Background

Welcome to the summary of results from our quarterly Valocity and Tony Alexander Valuers Survey. With this survey we are aiming to give some insight into what is happening within the residential real estate market in New Zealand from the unique perspective of property valuers.

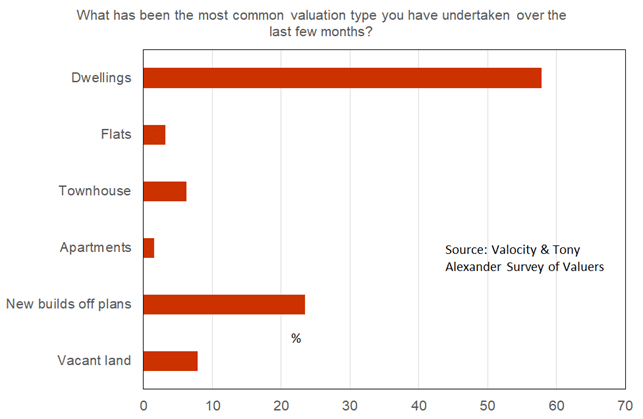

Most Common Valuation Type

58% of valuers have reported that their most common work in recent months has been on dwellings generally defined. 23% have chosen new builds and this is one of the many measures reflecting the strength of house building activity around the country. 8% of valuers have indicated they are busy with valuation requests for bare land, but this is down from 12% three months earlier.

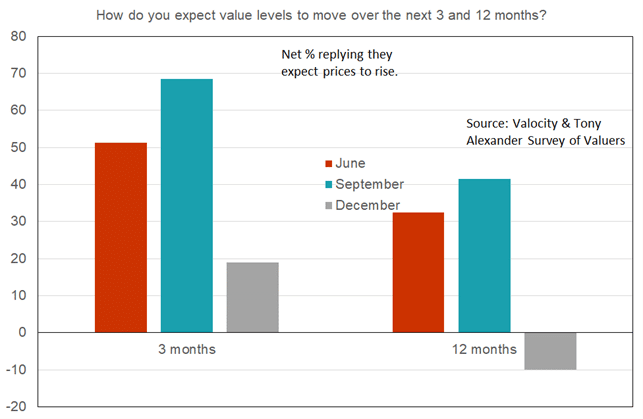

Price Expectation

Three months ago, we reported a noticeable rise in valuer expectations for price gains over the coming three and 12-month periods. Now, those expecting gains to occur have more than reversed. Whereas three months ago a net 69% of valuers expected property values to rise over the coming three months, now only a net 19% have that view. Three months back a net 42% of valuers expected price rises in the coming 12 months, up from a net 33% in our June quarter survey. Now, a net 10% expect property valuations to decline in the coming year.

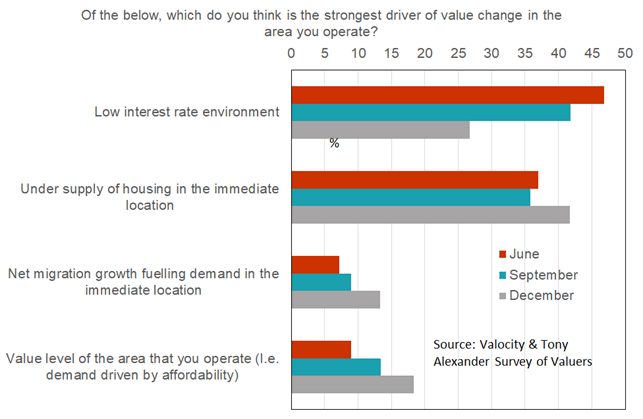

Market Drivers

Valuers were asked to rate what they feel are the strongest drivers of property values in their area of operation. Understandably, with interest rates already up and expected to rise further, less valuers see the levels of mortgage rates in New Zealand as driving valuations. Under-supply of dwellings continues to be rated highly as a driver of prices. Presumably, as supply grows and concerns about property shortages abate, unless prospects for interest rates alter from upward to downward, expectations for value changes noted above may deteriorate even further.

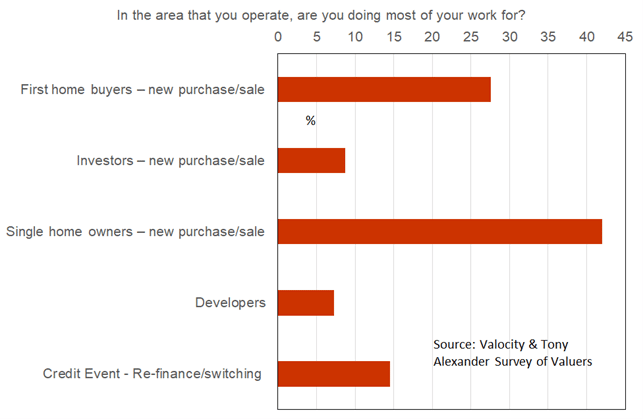

Buyer Type

Most of the work which valuers are doing around New Zealand is for existing single homeowners looking to sell or buy, or first home buyers. Just 9% is for investors, 7% for developers, while 14% is for an event such as refinancing or switching lenders.

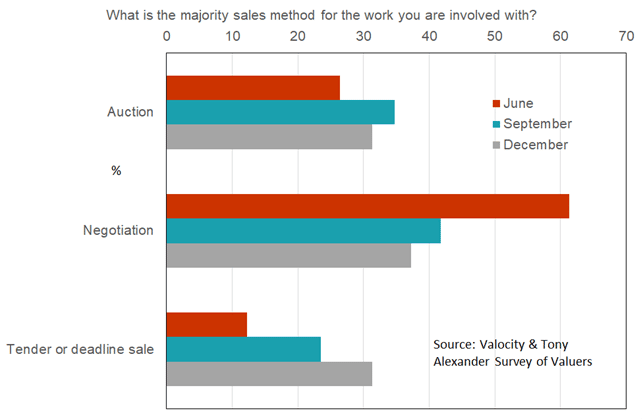

Sale Methods

This quarter, valuers have reported a decrease in the proportion of sales which are being undertaken through auctions, and a rise in the proportion via a tender or deadline sale. Interestingly, despite other measures indicating a switch in the residential real estate market towards greater power for buyers, there is yet to be a recovery in sales by negotiation according to valuers.

