Welcome to the first results from our new, quarterly Valocity and Tony Alexander Valuer Survey.

With this survey we are providing some exclusive insight into what is happening with the residential real estate market in New Zealand from the unique perspective of property valuers. This month’s survey comprises of over 120 responses representing active residential valuers in New Zealand.

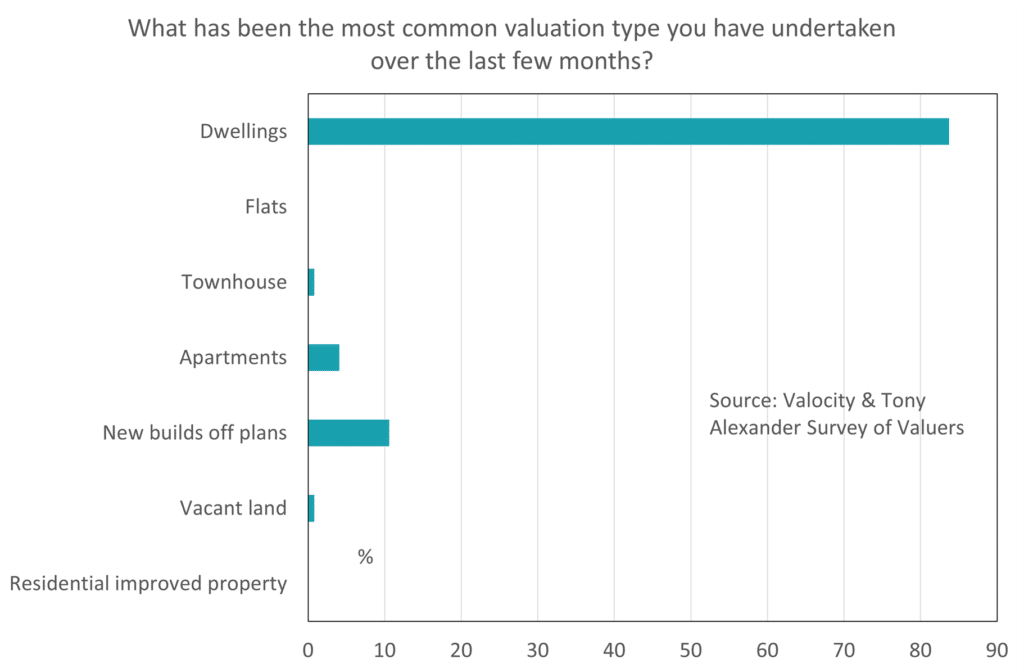

Of the respondents, 84% have reported on valuations of dwellings while 11% discuss off the plan new builds.

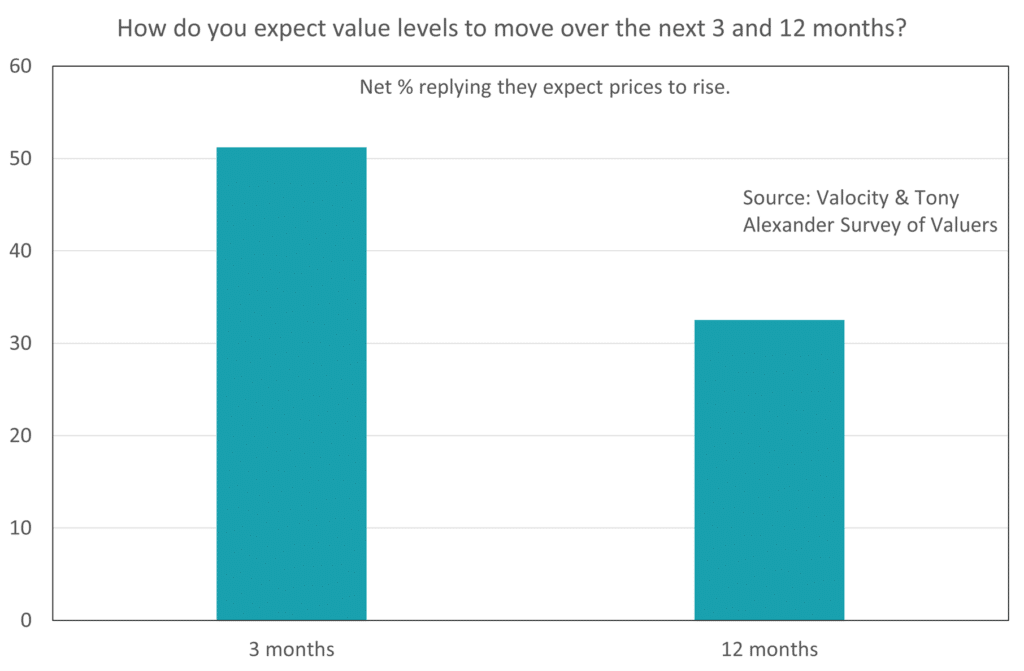

Over all properties, a net 51% of respondents have reported that they expect their valuation amounts to increase over the coming three months. But over the next twelve months this is expected to decrease to a net 33%. This tells us that much as there continues to be evidence of upward pressure on prices at the moment from a wide variety of statistical and anecdotal sources, valuers expect the pace of price growth to ease off.

