Our solutions at a glance

Digital valuation management platform

Digitally connecting the entire valuation ecosystem for the first time with end-to-end digital workflow management.

- Easily integrate with lender’s credit rules and workflows

- Automate work allocation and valuation frameworks

- Increase confidence with accurate property identification and validation

- Reduce Turn Around Time (TAT) and cost and improve portfolio visibility

- Gain control and improve transparency through audit trails

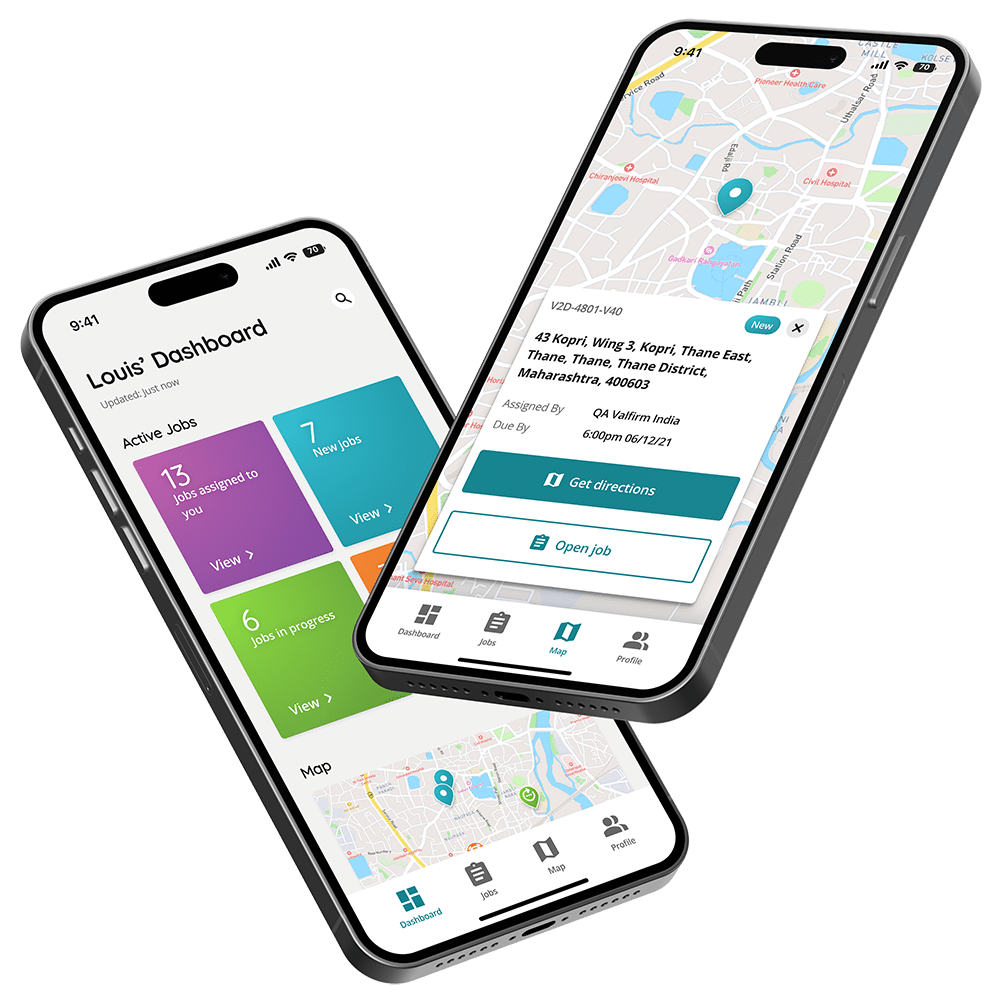

In-field data capture tool for valuers

For the first time, nationwide valuers can digitally and accurately complete valuation reports/appraisals in field.

- Simplify valuations with an end-to-end digital solution

- Leverage auto calculations and smart validations to reduce the risk of human error

- Digitally connect with lenders for secure communication

- Gain efficiency and speed with standardised valuation templates and customised workflows

Digital APF and legal workflow

Designed to facilitate pre and post-build project approval, BuildIQ delivers an entirely digital workflow to streamline the approved project financial (APF) process including technical and legal due diligence.

