Background

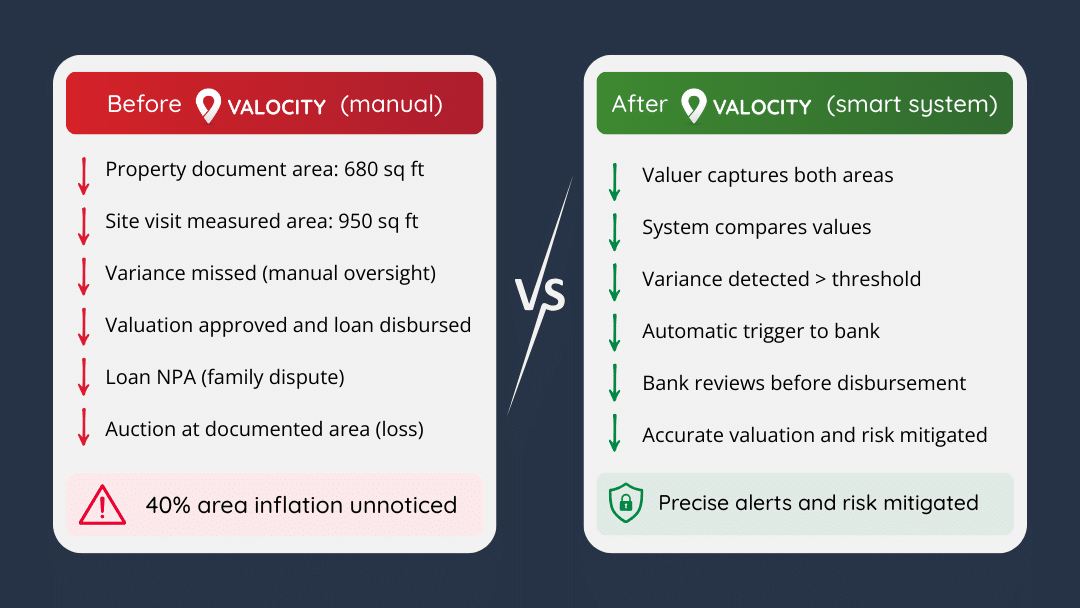

One of Valocity’s leading lender partners faced a critical challenge before adopting Valocity’s digital valuation platform. At the time, property valuations were conducted through a fully manual process, relying heavily on individual valuer judgement and manual review by technical managers.

While the process appeared robust, it lacked system-level controls to detect inconsistencies between documented property details and physical site measurements.

What happened

-

The Index II document recorded the super built-up area of the property as 680 sq. ft

-

During the physical site visit, the valuer measured the area as 950 sq. ft

-

This 40 percent variance between documented and measured area was not flagged during the manual technical assessment

-

The valuation was approved, the inflated area was accepted, and the loan was disbursed

At the time, the discrepancy went unnoticed.

What emerged during recovery

Two years later, the loan slipped into NPA following a family dispute. During the recovery process, the Bank’s collection team and technical manager re-inspected the property and discovered that:

-

The property had been subdivided

-

An enclosed balcony and space near the staircase, not part of the legally documented property, had been included in the measured area

-

These inclusions were not permissible under documented property norms

The valuation had therefore been based on an inflated area that was not legally saleable.

Background

One of Valocity’s leading lender partners faced a critical challenge before adopting Valocity’s digital valuation platform. At the time, property valuations were conducted through a fully manual process, relying heavily on individual valuer judgement and manual review by technical managers.

While the process appeared robust, it lacked system-level controls to detect inconsistencies between documented property details and physical site measurements.

What happened

-

The Index II document recorded the super built-up area of the property as 680 sq. ft

-

During the physical site visit, the valuer measured the area as 950 sq. ft

-

This 40 percent variance between documented and measured area was not flagged during the manual technical assessment

-

The valuation was approved, the inflated area was accepted, and the loan was disbursed

At the time, the discrepancy went unnoticed.

