How one smart trigger stopped fraud in its tracks

What happens when a single flagged outlier prevents ₹50 Lakhs in potential fraud?

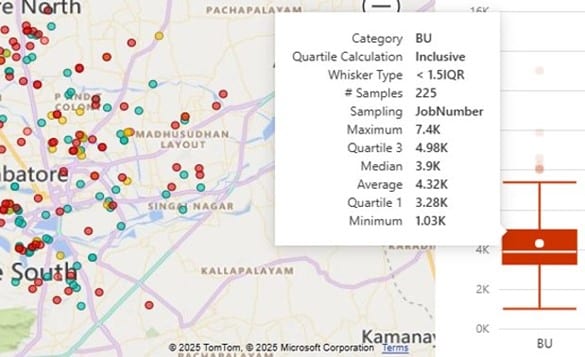

In Coimbatore, Tamil Nadu, a leading Indian lender averted a major fraud attempt that could have exposed them to ₹50 Lakhs in losses. The turning point: one anomaly, automatically detected by Valocity’s Surrounding Market Analysis (SMA) Module. This state-of-the-art tool delivers insights into property value rates across any type, area, or period, enabling credit teams to build robust policies and easily validate valuation reports.

This case shows the power of digitised valuation, data-driven vigilance, and proactive fraud detection – all in one seamless workflow.

The challenge: Hidden risks in inflated valuations

Fraudulent or inflated property valuations remain one of the biggest dangers in lending. When a property is deliberately overvalued, it can justify multiple loans or inflated loan amounts, leaving lenders dangerously exposed if repayments default.

In Coimbatore’s Manjeswari Colony, this exact risk surfaced.

During a routine monthly review, a valuation came through with a market rate of ₹19,205 per sq.ft. while the area’s median was closer to ₹4,000 per sq.ft.

In a manual or paper-based system, this discrepancy could have slipped through unnoticed. But Valocity caught it instantly.

The outlier that raised the alarm

The anomaly was automatically flagged by Valocity’s Outlier Detection function within the SMA Module.

Triggered by the alert, the lender’s CRO team investigated and uncovered:

-

Land value: ₹70 Lakhs

-

Building value: ₹10 Lakhs

-

Customer exposure: 5 loans (home loan + top-ups)

-

Total exposure: ₹50 Lakhs

The inflated valuation was a clear red flag, suggesting the property was being overvalued to justify multiple loans against the same asset.

In the past, uncovering this would have required weeks of manual cross-checking and still risked being missed. With Valocity, detection was instant.

The results: Fraud risk neutralised

In minutes, the lender shut down a fraud attempt that could have cost ₹50 Lakhs.

With one trigger and one investigation, they:

-

Prevented fraud across five loans tied to the same customer

-

Protected exposure worth ₹50 Lakhs

-

Eliminated risk with a single analysis

-

Gained confidence in their ability to act decisively with real-time insights

This wasn’t just one case. It was proof that digitisation shifts the balance from reactive firefighting to proactive prevention.

Efficiency gains beyond cost savings

The financial impact: ₹50 Lakhs saved.

The efficiency gain: equally transformative.

-

One trigger, one investigation, one decision

-

No prolonged back-and-forth

-

No growing risk exposure

Instead of chasing fraud after the damage, the lender had the tools to stop it before it started.

The future of fraud prevention: Proactive and data-led

Fraud risk is inevitable. But with the right digital tools, losses don’t have to be.

The Coimbatore case proved what’s possible:

-

Anomalies caught instantly, not after losses occur

-

Lenders empowered to act swiftly and decisively

-

Substantial exposure neutralised with minimal effort

-

A scalable model to protect operations nationwide

One anomaly detected. ₹50 Lakhs saved.

That’s the power of digital vigilance.

About Valocity

Valocity is a global leader in property data, AI and analytics, providing innovative solutions to streamline decision-making in the real estate, banking, and property valuation sector. Trusted by major lenders worldwide, Valocity’s platform harnesses the power of data to deliver actionable insights and drive efficiency for its customers.

For media inquiries, please contact:

Sara Pesic – Head of Marketing, Valocity