- Go completely paperless with a secure end-to-end digital workflow

- Gain visibility of legal and technical due diligence activities and documentation throughout the APF process

- Reduce delays and remove bottlenecks with a transparent workflow

- Avoid cost process automation

- Increase control over subsequent monitoring

From manual to digital

Harnessing technology and data to deliver digital transformation and significant value.

Random valuer allocation for quality control

Improved risk management for cost savings

Digital data capture and insights with standardised bank template

Geo-coding of addresses and digital capture of property level attributes and details

Bank-grade security to stay ahead of increasing regulatory compliance

Entirely digital process – end-to-end workflow increasing productivity and TAT

Portfolio analytics and SLA reporting for data-driven decision-making

Bench-marking to enable indices and trend analytics, delivering a competitive edge

Global recognition

NZDM Nexus Supreme Winner Award 2015

Innovation Award 2016, Property Institute NZ

2017 CIO award for ‘Best Business Transformation using Digital and IT’

Finalist Excellence in Innovation, Export NZ Awards 2018

Finalist Best Medium Business, Export NZ Awards 2018

Finalist Global Fintech Awards, Singapore Fintech Festival 2018

Fintech Startup of the Year Award, India Fintech Forum 2019

Finalist Global Fintech Hackcelerator Awards, Singapore Fintech Festival 2019

Finalist, IFTA India Fintech Award for Innovation 2019

Microsoft ISV Partner Award 2020

Winner of The Search NZ, Abu Dhabi Fintech 2020

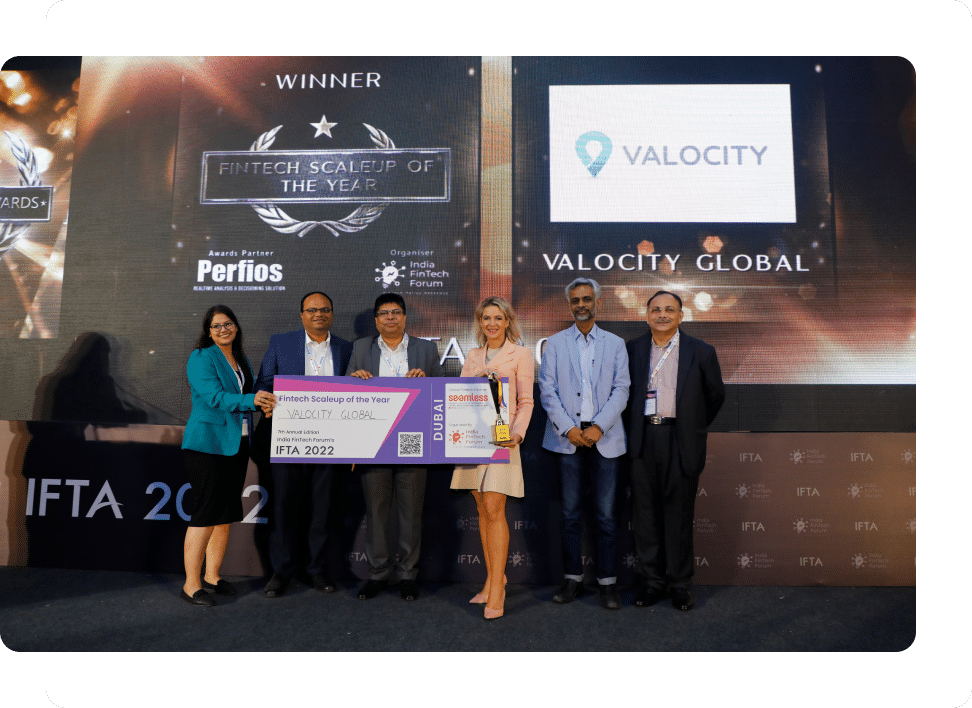

Fintech Scale Up of the Year, India Fintech Forum Awards (IFTA) 2022

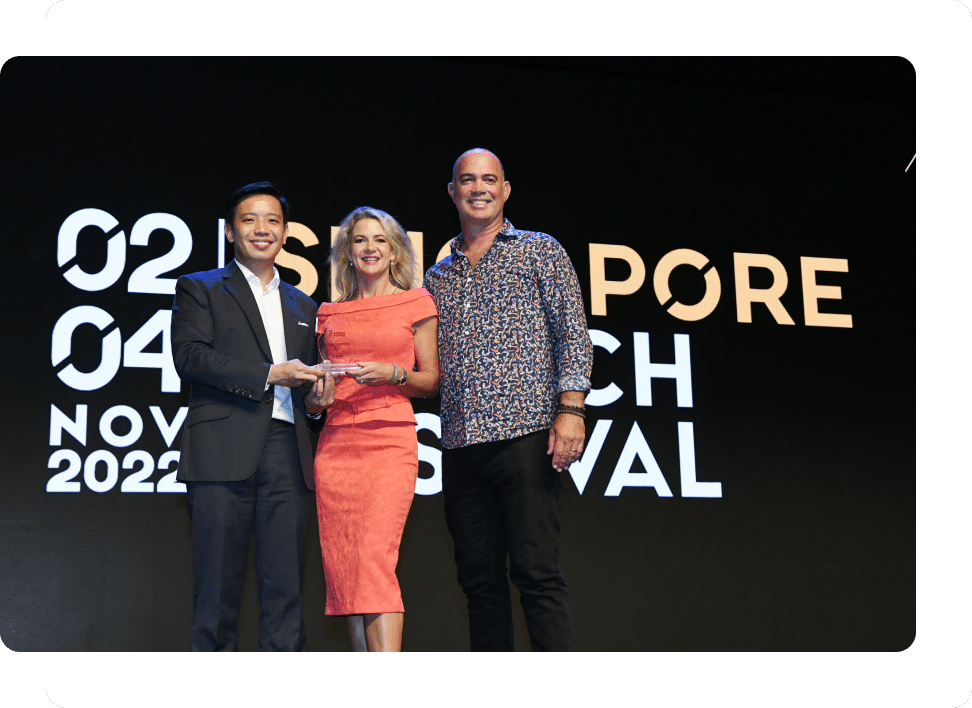

Runner Up Global Fintech of the Year, Singapore Fintech Festival 2022

Excellence in Innovation Technology Award 2022

Future of Living Challenge Winner, Cityscape 2024

Request a demo

Customer testimonials

