Brought to you by the Valocity Research Team: Wayne Shum and James Wilson

Executive Summary

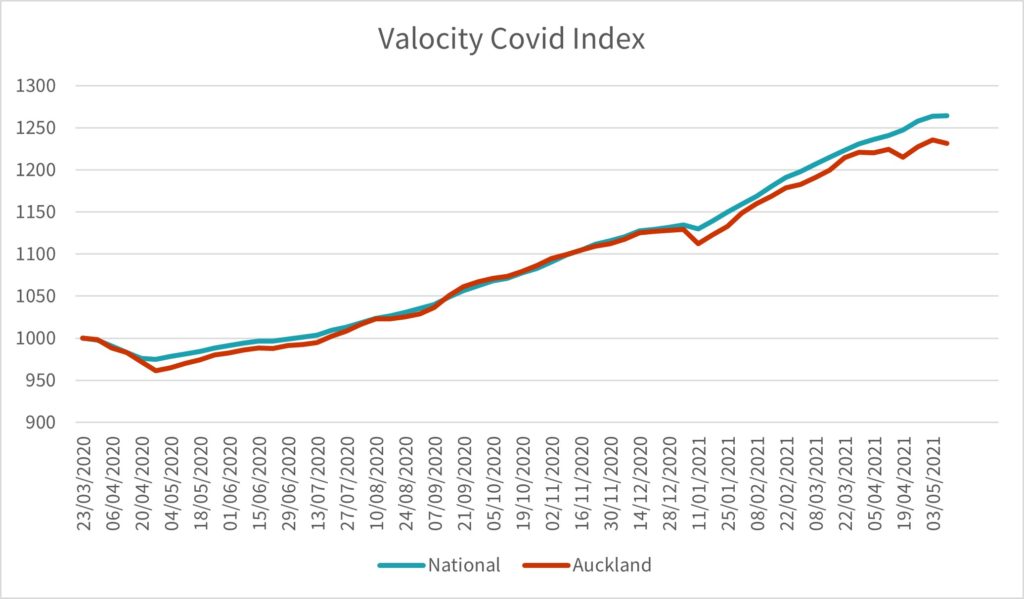

As part of the May 2021 Budget Announcement, Treasury have predicted the rate of growth will decline from 17% p.a. to 0.9% p.a. To put this in perspective, since the first Nationwide lockdown – The Valocity Covid Index has grown 26.4%. Therefore, if the rate of growth slows to 0.9% annual growth by June 2022, the New Zealand Housing market will remain 27% over pre Covid levels.

Looking into our largest market, the New Zealand and Auckland markets initially performed similarly since Covid. However, their performance has deviated more recently, with many other markets now performing more strongly than Auckland, indicating that the growth has shifted to the regions.

The implication of this being that we are not only seeing a handful of markets experiencing very strong housing conditions, growth is also now widespread across NZ – meaning that assumptions that house price growth will slow rapidly as predicted within Treasury’s budget.

Source: Valuation Covid Index

Source: Valuation Covid Index

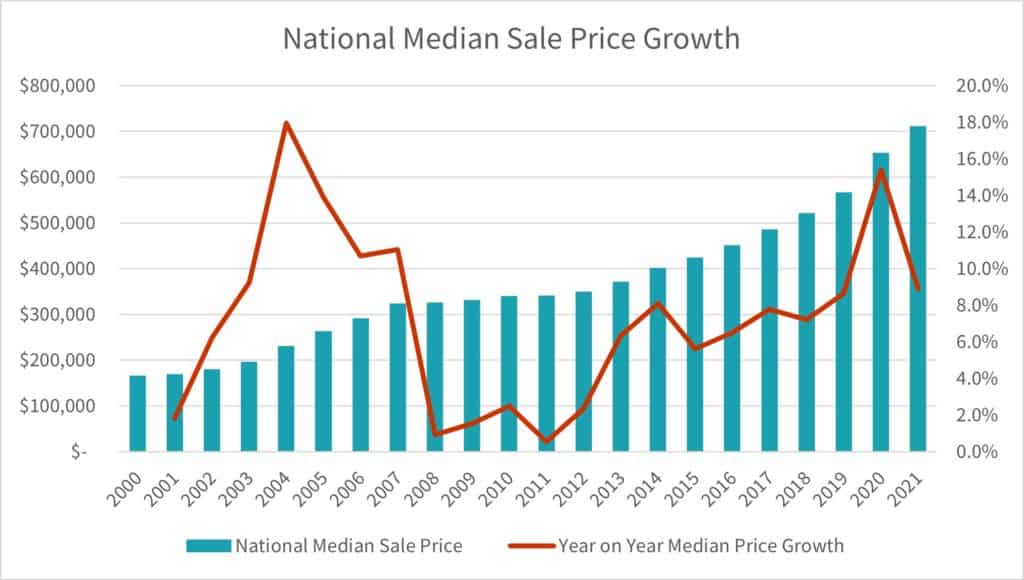

Source: Valocity Sale Data

Source: Valocity Sale Data

Drivers for market growth

The NZ housing market is driven by several key factors, including:

