to facilitate pre and post build project approval. It addresses the current market challenges and digitises and automates the process for lending and valuation clients alike, delivering a more seamless customer experience.

The innovative module delivers an entirely digital workflow to manage the end-to-end process of project valuations, infrastructure management and legal requirements for the first time ever. Core benefits of the solution include:

- The ability to integrate to banks LOS and core systems.

- Enables subsequent site visits to track building development progress, to enable presales or in the case of funding a project, enable progress payments to the builder.

- Ability to create a single source document storage from legal, technical and builder information.

- Risk reduction and mitigation by validation of site, through geo coding.

- Valuer Allocation assigns orders in accordance with a lenders panel of approved valuers.

- Builder Scoring Model will allow lenders to store final grading for builders through customisation for better data analysis.

- Builder approval letters generated to be used by third parties to advise project approval, therefore enabling lending.

- Disbursement Schedule Tracker provides a facility to store stages of the project and associated % fund release schedule.

- Intuitive MIS and Dashboards will visibility of ongoing and completed transactions.

- Legal Job workflow provides visibility of legal activities and documentation throughout the process.

- Enables risk monitoring e.g., quick identification of any delays in the project.

- Bank and non-bank lenders are empowered to grow in the primary market (first sale of the property).

With lenders using Valocity’s APF module, home buyers can now rest assured that the builder is trustworthy and has satisfied all regulatory requirements for the project. Customer loans are processed faster, and the loan amount is disbursed quickly and efficiently, resulting in a faster speed to yes on home loan approvals.

Some of the solution’s key features include:

Builder Project Master (BPM)

- Manages developer, developer group, project, and builder information.

- Imports lender’s current data to the Valocity database.

- Allows for early property flagging of approved projects by lender.

Technical Initiation and Approval Flagging

- Project address verification: lender can identify the exact project accompanied by a visual reference to its location.

- Vendor allocation: platform allows internal/and external empaneled vendor allocation for technical valuations, legal verifications, and background verification.

- Receiving data, files, and reports digitally: project data received from the vendor automatically updated in the Builder-Project Master along with reports sent digitally by vendor.

- Builder self-service portal: builder can log into the system and complete registration to save time for the lender.

- Authorised builders/builder Groups can register new project build for approval that lender can then confirm, score, and onboard.

Subsequent Valuation

- Subsequent Visit Scheduler allows the lender to schedule periodic workload of site visits in advance and sync additionally collected data with historic project data.

- Sends digital notifications and reminders prior to the scheduled site visit.

Data Insights and Analytics

- Facilitates indexation and gathers valuable insights on trends of projects.

- Unique, comprehensive, and actionable data insights for fact-based decision making e.g., approval turnaround time, concentration risk etc.

- Future proofs risk management with accurate performance metrics of builder delivery.

Lenders can streamline their processes, reduce costs, and deliver superior outcomes for their clients all while reducing risk and growing at pace with digital efficiency.

Talk to a member of our Valocity India team or book your demo today!

Author: Vikas Arora – Head of Technology

Co-Author: Mohini Sharma – Quality Analyst