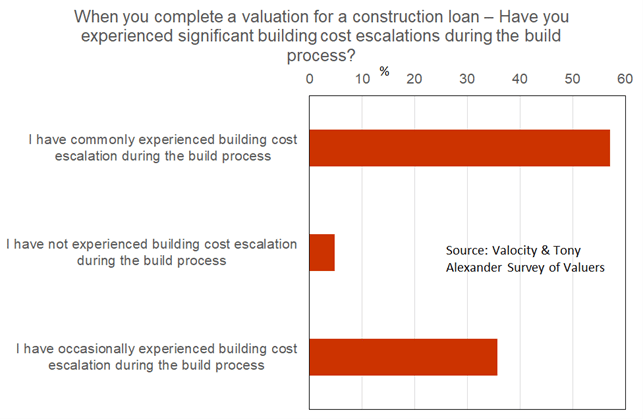

Construction Cost Escalation

With this edition, we added some new questions to our survey to measure some of the key issues which have been occurring in the housing sector in recent times. Firstly, when asked about construction cost escalation, 57% of valuers reported that they have experienced cost escalation during the construction process. Only 5% said they had not and 36% said on occasion they experienced it.

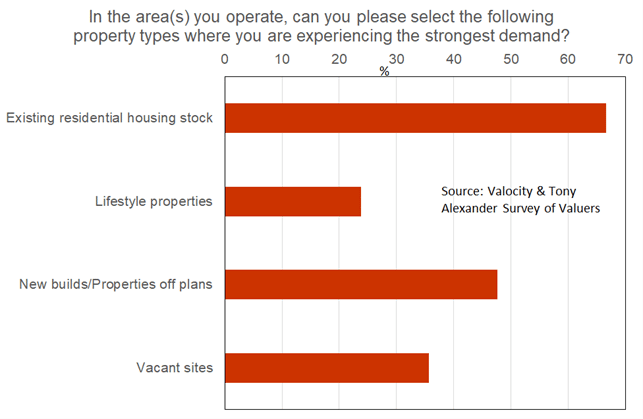

Valuation Property Types

Second, we asked about the types of properties which people are mainly seeking valuations on. A gross 67% replied existing residential properties, 24% lifestyle blocks, 48% new builds, and 36% vacant sites.

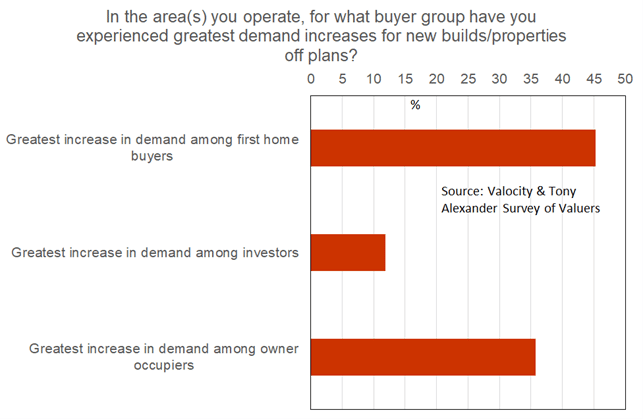

Demand for New Builds/Properties Off Plans

We also asked which types of people are seeking valuations for new builds and off the plan properties. A gross 45% of valuers reported first home buyers as showing the greatest increase in demand for such valuations, followed by owner occupiers.

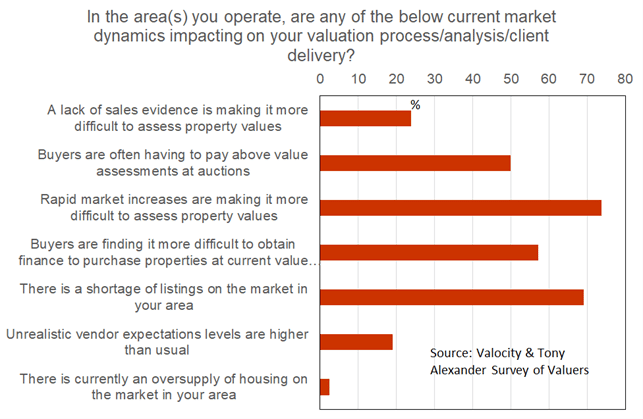

Factors Affecting the Valuation Process

Finally, we sought insight into the sorts of factors currently affecting the valuation process. A gross 74% cited the recent speed of house price changes, 69% the shortage of listings, 57% the difficulties which buyers are now experiencing getting finance, and 50% noted that buyers often have to pay above valuations to secure an auction win.

Overall, the results show the following:

- Pricing pressures have reversed in the residential property market and a majority of valuers expect prices to decline over the coming year

- The market continues to be affected by a shortage of existing dwellings and a shortage of listings

- Far more existing owner occupiers and first home buyers are seeking to purchase new builds and off the plan properties than investors

- A large majority of valuers are experiencing cost escalation affecting valuations during the construction process of a project

This survey and the resulting insights are part of an ongoing series. Keep an eye out for future valuer surveys to be undertaken by Valocity in collaboration with Tony Alexander.

Follow us on Linked In to ensure you are up to date with the latest property news and insights.

For any feedback, please get in touch at: hello@valocityglobal.com