Brought to you by the Valocity Research Team: Wayne Shum and James Wilson

Executive summary

Mortgage rates in New Zealand have experienced rapid rises in the past six months, with additional rises forecasted throughout 2022. Currently, the unemployment rate is low, and inflation is high.

The Official Cash Rate set by the Reserve Bank of New Zealand (RBNZ) is one of the influencers affecting mortgage rates. Currently, the OCR is 0.75% after a 0.25% rise in October and a further 0.25% in November. The rise in October was the first in seven years.

RBNZ lowered the OCR from 1.00% to 0.25% to prepare the economy for the potential economic shock of the COVID-19 pandemic in March 2020. The OCR has remained at 0.25% until October this year.

Given that the OCR and Interest rate environment has started to change, Valocity has investigated historical impacts on the housing market.

The RBNZ remit requires their monetary policy to:

“contribute to the public welfare by supporting maximum sustainable employment whilst maintaining price stability over the medium term. The Remit defines price stability as annual increases in the Consumers Price Index (CPI) of between 1 and 3 per cent on average over the medium term, with a focus on keeping future average inflation near the 2 percent target midpoint.”

Housing activity is not part of the RBNZ remit when setting the OCR.

OCR and interest rate trends in the past

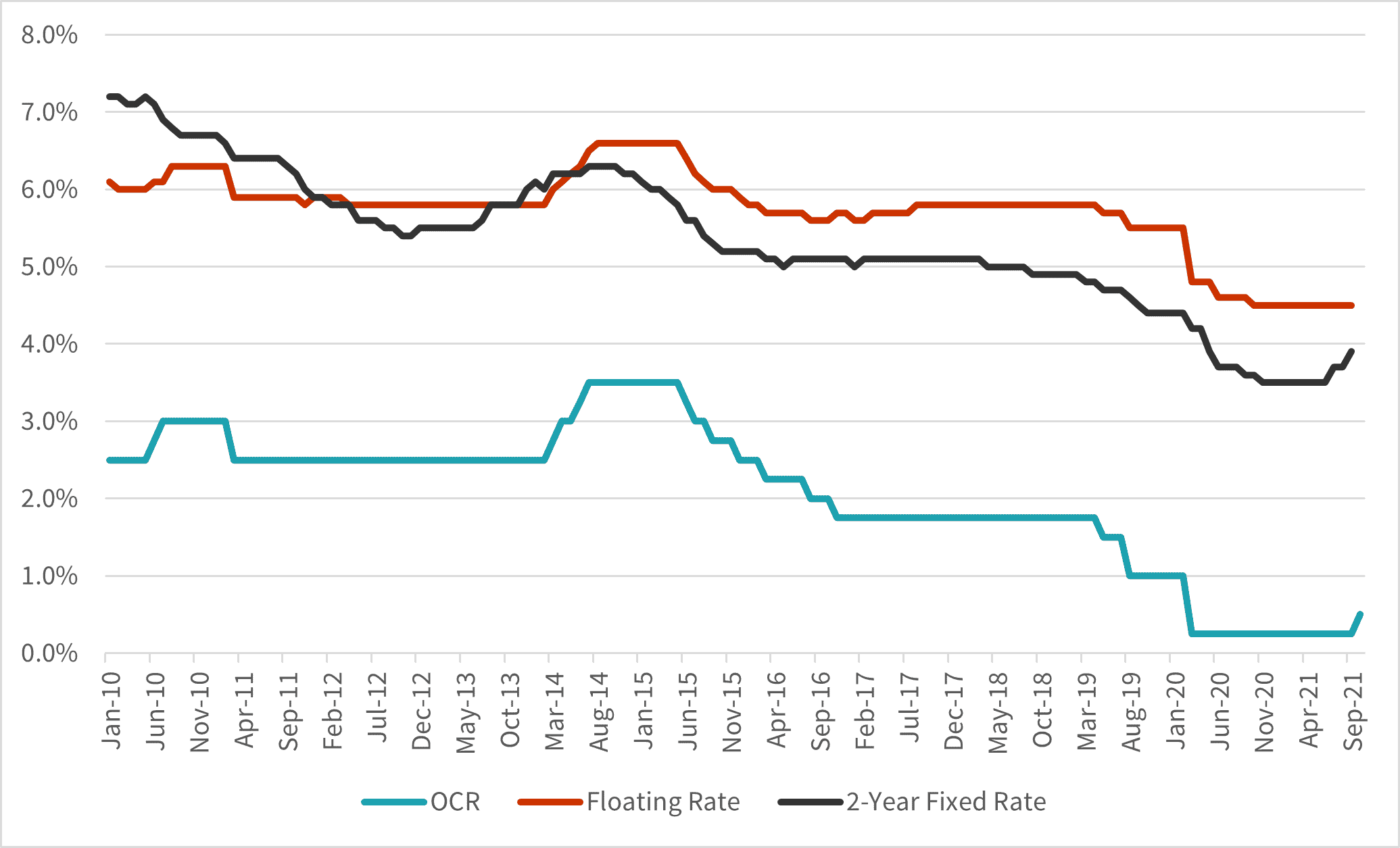

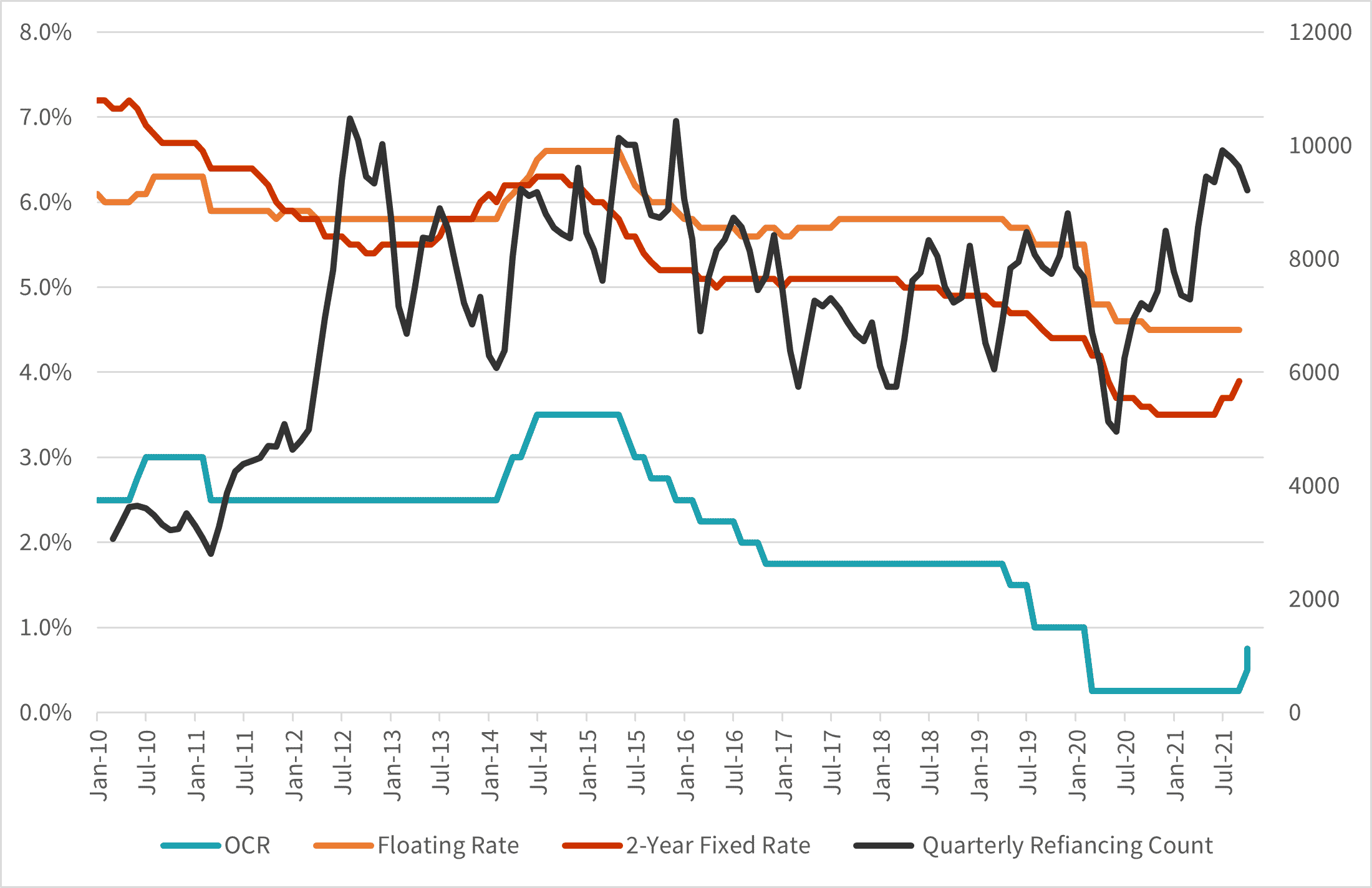

Since 2010, the OCR has experienced two tightening cycles:

- 5% increase over two months between May and July 2010

- No corresponding mortgage rate increase by banks, two-year fixed rate trended downwards over this period

- 1% increase over eight months between January and August 2014

- Two-year fixed rates saw increases six months before the OCR rises and fell six months before the OCR decline in July 2015

Mortgage rates saw increases in July, four months ahead of the OCR rise in October. Mortgage rates have continued to rise since. The OCR was widely expected to rise in the RBNZ August meeting, but the arrival of the Delta Variant of COVID-19 has delayed the OCR rise.

Graph 1: OCR and Mortgage Rate (source: RBNZ)

Impact on the housing market

The OCR is one of the factors affecting mortgage rates. Valocity wanted to explore what impact could be seen within the housing market, initially looking into sales volume and sales prices.