However, there are differences of opinion with regard to expected changes in prices for new builds as compared with existing dwellings.

A net 51% of valuers expect existing house prices to rise over the next three months, which is about the same as the net 54% expecting new build prices to rise. But over the next 12 months whereas a net 31% of valuers expect existing property prices to rise, a net 46% expect new build prices to go up.

This divergence likely reflects two developments. First, construction costs are rising rapidly. Second, investors have been incentivised by the government to purchase new builds in preference to existing houses (perhaps selling some) through planned changes in interest expense deductibility.

On the face of it, having a net 33% of valuers expect higher prices does not appear consistent with Treasury’s recent forecast in the May 20 Budget that prices on average will rise only 0.9% in the year to June 2020.

Who are the clients?

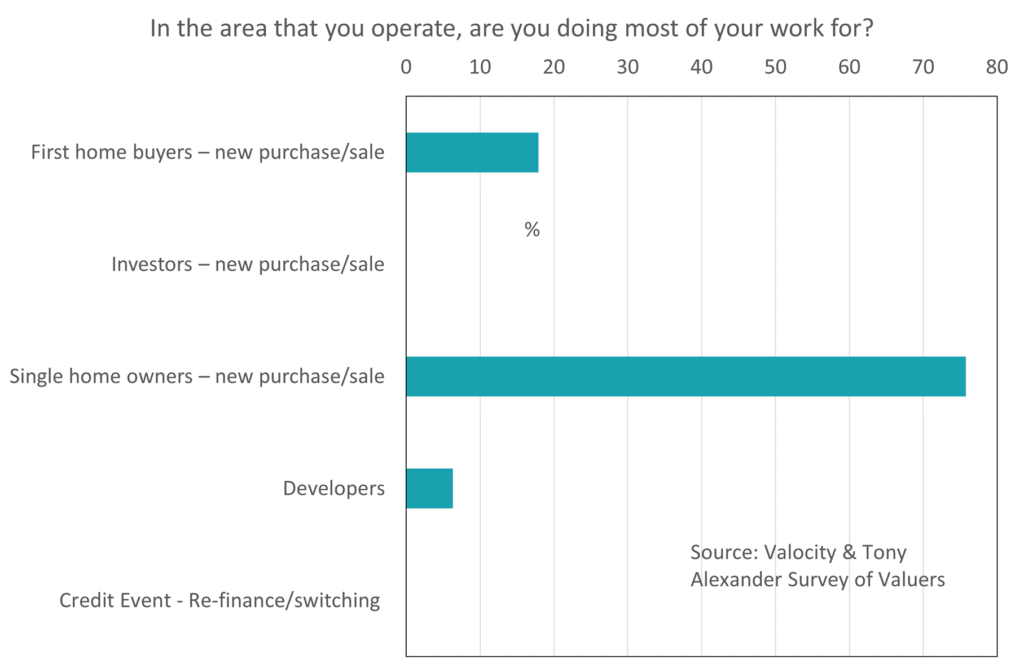

“In the area that you operate, who are you doing most of your work for?”

Valuers report that 59% of their work is for single homeowners buying and selling, 17% for first home buyers, and 5% for developers. For the next survey the option of single homeowners will be split into owner occupiers and investors so we can clearly see the changes in demand from investors – something of keen interest to policy makers in particular.