“What I like about Valocity is that you accommodate collaboration and focus on facilitating innovation for the industry.

I believe our industry, which has been held back and seen very little innovation, is ripe for transformation but needs an organisation like Valocity to help us facilitate it.”

Bart Mead

Global Head of Value & Risk Advisory, JLL

“Mortgage is one of the core needs in India, and it is important to create an ecosystem of all players powered by technology.

With Valocity’s mortgage valuation model, we will be able to digitise mortgage valuation, which will optimise the whole process and enhance customer experience.”

Ms. Shanti Ekambaram

Director, Kotak Mahindra Bank

“The team’s expertise both in software and data analytics ensures that the process is backed by a robust and reliable tech platform.

I am truly impressed with the exceptional services provided by Valocity. I highly recommend their services to anyone seeking a top-notch valuation software solution.”

Mr. Puneet Tyagi

Founder & Group CEO, MRICS

Our clients

Stay informed with Valocity Hub

How a 70-year-old valuer inspired a digital lending revolution

A 70-year-old valuer doubled his output and helped spark a 40% uplift in valuation capacity, all by going digital with Valocity Connect. This is how human-first innovation transforms lending.

How leading lenders are gaining a competitive advantage in a market that demands speed, precision, and agility

India’s top lenders and over 7,000 valuers have transformed mortgage valuations by adopting Valocity’s one-stop digital solution, replacing manual inefficiencies with automation. This shift has accelerated credit approvals, enhanced compliance, and delivered a significantly better experience for borrowers.

Strengthening connections and driving innovation: A visit from our Chief Product Officer to India

Valocity Global’s chief product officer, Tim Jenner, recently visited India to engage with our local teams and key clients, reinforcing our commitment to one of our fastest-growing markets.