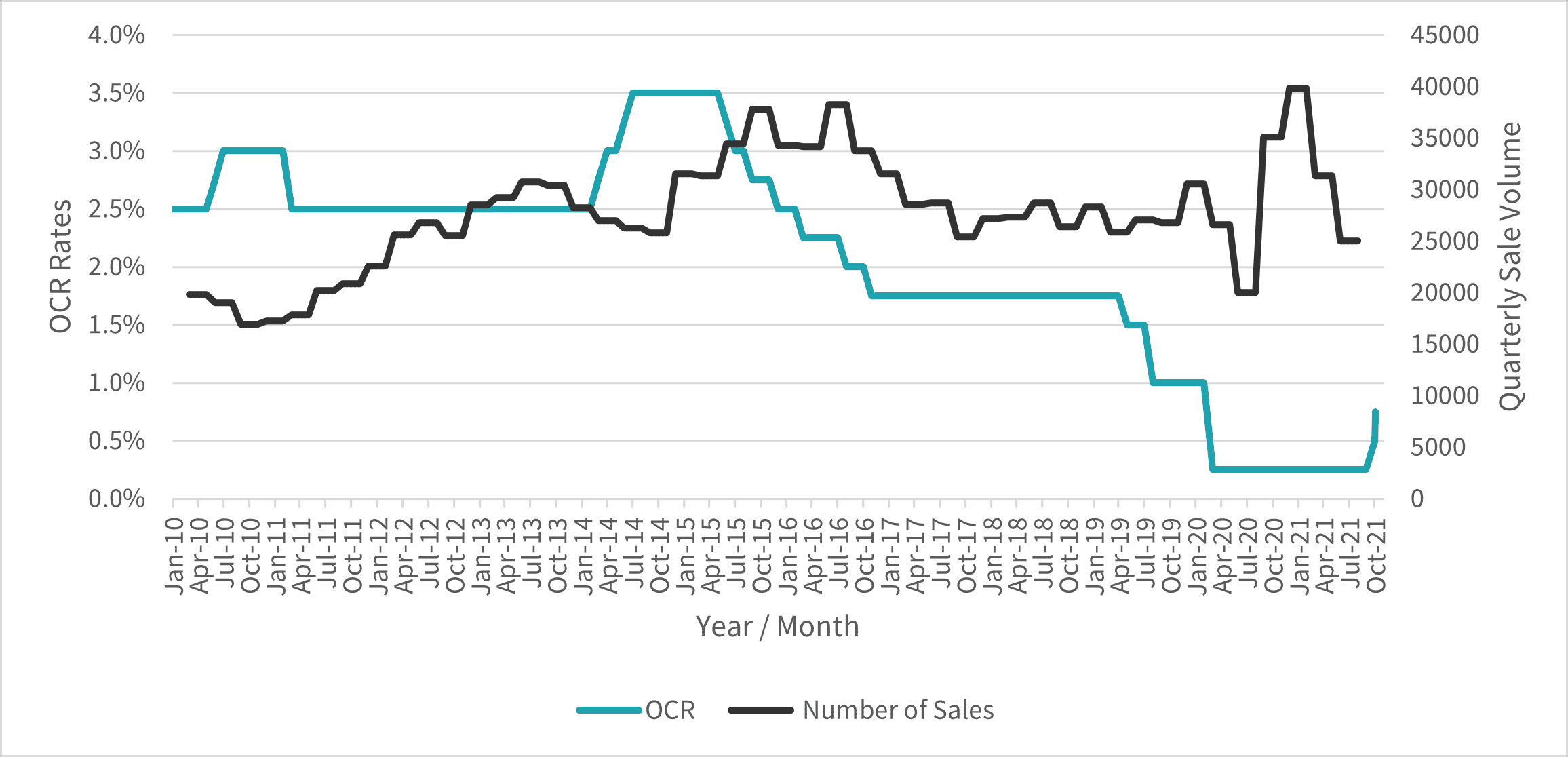

Graph 2: Official Cash Rate & Quarterly Sale Volume

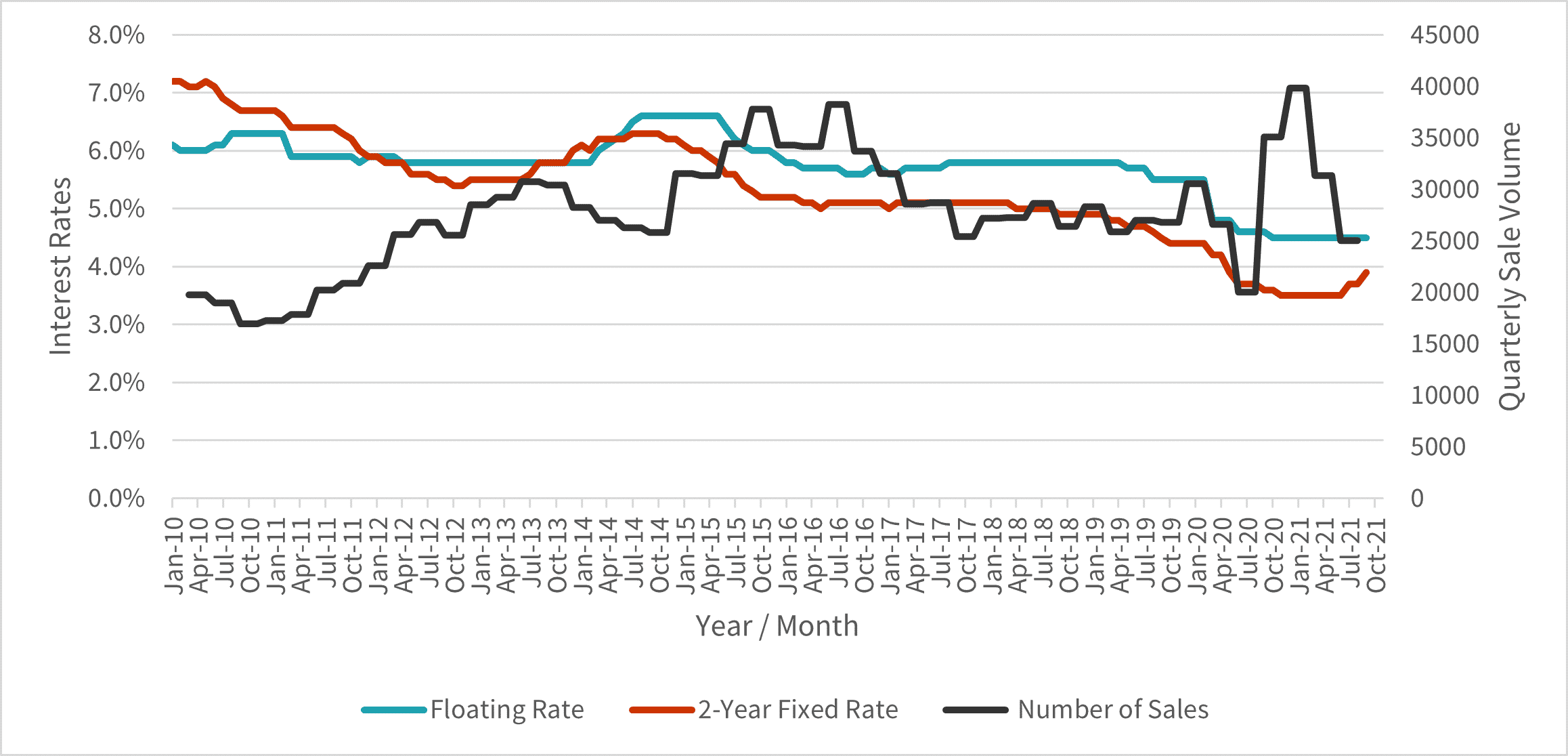

Graph 3: Mortgage Rates and Sale Volume

Analysis of historic housing market data reveals that sales volumes declined during the initial periods leading up to or after the OCR increases. For example, in 2010, the sale volume continued to decrease until the reduction of the OCR in February 2011. A similar trend followed in 2014; sales volume declined soon after the OCR rise in March 2014 but recovered in late 2014. This would indicate a correlation between OCR and interest rates rises and market activity levels – likely due to many market participants adopting a more cautious mindset during times of rising housing costs.

With the current round of rises, sales volumes began to decline in June, which is before the OCR increases in October and November. However, it is worth noting that signals and commentary of likely rises were very vocal back in mid-2021.

Further to this, regulatory changes enacted in late March appear to have also dampened demand ahead of the OCR rises. In addition, RBNZ had tightened LVR requirements and have entered conversation around Debt-to-Income ratios in assessing mortgage applications. The enactment of the Credit Contracts and Consumer Finance Act (CCCFA) will further hamper people’s ability to borrow. The reason for noting this is to draw attention to the fact that there are often many other drivers that may impact market activity, over and above OCR and Interest rate movement. This investigation however seeks to plot the impact on key market metrics during periods of rate change.