- Employment Rate: Current unemployment rate fell to 4.7% for Q1 2021, down from 4.9% from Q4 2020. The low unemployment rate would also lead to wage growth, further increasing the purchasing power of potential homeowners and increasing overall levels of confidence. This driver is NOT considered to support predictions of rapid stalling of the rate of house price growth.

- Population Growth: Traditionally high net migration has been linked to growing house prices. However, house price growth has been strong despite low net migration over latter half of 2020 and 2021. This driver could be considered to support the rate of house price growth stalling – however it is also worth noting that there Is also an undersupply of housing facing many key locations even with the reduction in net migration.

- OCR rate: The OCR rate remains at historically low levels, currently at 0.25%. Current inflation remains low at 1.5% for March 2021 and forecast to be within RBNZ mandate of 1-3%, therefore sharp increases of the OCR rate is unlikely in the short term – however it is worth noting that the latest RBNZ update in May 2021 did include messaging about potential increases becoming a reality in 2022. The OCR rate does have the ability to support Governments forecasts, there is no short term rise likely and therefore the potential to soften the rate of growth so drastically in the timeline predicted is unlikely.

- Mortgage interest rates: Arguably the strongest driver on the housing market in NZ is a strong driver. Currently interest rates are at a record low and are unlikely to rise sharply in the short term. Whilst we are now beginning to hear messaging about the potential of increasing the OCR rate in the medium term, we are not yet seeing this have an impact on mortgage interest rates, therefore this is NOT considered to support Government predictions of value growth stalling.

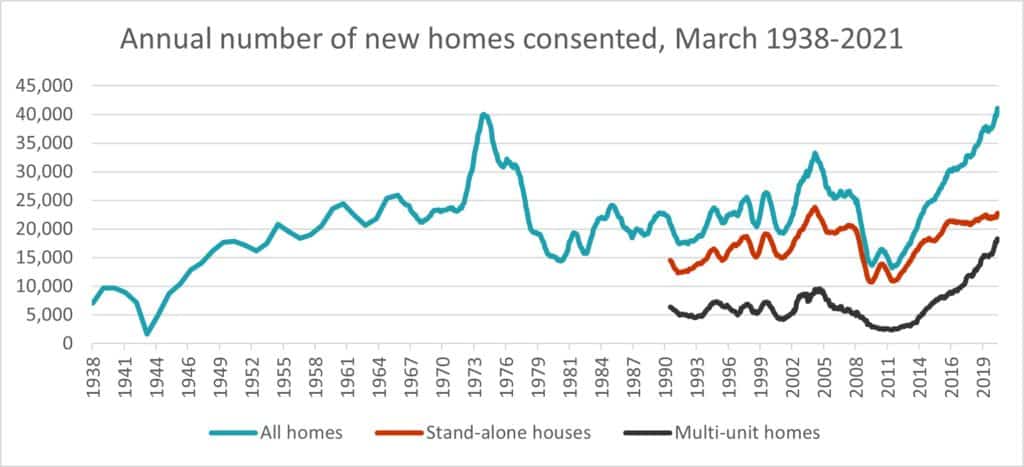

- Housing Supply: 40,000 new homes have been consented in 2020 across New Zealand, the highest number since 1970s. However, the construction sector has reported a shortage of material and lack of labour in recent months, driving up construction cost and delaying house completion. There is unlikely to be a lift in supply in the short term to meet the demand. Therefore, given the capacity constraints currently facing the NZ construction industry, even having regard to the significant funding boost targeted at increasing housing stock, this is NOT considered to support the Governments predictions of value growth stalling.

Investigation of the above key housing market drivers does not appear to have many drivers or current market settings supporting the Government predictions of house price growth stalling so significantly.

However, lets dive deeper into some of the key data that underpins these market drivers.