Sales method

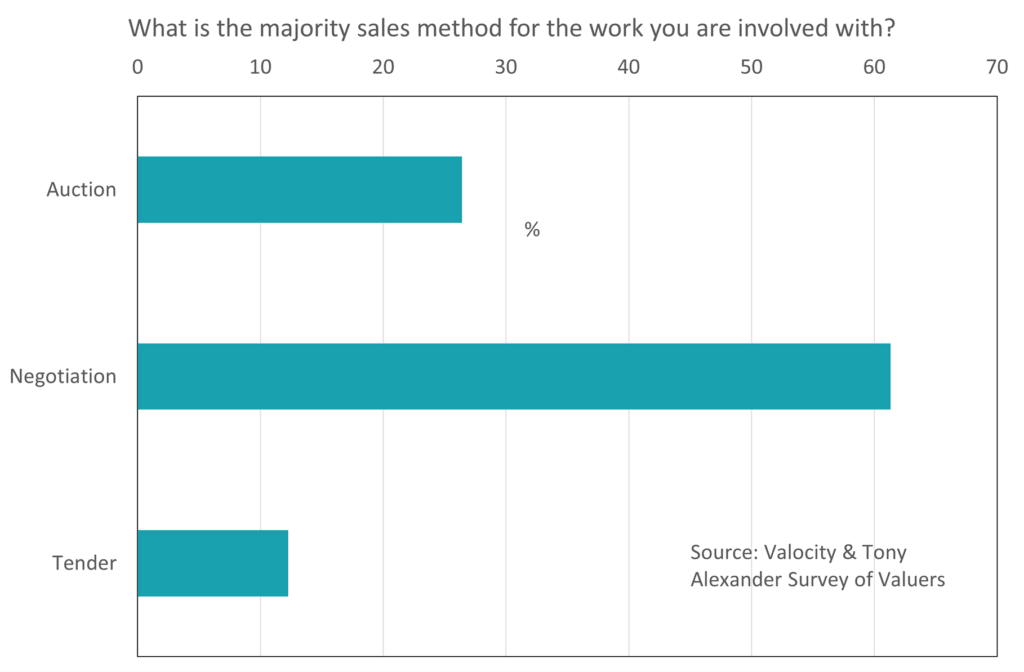

“What is the majority sales type method for the work you are involved with?”

In this first quarterly survey valuers have reported that 26% of their work is for sales by auction, 61% by negotiation, and 12% by tender. We will track this measure over time to see if the preference for auctions in particular alters as the housing cycle progresses.

Drivers of value

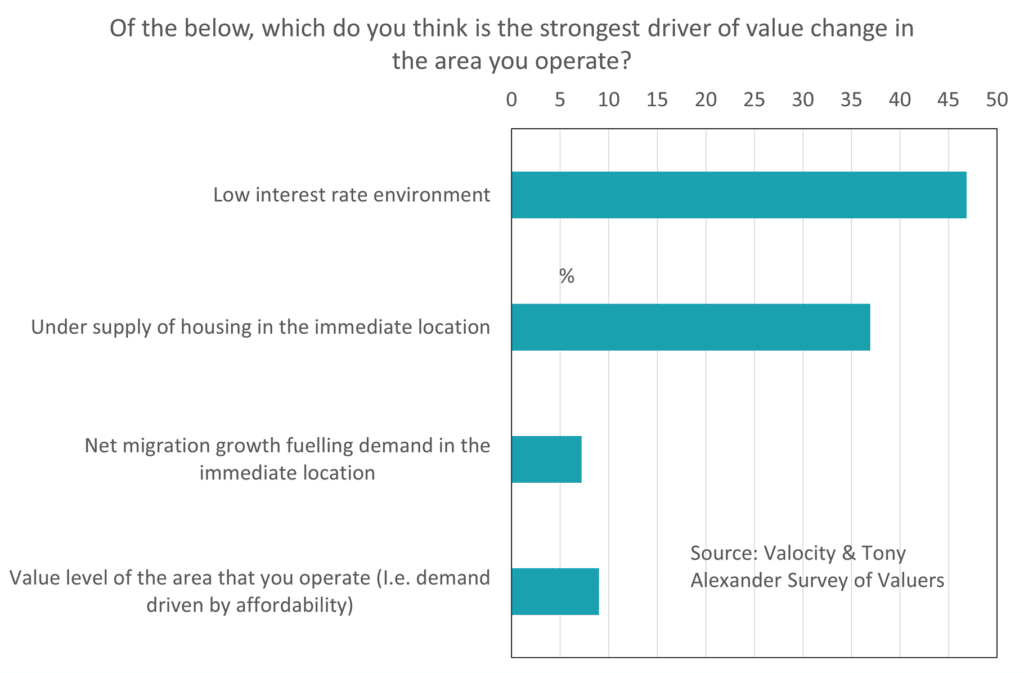

“What is the strongest driver of value change in the area you operate?”

We offer valuers four options and for our first survey the replies in percentage terms were as follows. Low interest rates are rated by almost half of valuers as the prime driver of price changes. This is important because it suggests that as interest rates move away from record low levels there will be a clear impact on the pace of house price inflation. Similarly, with 37% of agents rating shortages as a driving factor behind price rises, as construction lifts around the country, there will also be a suppressing impact on prices growth.

The low 7% of valuers indicating net migration is perhaps a reflection of the closed borders, therefore we should avoid reading much into this particular gauge until after the international borders reopen.

This survey and the resulting insights are the first of an ongoing series. Keep an eye out for future Valuer surveys to be undertaken by Valocity in collaboration with Tony Alexander.

Follow us on Linked In to ensure you are up to date with the latest property news and insights.

For any feedback, please get in touch at: hello@valocityglobal.com