What emerged during recovery

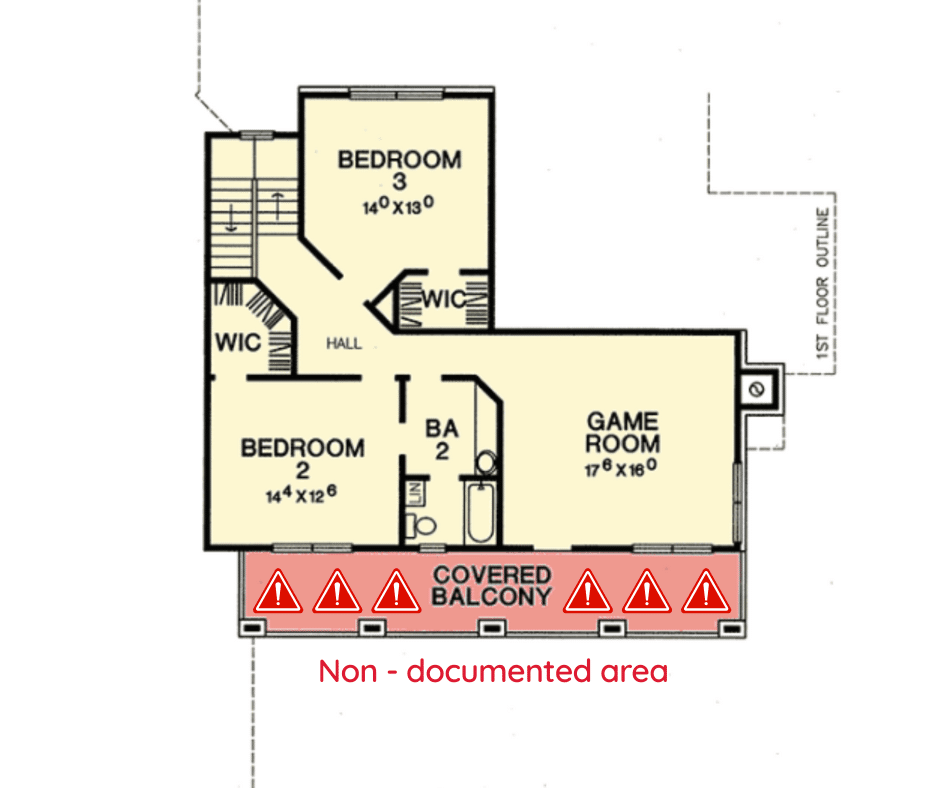

Two years later, the loan slipped into NPA following a family dispute. During the recovery process, the Bank’s collection team and technical manager re-inspected the property and discovered that:

-

The property had been subdivided

-

An enclosed balcony and space near the staircase, not part of the legally documented property, had been included in the measured area

-

These inclusions were not permissible under documented property norms

The valuation had therefore been based on an inflated area that was not legally saleable.

The impact

As a result:

-

The Bank had overfunded the loan based on an inflated valuation

-

During auction, the property could only be sold as per the documented 680 sq. ft, not the inflated 950 sq. ft

-

This led to reduced recoverable value and a direct financial loss during NPA recovery

What began as a minor oversight became a significant recovery risk.

How Valocity prevents this risk

Valocity’s digital valuation platform embeds automated checks and intelligence directly into the valuation workflow:

-

Valuers are required to capture both:

-

Area as per legal documents

-

Area as per physical site measurements

-

-

Any variance beyond a lender-configured threshold is automatically flagged

-

Smart alerts are triggered for technical managers, ensuring discrepancies are reviewed before valuation approval

These controls eliminate reliance on manual detection and ensure issues are addressed before disbursement.

The outcome

-

Area discrepancies are identified early in the valuation process

-

Banks make informed lending decisions and avoid overfunding

-

Undocumented extensions are excluded from valuation

-

The risk of future NPAs and recovery losses is significantly reduced

Key takeaway

Valocity transforms property valuation from a manual, judgement-led process into a system-controlled safeguard. What once resulted in costly NPAs is now prevented through built-in intelligence, compliance checks, and automated risk controls, giving lenders confidence at every stage of the lending lifecycle.

About Valocity

Valocity is a global leader in property data, AI and analytics, providing innovative solutions to streamline decision-making in the real estate, banking, and property valuation sector. Trusted by major lenders worldwide, Valocity’s platform harnesses the power of data to deliver actionable insights and drive efficiency for its customers.

For media inquiries, please contact:

Sara Pesic – Head of Marketing, Valocity