Lets’ look at the data

Population and housing supply

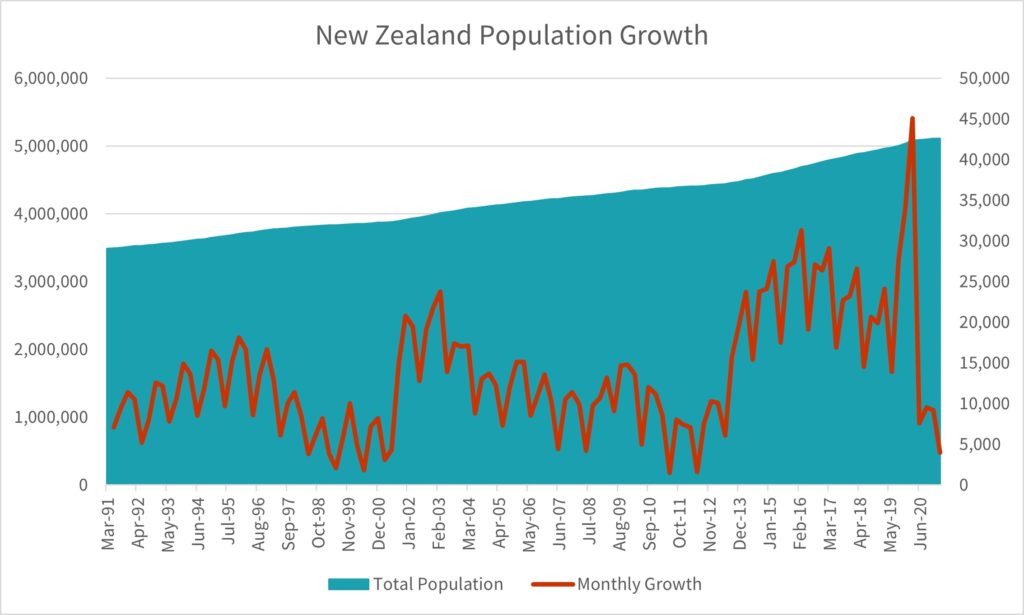

Whilst net migration has declined from 72,588 in 2019 to 41,176 in 2020 as the result of the Covid related border closure, the New Zealand population continued to rise. With increased population New Zealand need more homes to accommodate its people.

Source: Stats New Zealand Population Estimate

Source: Stats New Zealand Population EstimateOverall, the net growth in the New Zealand population increased 776,000 from 2010, we have adopted the New Zealand average size of 2.7 people per household. New Zealand required 287,407 new homes to accommodate this growth. However, over this period New Zealand have only built 256,718 new homes: a shortfall of 30,689 homes.

| Year | New Zealand Population | Annual Population Growth | Number of New Households |

| 2010 | 4,373,900 | 41,800 | 15,481 |

| 2011 | 4,399,400 | 25,500 | 9,444 |

| 2012 | 4,425,900 | 26,500 | 9,815 |

| 2013 | 4,477,400 | 51,500 | 19,074 |

| 2014 | 4,564,400 | 87,000 | 32,222 |

| 2015 | 4,663,700 | 99,300 | 36,778 |

| 2016 | 4,767,600 | 103,900 | 38,481 |

| 2017 | 4,859,500 | 91,900 | 34,037 |

| 2018 | 4,941,200 | 81,700 | 30,259 |

| 2019 | 5,040,400 | 99,200 | 36,741 |

| 2020 | 5,108,100 | 67,700 | 25,074 |

| 776,000 | 287,407 |

Source: Stats New Zealand Population Estimate, Stats New Zealand Household Survey

The New Zealand population is forecast to continue to grow by 45,000 by the end of June 2022 and an additional 49,000 by the end of June 2023. (Source: Stats New Zealand Population Estimate). That is an additional 35,000 homes required over the next 2 years.

How does our supply line look?

Near 40,000 new homes were consented in 2020, the highest since 1970s. However, how many of these would be converted to actual houses? The number of new homes consented has increased year on year since 2011, however, the trend for home completion is less consistent, with only 85% of consented homes having been built since 2016.

Source: Stats New Zealand Building Consent Data

Source: Stats New Zealand Building Consent DataAre we building enough houses?

In addition to the existing shortage of 30,000 from the 2010s, we need further 35,000 homes to cater to population growth for the next 2 years. Is New Zealand likely to build 65,000 homes in the next two years? There were approximately 40,000 new homes consents approved in 2020 – though it does not necessarily mean 40,000 homes will be added to the housing stock as existing homes will need to be demolished to make way for new developments. Developments are also taking longer due to the size and complexity in construction of townhouse and apartment blocks.

Therefore, it is unlikely the country will be able to meet this demand.

There are strong headwinds in the construction sector to fulfil this requirement. Stats New Zealand reported that building costs have gone up 3.5% year on year in March 2021. The sector is also reporting the shortage of material and labour, prolonging construction periods.

What are we building now?