Sales price to OCR correlation

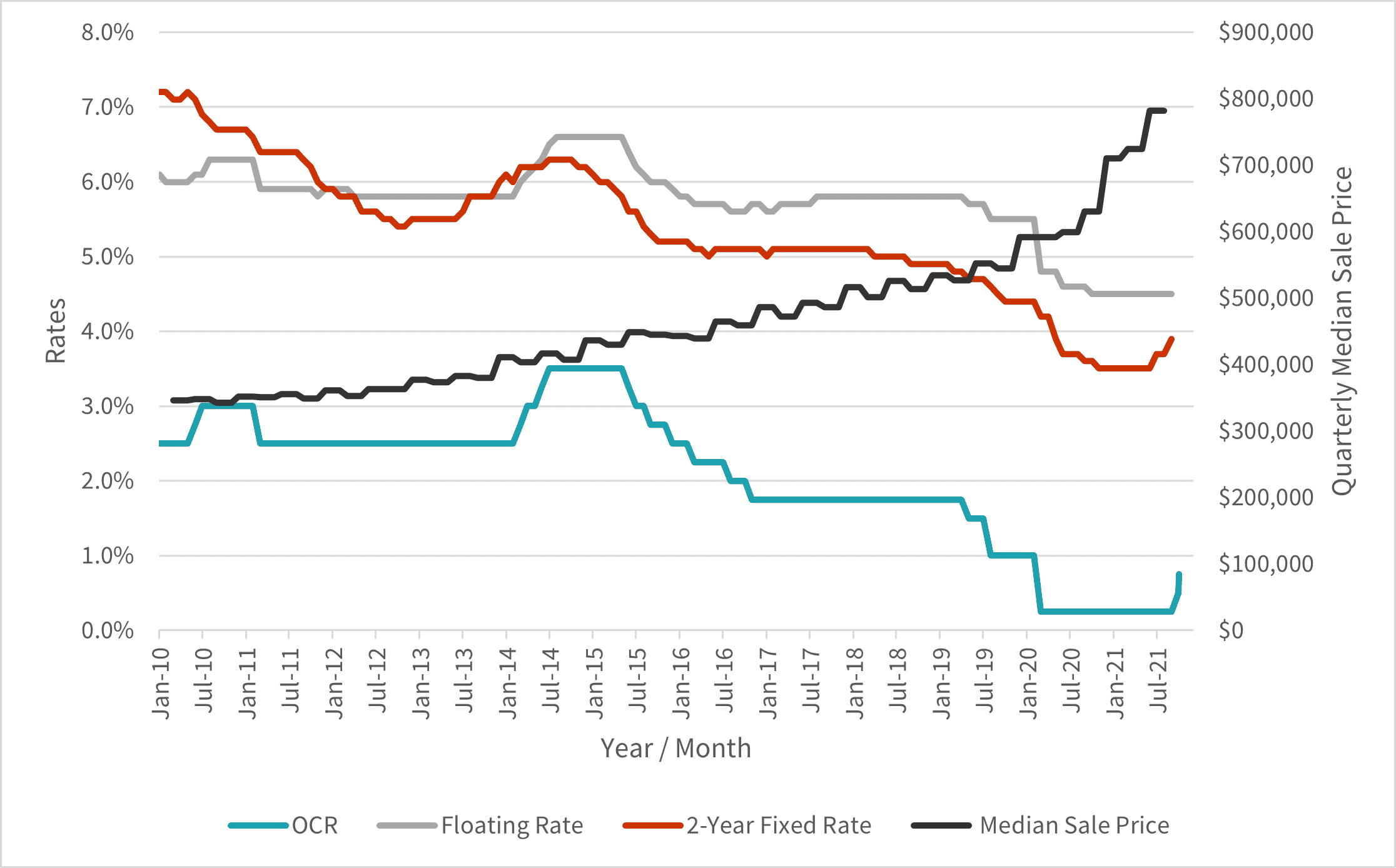

When we analyse past data, we begin to see how strong the correlation between OCR, interest rates and median sales prices really is. In the 2011 softening cycle, where the OCR rate fell from 3% to 2.5%, the median sale price rose by 2%.

Within the next phase of OCR rate softening, which commenced in 2014/15 until an OCR plateau in July 2019, we saw the OCR decrease from 3.5% to 1.5%, with the median sale price increasing from $450,000 to $540,000 across the same timeframe.

The most recent phase of OCR softening, which occurred as a result of COVID-19, has seen OCR rates decline from 1% to 0.25% and a correlating increase in the median sale price from $600,000 to $750,000 for the following 12 months. The Valocity Value Index had increased by 20% in the same period.

Impact of current OCR increased on price point

So far, the impact of increasing OCR and mortgage rates on sale prices is not yet evident. It would appear that the ‘FOMO effect’ and shortage of homes being taken to market continues to push sale prices to new heights.

Graph 4: Rates and Quarterly Median Sale Price

Impact on existing Homeowners

In addition to home buyers, the interest rate also affects existing homeowners. For example, homeowners may take advantage of low rates to reduce their repayment or length of their term.

In the two previous OCR tightening cycles, refinancing activity picked up initially as homeowners locked in rates before mortgage rates increased further. Refinancing activity then declined until mortgage rates fell.

In the 2021 cycle, refinancing activity peaked in July, just as banks were increasing their mortgage rate for the first time since the arrival of COVID. Refinancing activities have since declined as mortgage rates rose over the next four months.

Graph 5: Rates and Refinancing Activities

Research Conclusion

- The correlation between the OCR rate, retail interest rates and median sale prices is evident within the above analysis

- OCR and Interest Rates are two of many factors affecting the housing market

- The link between OCR rate and sales volumes is less conclusive, however this is likely the result of other market drivers such as an underlying supply/demand mismatch and other demand side levers such as LVR restrictions which impact certain buyer types more than others

- There are many other factors affecting prices and sales volume. The 2020 post-COVID-19 Lockdown boom was largely driven by the low mortgage rates, suspension of LVR by RBNZ and lack of housing stock

- Other measures on the horizon will have an impact on the housing market

- Debt-to-Income ratios may further limit the amount home buyers can borrow if introduced more widely

- Lenders will have to follow CCCFA guidelines in assessing credit applications

- LVR requirements were tightened by RBNZ, restricting lending to those with low deposits

- General confidence as a response to ongoing Covid-19 market impacts

For further information, or if you would like to understand more about interest rates, please contact wayne.shum@valocityglobal.com or james.wilson@valocity.co.nz.