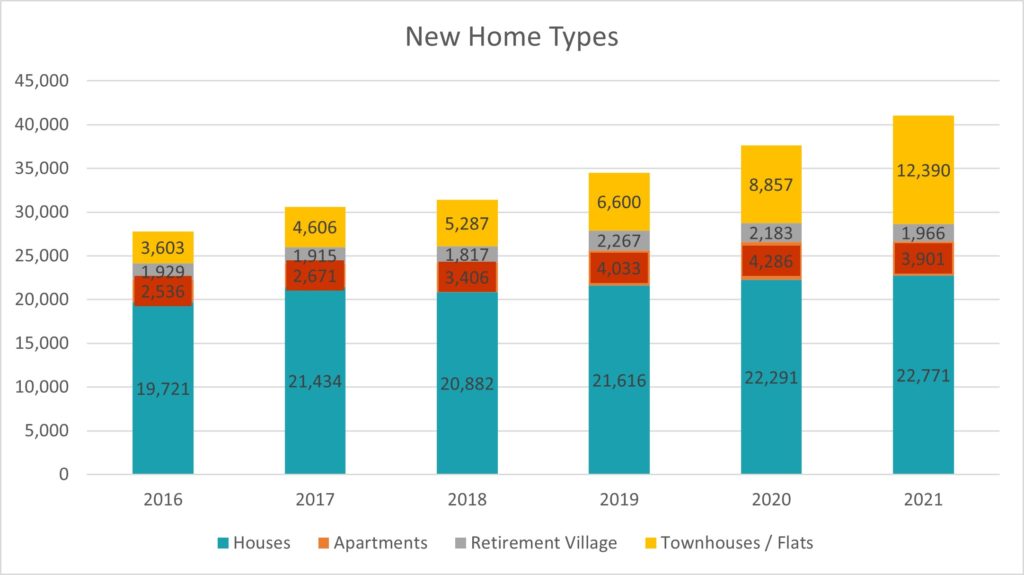

The number of building consents issued had increased but the type of new homes has also changed. Whilst the number of dwellings have increased by 10% over the past 5 years. The number of townhouses has tripled. As townhouses are generally at the lower price points this has improved affordability within some key markets which is a reassuring signal.

Source: Stats New Zealand Building Consent Survey for year ending March

Source: Stats New Zealand Building Consent Survey for year ending MarchUnemployment forecast remains low and CPI inflation forecast is within the targeted range; therefore it is unlikely for the RBNZ to raise the OCR quickly or steeply. The March 2021 unemployment rates were lower than Treasury forecast.

| Unemployment | CPI Inflation | ||

| Actual | Sep-20 | 5.30% | 1.40% |

| Dec-20 | 4.90% | 1.40% | |

| Mar-21 | 4.70% | 1.50% | |

| Forecast | Mar-21 | 5.11% | 1.53% |

| Jun-21 | 5.20% | 2.37% | |

| Sep-21 | 5.30% | 2.38% | |

| Dec-21 | 5.20% | 2.21% | |

| Mar-22 | 5.10% | 1.76% | |

| Jun-22 | 4.95% | 1.72% | |

| Sep-22 | 4.70% | 1.72% | |

| Dec-22 | 4.54% | 1.74% | |

| Mar-23 | 4.44% | 1.79% | |

| Jun-23 | 4.40% | 1.83% | |

| Sep-23 | 4.36% | 1.88% | |

| Dec-23 | 4.29% | 1.92% | |

| Mar-24 | 4.23% | 1.97% | |

| Jun-24 | 4.18% | 2.01% | |

| Sep-24 | 4.13% | 2.05% | |

| Dec-24 | 4.11% | 2.08% | |

| Mar-25 | 4.12% | 2.11% | |

| Jun-25 | 4.16% | 2.12% |

Source: Treasury Forecast – Budget 2021

Mortgage rates

Currently the mortgage borrowing rate is at a record low, with a one year fixed rate at 2.25% with major banks and as low as 1.85% from secondary lenders. There is limited inflationary pressure for interest rate to increase sharply in the short term. Major banks are forecasting rates to increase from mid 2022.

Conclusion

The key drivers to the housing market indicate there is unlikely to be a sharp housing market deceleration in the near future. (Based on foreseeable events).

- Current market conditions are fueled by low interest rates, and historical supply shortfall. These two issues have not subsided, but other supply issues are also arising; building cost inflation and material shortages will delay building projects. Underlying housing demand remains strong.

- Whilst current tougher policies by RBNZ or Government may slow the market, the headwinds don’t appear to be strong enough to drastically stall the market.

- There may be some softening in certain sub-markets such as Central Auckland apartments, however these are more the result of specific COVID-19 related conditions (lack of international students) impacting this market.

- A spotlight needs to be shone on what we are building, over just the total numbers – rather than try to ‘stop value growth’ – policy settings should be focused on ensuring we increase housing stock in value brackets/areas we need it, targeted at first home buyers.